📌 TOPINDIATOURS Hot crypto: Solana Price Prediction: SOL Chosen for Sovereign Gold

The government of Bhutan has decided to launch a new gold-pegged token on the Solana blockchain, further enhancing the network’s credibility and fueling increasingly bullish Solana price predictions.

The name of the token will be TER and it is the result of the collaboration of multiple financial institutions and fintech companies like DK Bank and Matrixdock Technology.

Through TER, Bhutan residents will now be able to invest in gold safely via blockchain technology.

Minting the asset in the Solana blockchain ensures that users can trade it at a low cost, as this smart contract platform is much more scalable than its top rival, Ethereum.

Bhutan has been mining Bitcoin for years by using renewable sources of energy and currently holds over 6,000 BTC tokens, worth over $500 million, as part of an ongoing effort to modernize its economy.

Solana Price Prediction: SOL Hits Key Resistance – Can It Reverse Its Downtrend?

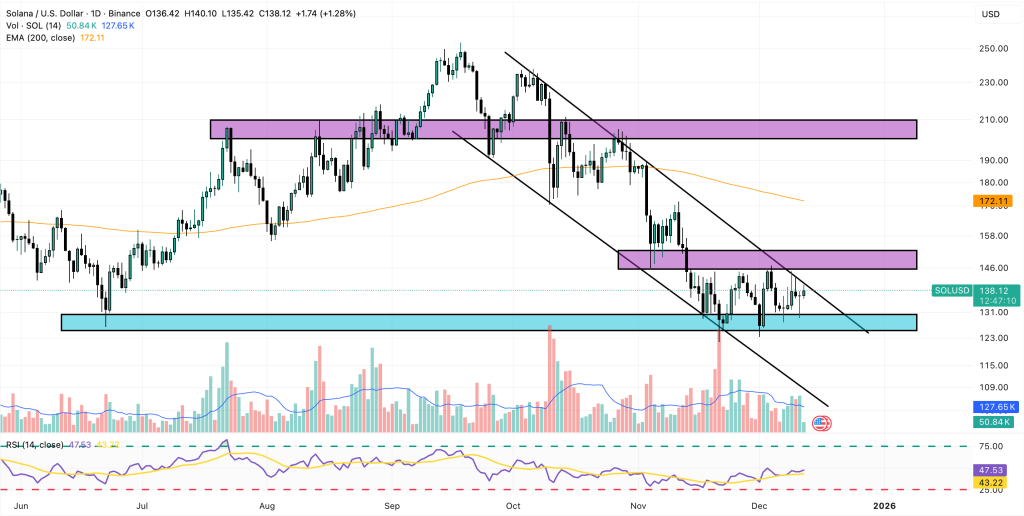

The price of Solana (SOL) has reacted positively to the news and has jumped 5.4% in the past 24 hours to $138.4.

SOL is hitting a key resistance that matches the upper bound of its latest descending price channel. The token has been consolidating for a few days, trading between $130 and $145 as the market struggles to find direction.

Now that the Fed has cut interest rates for a third time, it is up to the market to determine if conditions are sufficient to support a move higher for SOL.

If Solana breaks above the $150 level, it could trigger a full trend reversal, setting the stage for a potential rally back to $200.

On the flip side, a drop below $130 would open the door to a deeper correction, though for now, that outcome looks less likely as momentum continues to build.

While Solana eyes its next move, a far bigger opportunity is emerging on Bitcoin.

Bitcoin Hyper ($HYPER) is one of the best crypto presales right now, bringing Solana’s speed and low fees to Bitcoin, turning it into a true high-performance chain.

Bitcoin Hyper ($HYPER) Brings Solana’s High Speed and Low Costs to the Bitcoin Blockchain

Bitcoin Hyper ($HYPER) is giving Bitcoin the upgrade it needs, combining the power of Solana’s technology with the security of the Bitcoin network.

Built using Solana’s SVM, Bitcoin Hyper brings lightning-fast speed and ultra-low fees to Bitcoin, unlocking real utility like staking, yield generation, DeFi, NFTs, and more.

The key to this is the Hyper Bridge, which safely stores BTC and lets users mint a usable version on the Layer 2.

From there, they can access a growing list of apps, earn passive income, and trade with near-instant settlement — all while staying backed by real Bitcoin.

With nearly $30 million raised, Bitcoin Hyper is gaining serious traction, and as more exchanges and wallets adopt it, the value of $HYPER could rise fast.

This is one of the most promising Bitcoin Layer 2 projects to watch, and early buyers are getting in before the rest of the market catches on.

To buy $HYPER before the presale ends, simply head to the Bitcoin Hyper official website and link up a compatible wallet like Best Wallet.

You can complete the transaction in seconds by swapping crypto or using a bank card.

Visit the Official Bitcoin Hyper Website Here

The post Solana Price Prediction: SOL Chosen for Sovereign Gold Token – Are Countries Using Solana Now? appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

📌 TOPINDIATOURS Breaking crypto: Inside Putin’s Crypto Cold War: How Russia Evaded

The Russia-Ukraine war has waged on for nearly 4 years now. Western sanctions were meant to isolate Russia financially. Instead, they forced adaptation.

In 2025, BeInCrypto began documenting how Russia and Russia-linked actors rebuilt payment routes using crypto. What emerged was not a single exchange or token, but a resilient system designed to survive freezes, seizures, and enforcement delays.

This investigation reconstructs that system in chronological order, based on on-chain forensic analysis and interviews with investigators tracking the flows.

The First Warning Signs Were not Criminal

Early signals did not point to ransomware or darknet markets. They pointed to trade.

Authorities began asking new questions on how money crossed borders for imports, how dual-use goods were paid for, and how settlements occurred without banks.

At the same time, on-chain data showed Russian OTC desks surging in activity. Exchanges hosting Russian OTC liquidity also saw volumes spike, especially in Asia.

Meanwhile, Telegram groups and darknet forums discussed sanctions evasion openly. These were not hidden conversations. They described practical methods for moving value across borders without banks.

The method was simple. OTC desks accepted rubles domestically, sometimes as cash. They issued stablecoins or crypto. That crypto then settled abroad, where it could be converted into local currency.

Garantex Operated Russia’s Crypto Laundering Hub

Garantex played a critical role in this ecosystem. It functioned as a liquidity hub for OTC desks, migrants, and trade-linked payments.

Even after early sanctions, it continued interacting with regulated exchanges abroad. That activity persisted for months.

When enforcement finally escalated, the expectation was disruption. What followed instead was preparation.

“Even people who were leaving Russia were still using Garantex to move their money out. If you were trying to relocate to places like Dubai, this became one of the main ways to transfer funds once traditional banking routes were cut off. For many Russians trying to leave the country, Garantex became a practical exit route. It was one of the few ways to move money abroad after banks and SWIFT were no longer an option,” said Lex Fisun, CEO of Global Ledger

The Seizure Triggered a Reserve Scramble

On the day Garantex’s infrastructure was seized in March 2025, a linked Ethereum wallet rapidly consolidated more than 3,200 ETH. Within hours, nearly the entire balance moved into Tornado Cash.

That move mattered. Tornado Cash does not facilitate payouts. It breaks transaction history.

Days later, dormant Bitcoin reserves began moving. Wallets untouched since 2022 consolidated BTC. This was not panic selling. It was treasury management under pressure.

So, it was clear that assets outside stablecoin control remained accessible.

A Successor Appeared Almost Immediately

As access to Garantex faded, a new service emerged.

Grinex launched quietly and began supporting USDT. Traced flows passed through TRON and connected to Grinex-linked infrastructure. Users reported balances reappearing under the new name.

“It was probably the most obvious rebrand we’ve seen. The name was nearly the same, the website was nearly the same, and users who lost access to Garantex saw their balances reappear on Grinex,” Fisun told BeInCrypto.

In late July 2025, Garantex publicly announced payouts to former users in Bitcoin and Ethereum. On-chain data confirmed the system was already live.

At least $25 million in crypto had been distributed. Much more remained untouched.

The payout structure followed a clear pattern where reserves were layered through mixers, aggregation wallets, and cross-chain bridges before reaching users.

Ethereum Payouts Relied on Complexity

Ethereum payouts used deliberate obfuscation. Funds moved through Tornado Cash, then into a DeFi protocol, then across multiple chains. Transfers bounced between Ethereum, Optimism, and Arbitrum before landing in payout wallets.

Despite the complexity, only a fraction of the ETH reserves reached users. More than 88% remained untouched, indicating payouts were still in early stages.

Bitcoin Payouts Exposed a Different Weakness

Bitcoin payouts were simpler and more centralized.

Investigators identified multiple payout wallets linked to a single aggregation hub that received nearly 200 BTC. That hub remained active months after the seizure.

More revealing was where the funds touched next.

Source wallets repeatedly interacted with deposit addresses tied to one of the world’s large…

Konten dipersingkat otomatis.

🔗 Sumber: www.beincrypto.com

🤖 Catatan TOPINDIATOURS

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!