📌 TOPINDIATOURS Eksklusif crypto: Coinbase CEO Calls 4 Billion People “Unbrokered”

Coinbase CEO Brian Armstrong unveiled a sweeping vision to democratize global capital markets through blockchain tokenization, targeting roughly 4 billion adults worldwide who lack access to equity and bond investments despite the accelerating divergence between capital and labor income growth.

The exchange published a comprehensive policy paper titled “From the Unbanked to the Unbrokered: Unlocking Wealth Creation for the World,” arguing that technological barriers and cost structures have systematically excluded two-thirds of the global adult population from wealth-building opportunities.

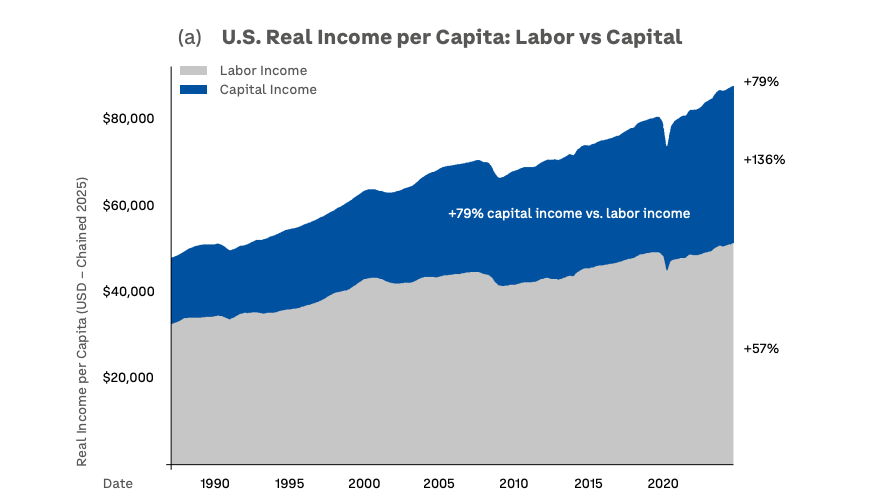

In the United States, labor income has grown by 57% since 1987, while capital income has surged by 136%, creating what Armstrong describes as a structural impediment to broad-based prosperity.

Capital Chasm Widens Across Geographic Lines

The paper identifies participation in capital markets as fundamentally determined by wealth and geography rather than merit or savings discipline.

Roughly 4 billion adults do not participate in equity and bond markets, with engagement rates ranging from 55-60% in the United States to below 10% in China and India.

“I think about a talented worker in Lagos or Jakarta who has the drive and ability to build a better life for themselves and their family—but who faces near-total exclusion from the same capital markets available to a wealthy investor in New York,” Armstrong wrote, emphasizing that geography rather than ability determines who gets access.

Beyond national participation rates, the research highlights severe home bias among existing investors.

Data shows domestic equity holdings far exceeding countries’ share of global market capitalization, with investors in Indonesia, Russia, and Turkey allocating over 95% of portfolios to local markets despite representing fractions of global equity value.

Tokenization as an Infrastructure Solution

The policy blueprint positions blockchain-based tokenization as the primary mechanism to collapse legacy cost structures that price out small savers.

Traditional financial infrastructure operates on fixed compliance costs, custody fees, settlement delays, and minimum account thresholds that render participation uneconomic for anyone below certain wealth levels.

According to the paper, recent studies estimate that tokenized equity trading could reduce investor transaction costs by more than 30%, with efficiency gains expanding over time as atomic settlement eliminates multi-day reconciliation cycles.

“Permissioned systems inevitably replicate existing power dynamics, allowing infrastructure owners to limit competition,” Armstrong wrote, comparing blockchain protocols to TCP/IP internet infrastructure that enables open innovation without gatekeeping.

Policy Roadmap Targets Regulatory Coordination

Coinbase outlined five policy pillars necessary to realize tokenized capital markets at scale.

The recommendations particularly prioritize base-layer neutrality, treating blockchain protocols as impartial infrastructure where compliance is concentrated at the application layers rather than at the protocol level.

The five policy pillars include:

- Uphold base-layer neutrality with compliance at application layers

- Create clear pathways for tokenizing traditional assets

- Foster integration with traditional finance institutions

- Recognize self-custody rights with blockchain transparency oversight

- Modernize safeguards through exchange controls rather than wallet bans

Modern blockchain analytics tools enable the detection and tracing of suspicious patterns with unprecedented precision, challenging historical assumptions that bearer instruments inherently facilitate illicit finance.

Everything Exchange Strategy Takes Shape

Armstrong defines success as a small saver anywhere on earth being able to convert spare earnings into fractional ownership of productive global assets as easily as sending a text message.

“When a farmer in a country without a functional stock exchange can own shares in the same companies as a hedge fund manager in New York, both on the same neutral infrastructure at basis-point costs, then the capital chasm will have truly narrowed,” he wrote.

The policy release comes as Coinbase began rolling out traditional stock trading to select users, positioning the exchange to compete directly with Robinhood, Charles Schwab, and Fidelity.

Earlier this month, Armstrong outlined three 2026 priorities, including building an “everything exchange” globally across crypto, equities, prediction markets, and commodities, scaling stablecoins and payments, and bringing users on-chain through the Base blockchain.

“Goal is to make Coinbase the #1 financial app in the world,” he posted. The exchange currently offers stocks through conventional methods using Apex Fintech Solutions, with plans to expand access to all customers within weeks.

David Duong, Coinbase’s head of investment research, also said regulatory clarity improvements and deepening institutional participation create favorable conditions ahead.

“We expect these forces to compound in 2026 as ETF approval timelines compress, stablecoins take a larger role in delivery-vs-payment structures, and tokenized collateral is recognized more broadly,”…

Konten dipersingkat otomatis.

🔗 Sumber: cryptonews.com

📌 TOPINDIATOURS Breaking crypto: Bitcoin Price Prediction: Double Bottom Near $89K

Bitcoin is consolidating near $89,600, down nearly 4% on the day, as broader crypto markets remain under pressure. Ethereum has slipped around 7% to $2,998, while Solana and XRP are down over 5%. Despite the pullback, market structure suggests controlled risk reduction rather than panic selling.

The total crypto market capitalization stands at $3.02 trillion, with $133.25 billion in 24-hour volume. The Fear and Greed Index reads 42 (Neutral), while the Altcoin Season Index remains low at 27/100, confirming that capital continues to favor Bitcoin over higher-beta assets.

Institutional positioning remains a key stabilizing factor. CoinShares data shows $2.17 billion in net crypto ETP inflows last week, the strongest weekly intake of 2026 so far and the largest since October.

Bitcoin absorbed $1.55 billion, or roughly 71% of total inflows, reinforcing its role as the primary institutional exposure during periods of uncertainty. Ethereum followed with $496 million, while XRP and Solana attracted $70 million and $46 million, respectively.

Assets under management across crypto funds have now surpassed $193 billion, the highest level since November. BlackRock led issuers with $1.3 billion in inflows, highlighting continued demand from large allocators even as spot prices soften.

Notably, most inflows occurred earlier in the week. Sentiment weakened into Friday as tariff headlines and geopolitical risks resurfaced, but weekly flows remained firmly positive.

Futures Open Interest Rebuilds Without Excess Leverage

Derivatives data supports the idea of a measured reset rather than renewed speculation. Bitcoin futures open interest has increased about 13% since January 1, rising from $54 billion to over $61 billion, with a brief peak near $66 billion, according to Coinglass.

This follows a sharp 17.5% OI contraction between October and December, when Bitcoin corrected roughly 36%. Importantly, leverage remains well below late-2025 levels, reducing liquidation risk.

Another constructive signal is that Bitcoin options open interest now exceeds futures OI, pointing to more structured hedging and positioning rather than directional leverage. This setup increases the likelihood that price dips are absorbed instead of amplified.

Dollar Weakness, Trade Risk, and Bitcoin’s Hedge Role

Macro pressure remains a near-term headwind. The US dollar slipped after President Donald Trump signaled potential 10% tariffs starting February 1 on goods from Germany, France, the UK, and Nordic countries. The move triggered risk-off flows into traditional havens, lifting the euro, pound, and Swiss franc.

Persistent trade friction and policy uncertainty continue to support Bitcoin’s longer-term hedge narrative, especially as institutional exposure grows through regulated products.

Bitcoin Price Prediction: What Is Happening to Bitcoin Right Now?

Bitcoin price prediction is strongly bearish as BTC broke below a well-defined uptrend earlier this week, slipping under $93,000, a level that had supported price through most of January. That breakdown accelerated selling, pushed BTC into oversold territory, and triggered long liquidations across futures markets.

Price action near $89,000, however, looks different. Instead of aggressive follow-through, recent candles show smaller bodies and longer lower wicks, signaling that sell pressure is being absorbed. This points to selective selling rather than panic, with dip buyers stepping in around key support.

Momentum indicators support this pause. The RSI is deeply oversold, a condition that often precedes short-term relief moves when it aligns with major horizontal levels.

Why $89K Matters

The $89,000 zone is now the pivot. Holding above it keeps the potential double bottom intact and limits immediate downside risk.

If support holds, upside tests may target:

- $91,000, first resistance

- $92,500–$93,000, where broken structure converges

A clean break below $89,000 would invalidate the setup and expose $87,500, then $85,500.

Bitcoin (BTC/USD) Price Outlook

Bitcoin is pausing, not collapsing. If higher lows form above $89K, this pullback may act as a reset rather than a deeper correction. Short term, $89K defines the next move.

Bitcoin Hyper: The Next Evolution of BTC on Solana?

Bitcoin Hyper ($HYPER) is bringing a new phase to the Bitcoin ecosystem. While BTC remains the gold standard for security, Bitcoin Hyper adds what it always lacked: Solana-level speed. …

Konten dipersingkat otomatis.

🔗 Sumber: cryptonews.com

🤖 Catatan TOPINDIATOURS

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!