📌 TOPINDIATOURS Breaking crypto: Trump Shifts on Fed Pick as Hassett Odds Fade: Wh

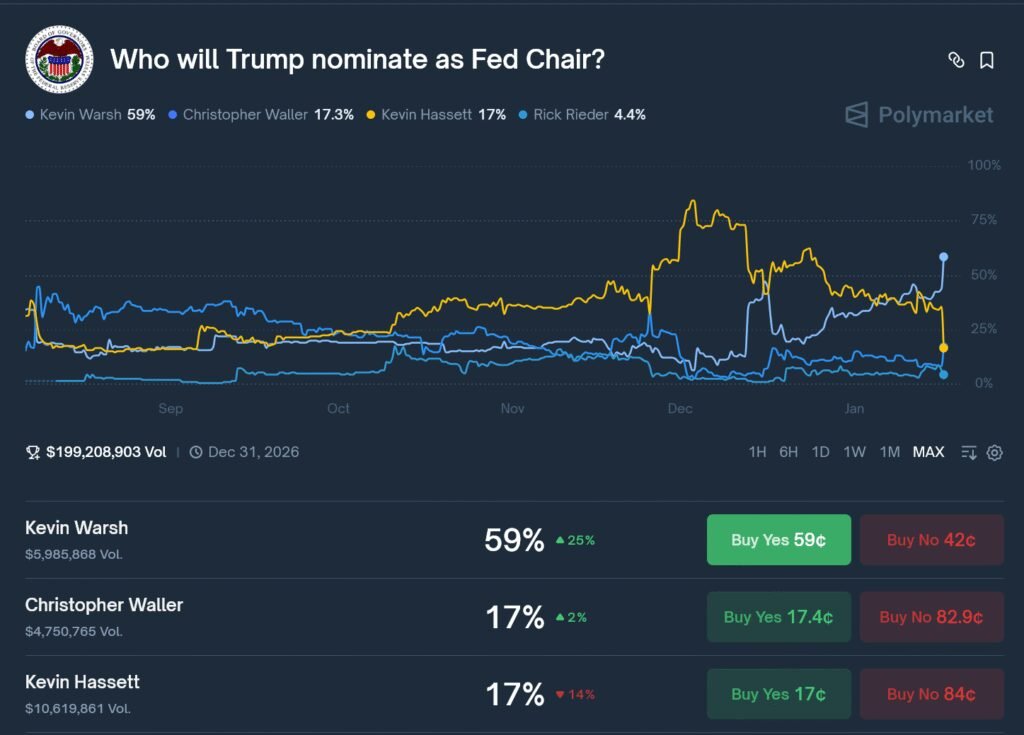

President Donald Trump publicly signaled hesitation about moving Kevin Hassett to the Federal Reserve, casting doubt on Hassett’s chances to succeed Jerome Powell as Fed Chair.

Speaking at a conference, Trump said he wants to keep Hassett in his current role, citing concerns about losing a trusted adviser if Hassett were sent to the Fed.

Kevin Hassett’s Chances Cool

That remark immediately reshuffled expectations around the next Fed chair. With Hassett’s odds slipping, attention has shifted to Kevin Warsh, now viewed by markets and Washington insiders as a leading contender.

Hassett had been widely discussed as a top replacement for Powell ahead of the May 2026 transition.

Trump’s comments, however, suggest a preference for continuity inside the White House rather than a move to the central bank.

As a result, prediction markets and analyst chatter have moved away from Hassett in recent days.

Kevin Warsh Moves to the Front

Kevin Warsh brings prior central-bank experience, having served as a Fed governor during the global financial crisis. His profile has long appealed to Republicans who want credibility with markets and a clearer separation between monetary policy and day-to-day politics.

Trump’s reluctance to part with Hassett has elevated Warsh into the top tier of candidates.

Crypto Lens: Warsh vs. Powell

On crypto, Warsh and Powell differ more in tone than in outcomes. Powell has maintained a cautious, institution-first approach, repeatedly stressing financial stability, consumer protection, and clear regulatory lines for stablecoins and exchanges.

He has avoided endorsing crypto as money while allowing markets to develop under existing rules.

Warsh’s record points to pragmatic skepticism. He has acknowledged Bitcoin’s potential as a store of value, often comparing it to gold, but he remains wary of private cryptocurrencies functioning as everyday money.

That stance suggests tighter guardrails rather than outright hostility. Compared with Powell, Warsh may sound more open to debate on digital assets, yet policy outcomes would likely stay conservative.

Powell’s Clock is Running Down

Powell’s term as Fed chair ends on May 15, 2026. He can remain on the Board of Governors until 2028, though chairs rarely do so after stepping down.

With inflation easing but not fully defeated, markets expect limited room for major policy shifts before his departure.

Traders increasingly price one more rate cut under Powell before the transition, assuming data cooperates.

Any larger pivot now appears unlikely, reinforcing the sense that the next chair will define policy direction for 2026 and beyond.

Meanwhile, Powell faces an unusual political backdrop. A Department of Justice probe tied to his congressional testimony on cost overruns for the Fed’s headquarters renovation has included subpoenas for records.

Powell has said the matter does not affect monetary policy. Yet, the investigation has intensified debate over central-bank independence as the leadership change approaches.

The post Trump Shifts on Fed Pick as Hassett Odds Fade: Who Will Replace Powell? appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 TOPINDIATOURS Update crypto: One of Wall Street’s Top Strategists No Longer Trus

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee — because this isn’t about price charts, ETF flows, or the next halving narrative. It’s about something far more uncomfortable: whether Bitcoin, as it exists today, is built to last.

Crypto News of the Day: Why One of Wall Street’s Biggest Bitcoin Bulls Just Walked Away

A quiet but consequential shift is unfolding in institutional crypto thinking. Christopher Wood, global head of equity strategy at Jefferies and one of Wall Street’s most closely followed market strategists, has removed Bitcoin entirely from his flagship model portfolio.

The Jeffries executive did not cite price volatility but instead cited doubts about the asset’s long-term durability.

Wood has cut a 10% Bitcoin allocation from Jefferies’ model portfolio and reallocated it evenly to physical gold and gold-mining stocks.

The decision was outlined in the latest edition of his Greed & Fear newsletter, where Wood pointed to the long-term threat posed by advances in quantum computing to Bitcoin’s security and store-of-value thesis.

“The once-distant threat of quantum computing has prompted one of the most closely followed market strategists to walk away from Bitcoin,” Bloomberg reported, citing Wood in the newsletter and highlighting how a theoretical risk is now entering mainstream portfolio construction.

Wood was an early institutional supporter of Bitcoin, first adding the asset to his model portfolio in December 2020 amid pandemic-era stimulus and fears of currency debasement.

He later raised the exposure to 10% in 2021. Notably, Bitcoin has since surged by approximately 325% since the initial allocation compared with gold’s 145% gain. Notwithstanding, Wood says performance is no longer the point.

In his view, quantum computing weakens the argument that Bitcoin can function as a dependable, multi-decade store of value, particularly for pension-style, long-term investors.

“There is growing concern in the Bitcoin community that quantum computing could only be a few years away rather than a decade or more,” Wood wrote.

Indeed, Bitcoin’s security rests on cryptographic systems that make it practically impossible for today’s computers to derive private keys from public ones.

However, cryptographically relevant quantum computers (CRQCs) could collapse that asymmetry. This could allow attackers to reverse-engineer private keys in hours or days.

Quantum Risk, Governance, and the Institutional Rethink of Bitcoin

The debate exposes a widening divide between capital allocators and developers. Nic Carter, a partner at Castle Island Ventures, captured this tension in a December post.

Nevertheless, governance is at the heart of the issue. Proposed solutions, including burning quantum-vulnerable coins or forcing a migration to post-quantum cryptography, raise uncomfortable questions about property rights and rule changes.

Jefferies noted that while Bitcoin has undergone forks before, confiscating or invalidating coins could undermine the very principles that give the network credibility.

Jefferies also highlighted that large portion of the Bitcoin supply could be vulnerable in a quantum scenario. These include:

- Satoshi-era holdings stored in Pay-to-Public-Key (P2PK) addresses

- Lost coins, and

- Addresses reused across multiple transactions

Altogether, this is potentially millions of BTC.

Recent analysis from Coinbase has echoed some of those concerns. Coinbase Head of Investment Research David Duong said quantum computing poses long-term risks beyond private key security, potentially affecting Bitcoin’s economic and security models.

While stressing that current quantum technology is far from breaking Bitcoin today, Duong warned that around 6.5 million BTC could be exposed to long-range quantum attacks. This makes migration to post-quantum cryptography essential, if still years away.

Konten dipersingkat otomatis.

🔗 Sumber: www.beincrypto.com

🤖 Catatan TOPINDIATOURS

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!