📌 TOPINDIATOURS Update crypto: 3 Real World Assets (RWA) Tokens To Watch In Februa

January is almost over, and real-world asset tokens have yet to deliver a broad breakout despite being one of crypto’s strongest narratives in 2025. Performance across the sector remains uneven, with sharp gains and losses concentrated in only a few names.

Against that backdrop, a small group of RWA tokens to watch is beginning to stand out based on conviction, positioning, and developing chart structures. As February approaches, these 3 setups highlight where strength may persist and where risk could be quietly building.

Chainlink (LINK)

Chainlink remains one of the core infrastructure leaders in the real-world asset space. But heading into February 2026, its setup is conflicted.

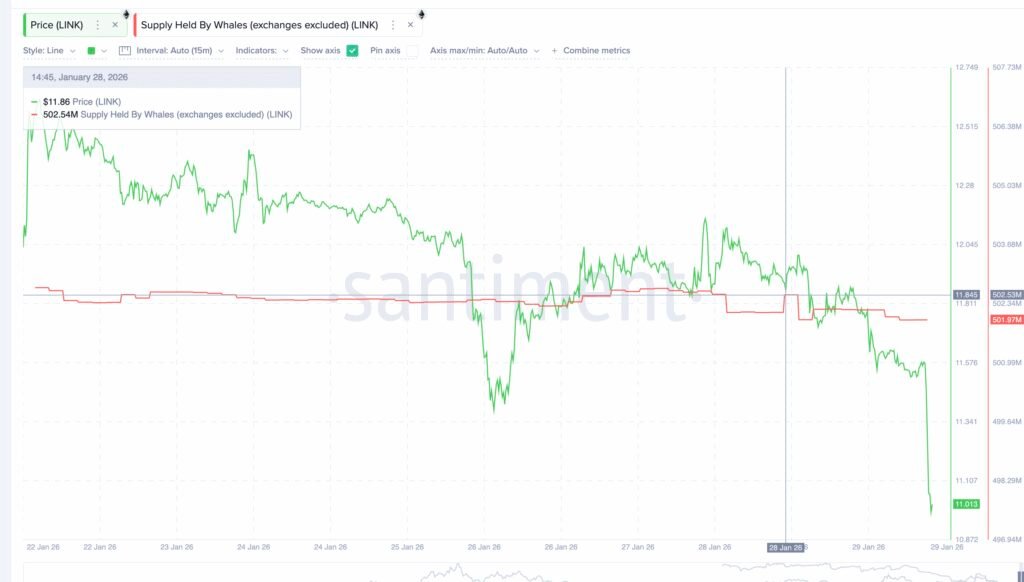

Social sentiment has turned sharply negative. Data from Santiment shows Chainlink is among the most criticized large-cap altcoins right now.

This shift matters because it lines up with recent whale behavior. Since January 28, whale holdings have fallen from 502.53 million LINK to 501.97 million LINK, a reduction of roughly 560,000 tokens.

That steady trimming suggests large holders are stepping back amid weak price action and rising retail pessimism.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

But this is where the story splits.

Despite whale selling, spot ETFs keep buying. Chainlink currently has two spot ETFs, from Grayscale and Bitwise. Since launch, every single week has recorded net inflows, with no weekly outflows so far.

Recent weekly additions have ranged between $2.26 million and $4.05 million, pushing cumulative inflows above $73 million.

This creates a clear divergence: large holders (whales) reduce exposure while longer-term ETF demand absorbs supply.

Price action, however, leans bearish for now.

LINK has slipped about 7.2% over the past month and is down roughly 3% in the last 24 hours. More importantly, it has lost a key support near $11.12.

If this level is not reclaimed on a daily close, the chart opens downside risk toward $9.10, a potential 17% drop from current prices. That scenario would validate recent whale caution.

On the flip side, reclaiming $11.12 shifts momentum back toward $11.82 and $12.37. For now, sentiment and price argue weakness, while ETFs quietly build a longer-term base. The next few candles decide which force wins.

Keeta (KTA)

Keeta has been one of the strongest RWA tokens to watch heading into February 2026. The token is up roughly 55% over the past 30 days, making it one of the top-performing real-world asset picks in that period. That strength did not come from a single spike. Price has been trending higher steadily since early January, showing sustained demand rather than short-term hype.

However, momentum has cooled. Over the past 24 hours, the KTA price is down nearly 10%, signaling that some traders could be locking in gains. This pullback is what makes Keeta a more interesting case than a simple momentum play.

On-chain data shows a clear split among large holders. Over the last 30 days, standard whales have reduced their holdings by 3.53%, suggesting caution after the strong rally.

At the same time, mega whales moved the other way, increasing their exposure by 1.96%. This divergence inside the whale cohort matters. It shows disagreement on whether the rally is ending or just pausing.

The KTA price chart currently sides with mega whales. Keeta is forming an inverse head and shoulders pattern, a structure that often appears before upside continuation. The neckline sits near $0.34, while the current price trades around $0.30, putting the breakout trigger roughly 10% above current levels.

A daily close above $0.34 would activate a projected upside move of around 73%, extending Keeta’s leadership among real-world asset projects.

Risk remains clear. Failure to cleanly reclaim $0.31, followed by a drop below $0.27, would weaken the right shoulder. A decisive break under $0.20 fully invalidates the bullish structure.

Keeta remains one of the more technically compelling RWA tokens to watch, but February will decide whether mega whale optimism or broader whale caution wins.

Maple Finance (SYRUP)

Maple Finance returns to the list of RWA tokens to watch for the second month in a row, and the reason is simple. While other real-world asset tokens like Chainlink and Keeta are down 3% to 10% over the past month, SYRUP has remained resilient.

SYRUP is up 11.5% over the last 30 days and down just 1% in the past 24 hours, even as the broader RWA space struggles. That relative strength is already a signal, but on-chain data makes the case stronger.

Whales have been steadily accumulating SYRUP despite short-term pull…

Konten dipersingkat otomatis.

🔗 Sumber: www.beincrypto.com

📌 TOPINDIATOURS Hot crypto: Solana Price Prediction: Wall Street Just Moved Billio

The U.S. asset management firm WisdomTree just expanded users’ access to its portfolio of tokenized funds to the Solana blockchain.

As more Wall Street firms like this start to embrace the network, this adds fuel to bullish Solana price predictions.

WisdomTree’s decision reflects growing interest in Solana’s low transaction costs and high settlement speeds.

Users will now be able to use their Solana-based USDC tokens to buy WisdomTree’s tokenized funds through the firm’s Connect and Prime solutions.

Solana is already an important player in the real-world assets (RWAs) market. Data from RWA.syz indicates that the network has $1.3 billion in assets at the time of writing. This makes it the fourth-largest blockchain in this segment with a 5.6% market share.

As network adoption accelerates among big players on Wall Street, demand for SOL could surge – how high can Solana go?

Solana Price Prediction: SOL Breaks Out of Price Channel – $145 Next?

Solana recently broke out of a bullish falling channel pattern and faced resistance at the $128 level.

It now looks ready to retest the channel’s upper bound to see where it goes next.

The $120 level is the key support to watch at the time. This has been a strong demand zone in the past few days.

The 4-hour chart shows that momentum has stalled for the time being, as the Relative Strength Index (RSI) has dived below the signal line.

If we get a strong bounce off $120, SOL could easily rally to $130 first and then to $145 if positive momentum gains traction.

Paired with positive news on the institutional front, this could set the stage for a broader recovery in the mid-term for SOL.

Meanwhile, Wall Street’s growing interest in blockchain technology benefits top crypto presales like SUBBD ($SUBBD). SUBBD leverages the power of AI to create new revenue streams for content creators who use its top-notch decentralized platform.

SUBBD Presale Lets Users Make Money with AI Characters and Crypto

The content creation industry is shifting, but creators are still held back by high fees, strict rules, and fragmented tools.

SUBBD ($SUBBD) is changing the landscape by launching an all-in-one platform where Web3 meets AI.

Instead of jumping between different apps to generate, edit, and post videos, creators can now manage their entire workflow in one place.

This ecosystem even allows users to mint and monetize AI influencer personas, creating brand new ways to earn in the digital economy.

At the heart of this revolution is the $SUBBD token, which simplifies everything from subscriptions to governance.

The project has already experienced a strong wave of positive momentum, with over $1.2 million raised as it taps into a network of 2,000 creators and 250 million fans.

To join the $SUBBD presale, visit the official website and connect a wallet like Best Wallet.

You can swap ETH or USDT, or use a bank card to get your tokens in seconds.

Visit the Official SUBBD Website Here

The post Solana Price Prediction: Wall Street Just Moved Billions Onto SOL – Is This the Most Bullish News of the Year? appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

🤖 Catatan TOPINDIATOURS

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!