📌 TOPINDIATOURS Update crypto: Mortgage Lender Newrez Embraces Crypto Assets in Lo

Newrez is set to begin counting certain cryptocurrency holdings as qualifying assets in its mortgage underwriting process, a policy shift that could expand access to home loans for borrowers with digital assets.

Key Takeaways:

- Newrez will begin counting certain crypto holdings as qualifying assets for mortgages starting in February.

- Borrowers will be able to use Bitcoin, Ether and stablecoins without selling them, subject to risk adjustments.

- The move targets younger buyers and aligns with ongoing US policy discussions on crypto in mortgage underwriting.

The change is expected to take effect in February and will apply across the lender’s non-agency products, including home purchases, refinancings and investment properties.

Newrez to Count Bitcoin, Ether and Stablecoins as Mortgage Assets

Under the new approach, Newrez will allow eligible crypto holdings to be considered alongside traditional assets such as stocks and bonds, removing a long-standing requirement for borrowers to liquidate their digital assets before applying.

At launch, the lender said it will recognize Bitcoin, Ether, spot exchange-traded funds backed by those assets, and U.S. dollar-pegged stablecoins.

The assets must be held with US-regulated crypto exchanges or fintech platforms, brokerages, or nationally chartered banks.

Newrez said crypto valuations used in underwriting may be adjusted to reflect market volatility, while borrowers will still need to cover closing costs and make mortgage payments in US dollars.

The lender emphasized that the policy is designed to integrate crypto within existing risk controls rather than overhaul its underwriting standards.

Chief commercial officer Leslie Gillin said the decision reflects changing investor behavior, particularly among younger buyers.

About 45% of Gen Z and Millennial investors hold cryptocurrency, Gillin said, adding that recognizing digital assets could help broaden access to homeownership for groups that have struggled to enter the housing market.

Newrez’s move comes as US policymakers continue to debate how cryptocurrencies should factor into mortgage risk assessments.

In June 2025, the Federal Housing Finance Agency directed Fannie Mae and Freddie Mac to study how crypto assets could be considered in single-family mortgage underwriting without first being converted into dollars.

Shortly afterward, Cynthia Lummis introduced the 21st Century Mortgage Act, which would codify that directive into law.

Lummis argued that housing affordability challenges are increasingly affecting younger Americans, many of whom hold a significant share of their savings in digital assets.

The bill has been referred to the Senate Committee on Banking, Housing and Urban Affairs, where it has yet to advance.

Interactive Brokers Enables 24/7 Account Funding With Stablecoins

Interactive Brokers has expanded its crypto services by allowing clients to fund brokerage accounts with stablecoins that are automatically converted into US dollars.

The new feature enables 24/7 deposits using USDC across multiple blockchain networks through a partnership with zerohash, removing delays tied to traditional wire transfers.

Once received, stablecoins are converted into dollars and credited directly to client accounts, letting investors begin trading within minutes.

Interactive Brokers said support for Ripple USD and PayPal USD will launch next week, building on USDC funding that was first introduced for retail clients in December.

The brokerage said the move addresses a key friction point for global investors, as wire transfers can be slow and costly.

The post Mortgage Lender Newrez Embraces Crypto Assets in Loan Decisions appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

📌 TOPINDIATOURS Breaking crypto: Why Is The Crypto Market Down Today? Edisi Jam 11

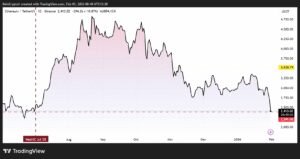

The total crypto market cap (TOTAL) and Bitcoin (BTC) took a hit over the past day as the market remained slightly bearish. Although BTC is still holding above $95,000, altcoins led by Monero (XMR) witnessed a sharper decline in the last 24 hours.

In the news today:-

- The US Department of Justice charged Venezuelan national Jorge Figueira for allegedly laundering $1 billion through crypto exchanges and shell companies. Prosecutors claim the scheme moved funds in and out of the US, targeting high-risk jurisdictions including Colombia, China, Panama, and Mexico.

- The White House is considering withdrawing support for a digital asset market structure bill after Coinbase abruptly pulled its backing. Officials say the move, described as a “rug pull,” angered the administration and destabilized broader crypto policy efforts.

The Crypto Market Dips

The total crypto market cap declined by $15.5 billion in the past 24 hours, reaching $3.18 trillion, according to market data. This places TOTAL just below the $3.21 trillion resistance level. The drop reflects cautious sentiment as investors react to macro uncertainty and reduced short-term risk appetite.

If current market conditions persist, TOTAL is likely to retest support near $3.16 trillion. A breakdown below this level would signal stronger selling pressure across major assets. Such a move could increase volatility, as traders reduce exposure amid weakening momentum and limited near-term catalysts.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

A recovery remains possible if broader market sentiment improves over the coming week. Should buying activity return, TOTAL could reclaim $3.21 trillion as support. Holding that level may allow the market cap to rebound toward $3.26 trillion, signaling renewed confidence and stabilizing capital inflows.

Bitcoin Is Holding Above $95,000

Bitcoin is trading at $95,100, holding above the $95,000 support at the time of writing, while trading inside an ascending broadening wedge pattern. This formation can favor upward continuation if the price pushes higher with conviction. For a valid breakout, BTC must move above $98,000 and confirm that level as a new support zone.

Current price behavior suggests a potential base is forming. Maintaining strength above the $95,000 psychological threshold is essential. If buyers continue defending this area, another attempt at $98,000 becomes likely. A successful reclaim would position Bitcoin for a move toward the $100,000 psychological target.

However, downside risk has not been eliminated. If momentum weakens and short-term participants take profits, BTC could slip below $95,000. A decline toward $93,471 would come into focus. Losing that level would negate the bullish setup and postpone any near-term upside breakout.

Monero Falls 8%

Monero price fell 8% in the last 24 hours, trading near $624 at the time of writing. The privacy-focused cryptocurrency recently surged to a new all-time high of $800. The pullback follows rapid gains, suggesting cooling momentum after an aggressive rally driven by heightened demand.

Profit-taking by long-term holders, combined with broader bearish crypto market conditions, continues to pressure XMR price action. Weak sentiment across altcoins is increasing downside risk. If selling persists, Monero could decline toward the $560 level, where buyers may attempt to slow further losses.

For a bullish reversal, XMR must rebound and reclaim $711 as a key support level. A successful hold above this threshold would signal renewed strength. Such a move could open the path for Monero to retest $800 and potentially establish a fresh all-time high.

The post Why Is The Crypto Market Down Today? appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

🤖 Catatan TOPINDIATOURS

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!