📌 TOPINDIATOURS Breaking crypto: How Will Fidelity’s FIDD Stablecoin Fare in An Al

Fidelity Investments, one of the world’s largest asset managers, announced on Wednesday that it will launch a stablecoin on Ethereum. The token, called the Fidelity Digital Dollar (FIDD), is expected to become available on exchanges in the coming weeks for institutional and retail investors.

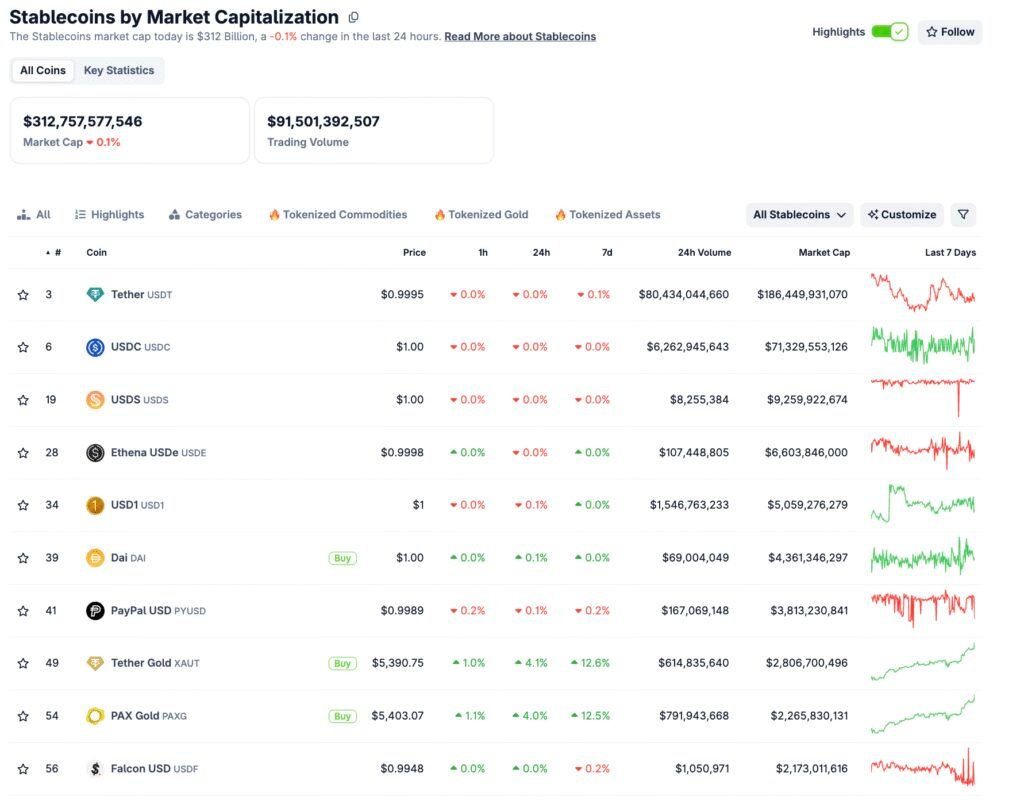

The move highlights the growing entry of companies and financial institutions into the stablecoin sector, now valued at more than $316 billion. As competition intensifies, questions remain over which projects will achieve lasting adoption and which will fade.

Fidelity Enters Stablecoin Race With FIDD

In the official statement, Fidelity claimed that FIDD would seek to provide a stable digital dollar that combines the value of blockchain with the reliability of the US dollar.

“At Fidelity, we have a long-standing belief in the transformative power of the digital assets ecosystem and have spent years researching and advocating for the benefits of stablecoins,” said Mike O’Reilly, resident of Fidelity Digital Assets, in a statement.

The move comes a month after Fidelity Digital Assets, National Association, the firm’s national trust bank, received conditional approval to operate from the US Office of the Comptroller of the Currency. The entity will be responsible for issuing the FIDD.

In its statement, Fidelity described itself as one of the first traditional financial institutions to issue its own digital dollar. As with other stablecoins, FIDD will be fully backed by reserves to maintain its peg.

O’Rielly also cited the United States’ increasingly favorable stance toward stablecoins as a key factor behind the launch of FIDD.

“The recent passage of the GENIUS Act was a significant milestone for the industry in providing clear regulatory guardrails for payment stablecoins. We’re thrilled to launch a fiat-backed stablecoin at a time of increasing regulatory clarity to better support our customers’ needs,” he said.

However, given this newfound regulatory clarity, Fidelity is also entering an increasingly competitive arena.

Stablecoin Market Crowds After Genius Act

Since the passage of the Genius Act, stablecoin adoption has accelerated rapidly. At the time of writing, total trading volume sits just below $100 billion.

Market leader Tether has long dominated the sector, with its flagship USDT token accounting for nearly 60% of all stablecoins in circulation and a market capitalization exceeding $186 billion.

Because much of Tether’s operations are based overseas, the company launched a new stablecoin, USA₮, earlier this week to comply with the Genius Act’s regulatory requirements.

Meanwhile, Circle’s USDC is the market’s second-largest stablecoin, with a market capitalization of more than $71 billion.

While these two stablecoins dominate the market, competition is intensifying as new entrants gain traction. Over the past two years, major financial firms, including PayPal and Ripple, have launched their own stablecoins.

However, compared with Tether and Circle, these stablecoins remain far from achieving a similar level of market penetration.

Against this backdrop, Fidelity’s entry into the stablecoin market with FIDD comes amid intense competition.

The post How Will Fidelity’s FIDD Stablecoin Fare in An Already Crowded Marketplace? appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 TOPINDIATOURS Eksklusif crypto: Asia Market Open: Bitcoin Range-Bound Near $88K

Bitcoin held near $88,000 early Thursday as Asian markets eased out of a hot streak in tech and investors shifted focus to earnings, central bank signals, and a fresh run higher in gold.

Shanghai rose 0.21% and DJ Shanghai gained 0.22%, and the SZSE Component slipped 0.10% and China A50 fell 0.20%. Hong Kong stood out as the Hang Seng jumped 1.22%.

Market snapshot

- Bitcoin: $88,527, down 0.7%

- Ether: $2,990, down 0.6%

- XRP: $1.89, down 0.1%

- Total crypto market cap: $3.08 trillion, down 0.6%

Markets Torn Between Tech Hopes And Macro Uncertainty

Lukman Otunuga, senior market analyst at FXTM, said that markets are being pulled in two directions.

“On one hand, optimism around global equities and major tech earnings is supporting risk appetite. On the other, persistent trade uncertainty, sharp currency moves, and doubts around US fiscal and monetary policy are keeping investors on edge,” he said.

“With the dollar still vulnerable and big tech earnings accounting for a significant share of the S&P 500, the coming days could set the tone for risk sentiment well beyond this week.”

Gold and silver pushed to fresh all-time highs as investors stayed committed to physical assets, and oil hit a four-month top after President Donald Trump warned Iran of possible attacks if it did not make a deal on nuclear weapons.

Powell Signals Steady Policy As Markets Reprice Easing Path

In the US, the Federal Reserve kept rates on hold, and Chair Jerome Powell talked of a “clearly improving” economic outlook and broad support on the committee for a pause. Powell also sidestepped questions on whether he would remain as a governor after stepping down as chair in May as Trump presses for deeper cuts.

Traders then repriced the path ahead, with the chance of another easing by April pared back to 26% and June seen as the next likely window at 61%.

Earnings kept driving the equity story. Samsung Electronics reported a surge in operating profit as AI spending lifted chip prices, and markets also watched the split reaction to Microsoft and Meta, with investors turning next to Apple results.

Currency markets stayed unsettled as the dollar remained under pressure, even after US Treasury Secretary Scott Bessent reiterated the administration’s preference for a strong dollar, and European officials monitored the euro’s rise as the European Central Bank flagged that a steep move could influence rate decisions.

For crypto, the mood stayed cautious. Thin spot ETF activity and softer derivatives positioning kept bitcoin trading in a tight range, with traders looking for a clearer catalyst from risk markets, earnings, and the next signals from policymakers.

The post Asia Market Open: Bitcoin Range-Bound Near $88K As Asia Tech Loses Momentum, Gold Pushes Higher appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

🤖 Catatan TOPINDIATOURS

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!