📌 TOPINDIATOURS Hot crypto: Worldcoin Jumps 16% After Report OpenAI Is Exploring P

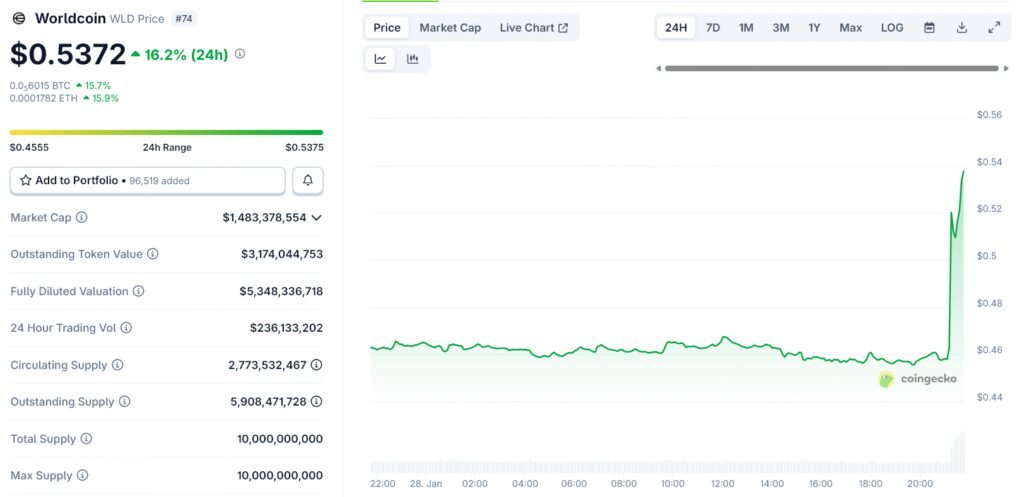

Worldcoin (WLD) surged more than 16% in a straight line after a Forbes report said OpenAI is developing a social network designed to tackle the growing bot problem online using “proof of personhood.”

According to the report, the project is still in the early stages and has a team of fewer than 10 people. Sources said OpenAI is evaluating biometric verification methods, including Apple’s Face ID and World’s iris-scanning technology.

OpenAI’s Social Network Report Sparks Market Reaction

WLD rose to around $0.53 within hours of the story, marking one of its strongest single-day moves in recent months.

Trading volume also spiked as investors reacted to the potential validation of World’s core identity thesis.

World Network, formerly Worldcoin, focuses on proving that a user is a real and unique human without relying on traditional identity documents.

Its system uses a device known as the Orb to scan a person’s iris and generate a cryptographic proof called World ID.

The project says it does not store raw biometric images, instead converting them into privacy-preserving identifiers used to prevent duplicate identities.

The idea behind this approach is proof of personhood.

Unlike KYC, proof of personhood does not aim to identify who someone is. It aims to confirm that each account belongs to one real human.

This has become increasingly relevant as AI-generated bots flood social platforms, governance systems, and token distribution mechanisms.

The Bot Problem Is Forcing Platforms to Rethink Identity

Over the past year, World Network has expanded its infrastructure and pushed for broader adoption of World ID. At the same time, it has faced regulatory scrutiny in several regions over biometric data collection.

These pressures have slowed deployments in some markets but also sharpened the debate around digital identity and privacy.

The OpenAI report arrives as major platforms openly struggle with bots.

Earlier this month, X updated its API and algorithm rules to block so-called InfoFi crypto projects that financially reward posting and engagement.

X said those incentives had fueled bot activity and low-quality content, worsening the platform’s spam problem.

Together, these developments highlight a broader shift. Platforms are moving from reactive moderation toward stronger identity and participation controls.

Proof of personhood has emerged as one of the few proposed solutions that does not rely on full identity disclosure.

While OpenAI has not announced a product or timeline, the market reaction shows how sensitive crypto investors remain to signals that large technology firms are taking decentralized identity and human verification seriously.

The post Worldcoin Jumps 16% After Report OpenAI Is Exploring Proof of Personhood appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 TOPINDIATOURS Hot crypto: How Will Fidelity’s FIDD Stablecoin Fare in An Already

Fidelity Investments, one of the world’s largest asset managers, announced on Wednesday that it will launch a stablecoin on Ethereum. The token, called the Fidelity Digital Dollar (FIDD), is expected to become available on exchanges in the coming weeks for institutional and retail investors.

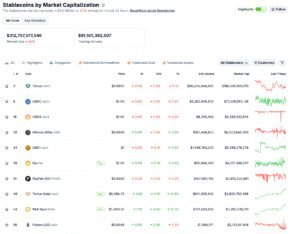

The move highlights the growing entry of companies and financial institutions into the stablecoin sector, now valued at more than $316 billion. As competition intensifies, questions remain over which projects will achieve lasting adoption and which will fade.

Fidelity Enters Stablecoin Race With FIDD

In the official statement, Fidelity claimed that FIDD would seek to provide a stable digital dollar that combines the value of blockchain with the reliability of the US dollar.

“At Fidelity, we have a long-standing belief in the transformative power of the digital assets ecosystem and have spent years researching and advocating for the benefits of stablecoins,” said Mike O’Reilly, resident of Fidelity Digital Assets, in a statement.

The move comes a month after Fidelity Digital Assets, National Association, the firm’s national trust bank, received conditional approval to operate from the US Office of the Comptroller of the Currency. The entity will be responsible for issuing the FIDD.

In its statement, Fidelity described itself as one of the first traditional financial institutions to issue its own digital dollar. As with other stablecoins, FIDD will be fully backed by reserves to maintain its peg.

O’Rielly also cited the United States’ increasingly favorable stance toward stablecoins as a key factor behind the launch of FIDD.

“The recent passage of the GENIUS Act was a significant milestone for the industry in providing clear regulatory guardrails for payment stablecoins. We’re thrilled to launch a fiat-backed stablecoin at a time of increasing regulatory clarity to better support our customers’ needs,” he said.

However, given this newfound regulatory clarity, Fidelity is also entering an increasingly competitive arena.

Stablecoin Market Crowds After Genius Act

Since the passage of the Genius Act, stablecoin adoption has accelerated rapidly. At the time of writing, total trading volume sits just below $100 billion.

Market leader Tether has long dominated the sector, with its flagship USDT token accounting for nearly 60% of all stablecoins in circulation and a market capitalization exceeding $186 billion.

Because much of Tether’s operations are based overseas, the company launched a new stablecoin, USA₮, earlier this week to comply with the Genius Act’s regulatory requirements.

Meanwhile, Circle’s USDC is the market’s second-largest stablecoin, with a market capitalization of more than $71 billion.

While these two stablecoins dominate the market, competition is intensifying as new entrants gain traction. Over the past two years, major financial firms, including PayPal and Ripple, have launched their own stablecoins.

However, compared with Tether and Circle, these stablecoins remain far from achieving a similar level of market penetration.

Against this backdrop, Fidelity’s entry into the stablecoin market with FIDD comes amid intense competition.

The post How Will Fidelity’s FIDD Stablecoin Fare in An Already Crowded Marketplace? appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

🤖 Catatan TOPINDIATOURS

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!