📌 TOPINDIATOURS Breaking crypto: Worldcoin Jumps 16% After Report OpenAI Is Explor

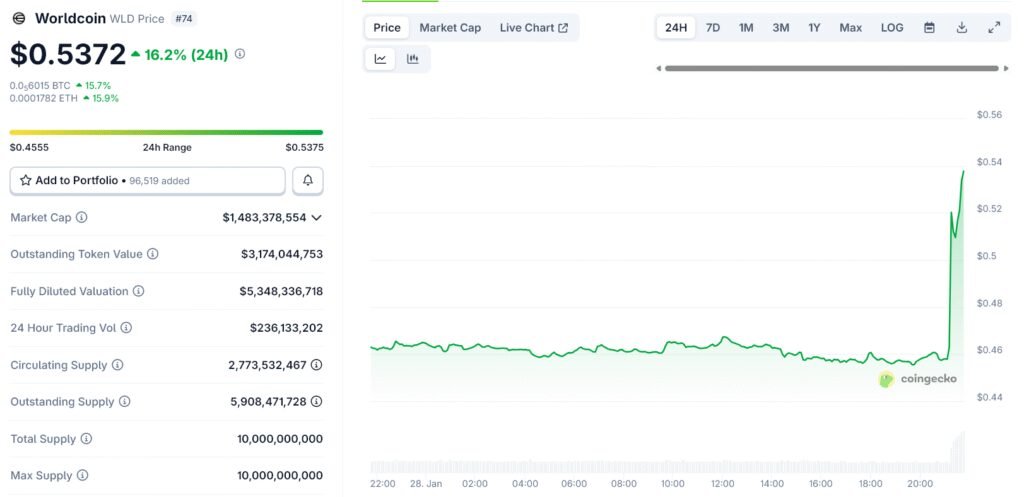

Worldcoin (WLD) surged more than 16% in a straight line after a Forbes report said OpenAI is developing a social network designed to tackle the growing bot problem online using “proof of personhood.”

According to the report, the project is still in the early stages and has a team of fewer than 10 people. Sources said OpenAI is evaluating biometric verification methods, including Apple’s Face ID and World’s iris-scanning technology.

OpenAI’s Social Network Report Sparks Market Reaction

WLD rose to around $0.53 within hours of the story, marking one of its strongest single-day moves in recent months.

Trading volume also spiked as investors reacted to the potential validation of World’s core identity thesis.

World Network, formerly Worldcoin, focuses on proving that a user is a real and unique human without relying on traditional identity documents.

Its system uses a device known as the Orb to scan a person’s iris and generate a cryptographic proof called World ID.

The project says it does not store raw biometric images, instead converting them into privacy-preserving identifiers used to prevent duplicate identities.

The idea behind this approach is proof of personhood.

Unlike KYC, proof of personhood does not aim to identify who someone is. It aims to confirm that each account belongs to one real human.

This has become increasingly relevant as AI-generated bots flood social platforms, governance systems, and token distribution mechanisms.

The Bot Problem Is Forcing Platforms to Rethink Identity

Over the past year, World Network has expanded its infrastructure and pushed for broader adoption of World ID. At the same time, it has faced regulatory scrutiny in several regions over biometric data collection.

These pressures have slowed deployments in some markets but also sharpened the debate around digital identity and privacy.

The OpenAI report arrives as major platforms openly struggle with bots.

Earlier this month, X updated its API and algorithm rules to block so-called InfoFi crypto projects that financially reward posting and engagement.

X said those incentives had fueled bot activity and low-quality content, worsening the platform’s spam problem.

Together, these developments highlight a broader shift. Platforms are moving from reactive moderation toward stronger identity and participation controls.

Proof of personhood has emerged as one of the few proposed solutions that does not rely on full identity disclosure.

While OpenAI has not announced a product or timeline, the market reaction shows how sensitive crypto investors remain to signals that large technology firms are taking decentralized identity and human verification seriously.

The post Worldcoin Jumps 16% After Report OpenAI Is Exploring Proof of Personhood appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 TOPINDIATOURS Breaking crypto: Trump’s Greenland Ambition Has Stalled, Will Worl

World Liberty Financial’s price has seen heightened volatility following months of politically driven momentum. The Trump-backed token posted strong macro gains during renewed discourse around Greenland’s strategic future.

That narrative now appears to be fading. As diplomatic tensions eased, speculative interest weakened, raising concerns that recent price strength could unravel.

What Went Down Between Trump and Greenland

Interest in World Liberty Financial accelerated as Donald Trump revived his long-standing push to acquire Greenland. First raised in 2019, the proposal resurfaced after Trump returned to office, reigniting political and market attention.

Traders viewed the narrative as a catalyst, betting that geopolitical pressure could translate into policy-driven upside for Trump-linked assets.

Momentum intensified in late 2025 as protests erupted across Greenland and Denmark. Demonstrators rejected any transfer of sovereignty and stressed the right to self-determination.

In January 2026, Trump claimed the US would gain “total access” to Greenland, fueling speculative buying.

Officials later clarified talks focused on defense cooperation, not ownership. At the World Economic Forum in Davos, Trump announced a security framework, while European leaders reaffirmed firm red lines.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

WLFI Holders Are Booking Profits

Investor behavior shifted sharply during the buildup. In November 2025, large holders accumulated roughly 300 million WLFI within ten days.

The buying reflected expectations of prolonged geopolitical escalation. On-chain data suggested confidence that the narrative would persist into early 2026, supporting higher valuations.

That stance reversed after January 22, when Trump formally backed away from ownership ambitions. Following the announcement of a cooperative framework, holders began reducing exposure.

Exchange balances jumped from 1.71 billion to 1.94 billion WLFI in one day. About 230 million tokens, worth nearly $37 million, were sold within 24 hours. The move reflected fears of declining relevance now that the catalyst had ended.

Momentum indicators confirm weakening demand. The Money Flow Index shows buying pressure has nearly dissipated following the recent sell-off. The sharp dip reflects capital exiting WLFI as speculative traders reassess risk.

If the MFI falls below the zero line, selling pressure would be confirmed. Such a signal often precedes extended declines, especially for narrative-driven assets. Without renewed inflows, WLFI remains vulnerable to further downside as liquidity thins.

WLFI Price Does Not Have A Bright Future

WLFI is trading near $0.164 after moving within an ascending wedge for nearly 3 months. The structure typically signals weakening momentum during extended uptrends.

Despite a brief upside fakeout, the pattern remains intact. A confirmed breakdown projects a 28% decline, targeting $0.1145.

Technical confirmation would occur if WLFI slips below the $0.143 support level. Such a move would mark a new low for 2026. Given the token’s sensitivity to Trump-related developments, further selling would not be surprising. A continued shift toward diplomatic stability could accelerate downside pressure.

Bullish risk remains if political rhetoric resurfaces. Should Trump reignite the Greenland discourse, WLFI could rebound from $0.165. A move above $0.182 would signal renewed speculative interest.

Reclaiming $0.193 or higher would invalidate the bearish pattern. Under those conditions, a push toward $0.200 would become feasible.

The post Trump’s Greenland Ambition Has Stalled, Will World Liberty Financial Price React? appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

🤖 Catatan TOPINDIATOURS

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!