📌 TOPINDIATOURS Breaking crypto: Ethereum Nears $5,000 as ETFs and Staking Reshape

Ethereum’s rally toward the $5,000 mark is reframing its role in global markets. The asset is transitioning from a speculative token into a reserve choice for institutions and large-scale investors.

A CryptoQuant report revealed that surging ETF inflows, aggressive whale accumulation, and record staking levels are driving this change.

Ethereum ETFs Anchor Institutional Demand

According to the report, Ethereum ETFs have emerged as a defining catalyst in this rally. The nine US-listed funds now hold roughly 6.7 million ETH—almost double the level seen when the market rally began in April.

This expansion followed record inflows of nearly $10 billion between July and August. The surge cemented ETFs as the preferred vehicle for institutional exposure.

While September has shown a slower pace, the funds still attracted more than $640 million in new capital last week, according to SoSoValue data.

That momentum signals growing investor reliance on ETFs not only as an entry point but also as a way to sustain long-term allocations in the crypto asset.

Moreover, large ETH holders appear to be reinforcing this pattern. CryptoQuant data shows that wallets controlling between 10,000 and 100,000 ETH accumulated approximately 6 million coins during the same period.

Their combined reserves reached a record 20.6 million ETH, mirroring Bitcoin’s early trajectory after ETF approvals, when institutional players raced to establish positions.

Staking and Network Activity Tighten Supply

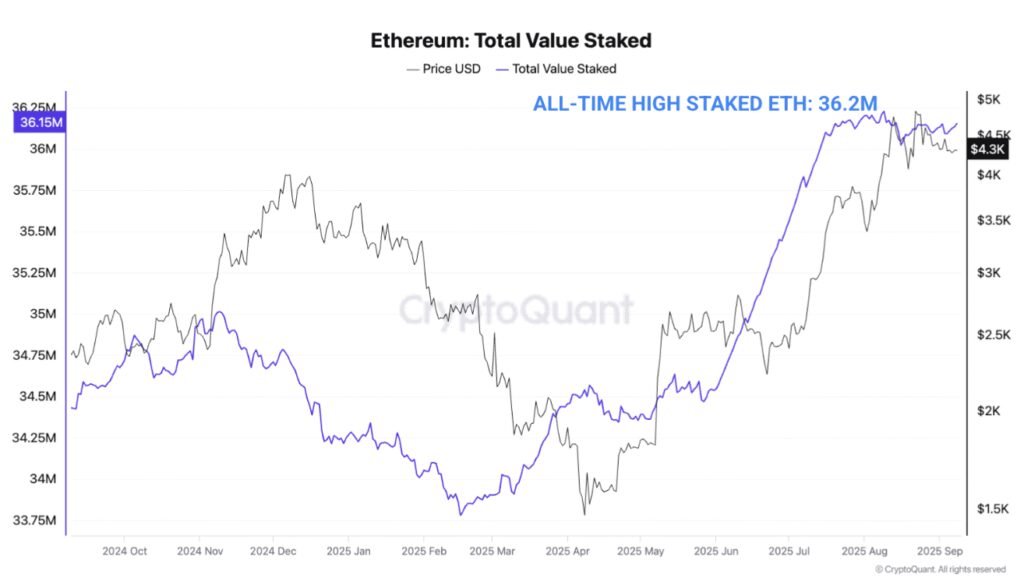

Aside from the above factors, Ethereum staking activity is locking up more ETH than ever before.

Data from CryptoQuant showed that Ethereum investors have locked up an additional 2.5 million ETH since May, pushing the total amount of staked ETH to 36.2 million. According to Dune Analytics data, this represents nearly 30% of Ethereum’s total supply.

This steady increase reduces the top crypto’s circulating supply and reinforces its upward price pressure. It also signals that investors are committed to ETH for the long term and not short-term speculative plays.

Another strong piece of evidence showing that Ethereum’s market role has significantly changed is the acceleration of its on-chain utility.

According to CryptoQuant, Ethereum’s daily transactions spiked to 1.7 million in mid-August, and the number of active addresses on the network reached a high of 800,000.

At the same time, smart contract calls broke past 12 million per day, which is an unprecedented level in prior cycles.

This activity level underscores Ethereum’s growing role as the backbone for decentralized finance, stablecoins, and tokenized assets. Notably, the network has the highest total value locked and adoption rate for each sector.

Taken together, these developments point to a structural realignment that shows that Ethereum’s valuation rests on more than market sentiment.

Indeed, it is increasingly positioned as a functional backbone for digital commerce. At the same time, it has become a strategic holding for large-scale investors seeking exposure to the emerging crypto industry.

The post Ethereum Nears $5,000 as ETFs and Staking Reshape Market Demand appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 TOPINDIATOURS Eksklusif crypto: Ethereum Foundation’s Privacy Team Rebrands as P

The Ethereum Foundation’s Privacy & Scaling Explorations team rebranded as Privacy Stewards for Ethereum (PSE), unveiling an ambitious roadmap to make privacy the default rather than exception across Ethereum’s technical stack.

The transformation shifts focus from cryptography exploration to problem-first solutions addressing Ethereum’s surveillance vulnerabilities.

PSE’s new mission centers on three core tracks: private writes to make on-chain actions as cheap and seamless as public ones, private reads enabling surveillance-free blockchain queries, and private proving for accessible data verification.

The initiative follows Vitalik Buterin’s April advocacy for privacy as essential to Ethereum’s survival as a global settlement infrastructure.

The roadmap warns that without robust privacy protections, Ethereum risks becoming “the backbone of global surveillance rather than global freedom.”

PSE emphasizes that institutions and users will migrate elsewhere if private transactions, identity, and data remain compromised by public blockchain transparency.

From Cryptography Lab to Privacy Stewardship Mission

PSE abandoned its previous approach of pursuing “cool tech” for concrete problem-solving focused on ecosystem outcomes rather than internal projects.

The rebrand includes website updates to pse.dev and restructured team goals with particular emphasis on subtraction by default and problem-driven resource allocation.

The strategy involves continuous problem mapping, execution decisions across lead-support-monitor engagement levels, and public communication through newsletters, community calls, and working groups.

PSE draws inspiration from Protocol and EcoDev announcement simplicity while addressing feedback from Vitalik Buterin, Silviculture Society, and EF management.

Key initiatives include PlasmaFold development for private transfers using PCD and folding, targeting proof-of-concept by Devconnect.

The team continues to develop the Kohaku privacy wallet, focusing on zk account recovery frameworks and keystore implementation for stealth addresses.

Private governance efforts focus on a “State of private voting 2025” report while collaborating with Aragon on protocol integrations.

The Institutional Privacy Task Force launches with the EF EcoDev Enterprise team to unblock adoption through privacy specifications and proof-of-concepts.

Another key aspect of this new direct is PSE’s data portability. It tracks advances in TLSNotary development for production-ready zkTLS protocols, while building SDKs that enable seamless integration across mobile, server, and browser platforms.

Additionally, network privacy initiatives include Private RPC working groups, ORAM solution integration for privacy-preserving state reads, and sphinx mixing protocol implementation for broadcast privacy.

The team has stated that it will methodically study ORAM and PIR state-of-the-art techniques while translating research into practical wallet and browser experiences.

Industry Experts Warn Public Ledgers Threaten Mass Adoption

The privacy push addresses growing concerns from industry veterans about Ethereum’s transparency model.

In an interview with Cryptonews in August, British Gold Trust’s Petro Golovko argues public blockchains expose salaries, business deals, and balance sheets, making crypto “unusable for regular people and impossible for institutions.“

Golovko compares current blockchain transparency to the pre-SSL internet, when users refused to enter credit card numbers due to a lack of encryption.

He maintains that crypto remains stuck in this vulnerable phase, preventing the scaling that transformed e-commerce into a $6 trillion industry.

Institutional adoption concerns center on the exposure of trade secrets and the competitive disadvantage resulting from visible treasury movements.

Golovko warns that no board will approve systems exposing supply chains or financial operations globally, limiting crypto to speculation rather than serious commerce.

Vitalik Buterin’s April privacy advocacy stemmed from similar concerns about AI-driven surveillance and data misuse eroding personal autonomy.

His roadmap outlined four areas for enhancing privacy: anonymous payments, application-level privacy, secure data access, and network obfuscation.

The Ethereum co-founder advocated for wallets to integrate tools like Railgun and Privacy Pools, creating “shielded balances” that enable private-by-default transactions.

He emphasized that separate addresses per dApp would eliminate traceable links between applications while maintaining usability.

European regulatory pressure adds urgency to the development of privacy.

Community member Eugenio Reggianini outlined GDPR compliance practices that require personal data to remain off-chain, with blockchain nodes relaying only encrypted references or proofs, rather than identifiable information.

Looking forward, the team aims to accelerate ecosystem adoption through community initiatives with privacy and robust security at the center of its decentralized identity systems.

The post Ethereum Foundation’s Privacy Team Rebrands as PSE, …

Konten dipersingkat otomatis.

🔗 Sumber: cryptonews.com

🤖 Catatan TOPINDIATOURS

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!