📌 TOPINDIATOURS Eksklusif crypto: The Fed Under Fire: Is America’s Monetary Crisis

US President Donald Trump’s escalating attacks on the independence of the Federal Reserve are worrying investors. From pressuring Chair Jerome Powell to cut interest rates to firing Governor Lisa Cook, these measures have shaken investor confidence in American institutions and the US dollar.

According to Bitget, Jelly Labs, WeFi, and ZIGChain representatives, Trump’s moves represent historically uncharted territory in US monetary policy. They also believe that, while gold has always been around to soften the blow during times of uncertainty, investors may also begin to turn toward Bitcoin to safeguard their portfolios from government-controlled currencies.

Escalating Political Pressure on the Federal Reserve

Since assuming office, President Trump has carried out a series of attacks against the Federal Reserve over what he views as inadequate monetary policy.

Even before his inauguration, Trump had made a series of public comments urging Chairman Jerome Powell to lower interest rates and stimulate economic growth. In different social media posts, the President referred to Powell as “Mr. Too Late” and a “total and complete moron.”

These pressures on the central bank’s political independence have reached new heights recently. Last month, Trump announced the firing of Federal Reserve Governor Lisa Cook over mortgage fraud allegations.

Cook later filed a lawsuit against Trump, citing an illegal attempt to undermine the Fed’s independence. Two days ago, a US District Judge sided with Cook, temporarily blocking the administration from removing her. Trump has since appealed the decision.

Why This Time Is Different

History has shown that this isn’t the first time the US government has pressured the Federal Reserve over differences between the former’s political agenda and the latter’s monetary policy.

Former President Richard Nixon, for example, was determined to avoid the economic downturn in his 1972 re-election campaign that he believed cost him the 1960 election. Nixon’s conversations, later revealed in the Nixon tapes, show him urging then-Chairman Arthur Burns to lower interest rates and increase the money supply to stimulate the economy.

More famously, former President Lyndon B. Johnson physically shoved then-Chairman William McChesney Martin Jr. against a wall over the Fed’s decision to raise interest rates in the midst of the Vietnam War.

However, experts agree that the current level of intervention is unprecedented.

“In its 112-year history, no sitting US President has tried to remove a Federal Reserve Governor or the Chairman. The situation with Lisa Cook is highly polarizing as a US Judge has now blocked the President from removing the Fed Governor. The Trump administration is not known to back down from legal hurdles, and the country might not have seen the last of the Lisa Cook removal,” Bitget COO Vugar Usi Zade told BeInCrypto.

If the Trump administration wins its appeal, it would undermine the legal foundation of Fed independence, potentially causing the central bank to be perceived as a political tool.

Witnessing these developments, investors are asking a crucial question: What is the best investment strategy now?

How Is the Market Reacting to Attacks on Fed Independence?

Maksym Sakharov, CEO of WeFI, finds the recent attacks on the central bank particularly alarming because, instead of discreetly expressing dissatisfaction, the President is openly attacking the institution on social media for the world to see.

Investors have already taken note of this.

“For investors, this is a completely different ballgame because in the past, the market could largely dismiss political noise as just that— noise. But today the threats look credible, and markets are starting to price the risk of a compromised Fed,” Sakharov said.

Meanwhile, diminishing investor confidence in the US government will inevitably cause the dollar to suffer. If this contentious environment continues, the American economy will experience significant instability.

“If policymakers fail to take fiscal steps that restore confidence and instead continue policies that erode it, the consequences could be significant. We would likely see persistent inflation, rising bond yields as investors demand higher risk premiums, and growing pressure on the dollar’s status as the world’s reserve currency,” Jelly Labs Managing Director Santiago Sabater, said, adding, “This erosion of confidence will… widen wealth inequality, and deepen social and political polarization — potentially leading to periods of instability until the system resets.”

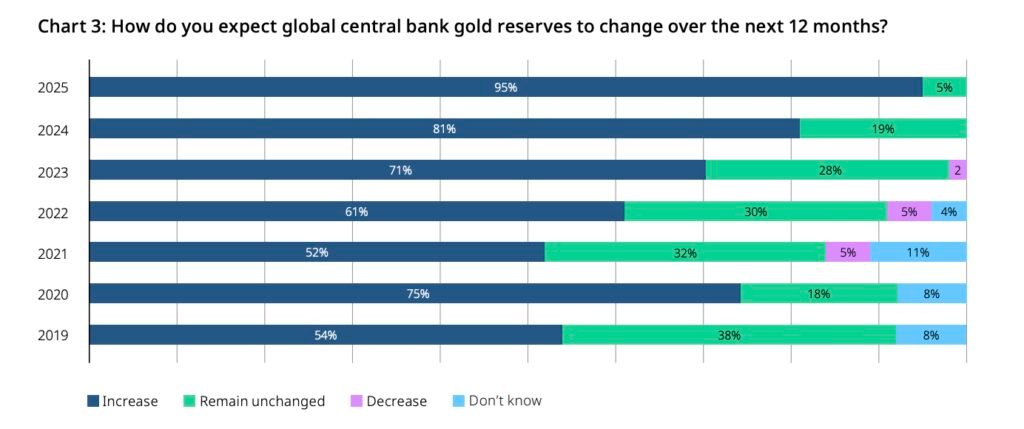

In fact, data is already showing that investors are re…

Konten dipersingkat otomatis.

🔗 Sumber: www.beincrypto.com

📌 TOPINDIATOURS Update crypto: Blockchain will transform football’s broken transfe

Football’s transfer system is plagued by delays and barriers. Blockchain technology offers faster settlements and global market access.

🔗 Sumber: www.cointelegraph.com

🤖 Catatan TOPINDIATOURS

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!