📌 TOPINDIATOURS Eksklusif crypto: Bitcoin’s 7% Drop to $77K May Mark Cycle Low, An

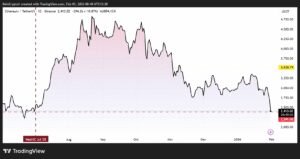

Bitcoin may have found a floor after sliding roughly 7% to $77,000 over the weekend, according to analyst PlanC, who argues the move could mark the deepest pullback of the current bull cycle.

Key Takeaways:

- An analyst says Bitcoin’s drop to $77,000 may mark a capitulation-style cycle low.

- The pullback mirrors past crashes that preceded major recoveries, though losses remain deep.

- Other analysts warn further downside is still possible despite the recent bounce.

In a post on X on Saturday, PlanC said there is a “decent chance” the latest drop represents a capitulation-style low rather than the start of a prolonged downturn.

Bitcoin briefly touched the $77,000 level before stabilizing and rebounding modestly to around $78,600, data from CoinMarketCap shows.

Bitcoin Drawdown Echoes Past Capitulations That Led to Recoveries

Despite the bounce, the asset remains down more than 11% over the past month and roughly 38% below its October all-time high of $126,100.

PlanC compared the current price action to several historic drawdowns that ultimately preceded major recoveries.

He pointed to the 2018 bear market capitulation near $3,000, the March 2020 COVID-driven crash to around $5,100, and the sharp declines following the FTX and Terra-Luna collapses, when Bitcoin briefly traded in the $15,500–$17,500 range.

“There is a decent chance we are going through another major capitulation low as we speak,” PlanC wrote, adding that his estimated range for a cycle bottom sits between $75,000 and $80,000.

In his view, the recent sell-off may represent a final shakeout rather than a structural shift in the broader trend.

Others urged caution but echoed the view that weekend moves can exaggerate market sentiment. Bitcoin advocate and financial accountant Rajat Soni noted that the drop occurred during one of crypto’s most volatile trading windows.

“Never trust a weekend pump or dump,” he said, warning traders against drawing firm conclusions from short-term price swings.

Still, not all market watchers are convinced the downside is over. Veteran trader Peter Brandt has suggested Bitcoin could slide as low as $60,000 by the third quarter of 2026.

Crypto analyst Benjamin Cowen also expects the cycle low to arrive later this year, potentially around October, though he anticipates multiple relief rallies before then.

Adding to the cautious outlook, Jurrien Timmer of Fidelity said 2026 could prove to be a “year off” for Bitcoin, with prices potentially revisiting the mid-$60,000 range before a more durable recovery takes hold.

Bitcoin Slides as Fed Caution, Geopolitics Sap Risk Appetite

Bitcoin has fallen back below $89,000 after a short-lived rebound, pressured by tighter financial conditions and rising geopolitical stress that have weighed on risk assets.

According to XS.com analyst Samer Hasn, a Federal Reserve stance that remains neutral to hawkish, combined with tensions in the Middle East, has reduced demand for speculative investments across crypto markets.

Market data points to weakening conviction among traders. CoinGlass figures show crypto futures open interest is down 42% from record highs, with attempted breakouts quickly reversed by sharp sell-offs.

At the same time, capital has rotated toward traditional havens such as gold and silver, leaving digital assets struggling to attract fresh inflows as volatility persists.

With Federal Reserve Chair Jerome Powell signaling little urgency to cut rates and geopolitical risks pushing investors toward tangible assets, analysts say Bitcoin remains a higher-risk trade until either policy eases or global tensions cool.

The post Bitcoin’s 7% Drop to $77K May Mark Cycle Low, Analyst Says appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

📌 TOPINDIATOURS Update crypto: $30M Stolen as Step Finance Treasury Wallets Compro

Step Finance, a major Solana DeFi platform, confirmed multiple treasury and fee wallets were compromised by a sophisticated attacker during Asian Pacific trading hours, resulting in the theft of approximately 261,854 SOL tokens worth roughly $30 million.

The breach sent shockwaves through the Solana ecosystem as blockchain security firm CertiK flagged that the stolen SOL “has been withdrawn after stake authorization had been transferred” to an unknown wallet address.

The incident triggered immediate market panic, with the platform’s native STEP token plummeting over 90% within 24 hours.

While the team insists user funds remained unaffected, questions swirl over whether the breach represents a genuine security failure or a disguised exit scam, particularly given that the attacker appeared to have direct wallet access rather than exploiting smart contract vulnerabilities.

Emergency Response and Damage Control

Step Finance disclosed the security breach through a series of urgent social media posts, stating “several of our treasury and fee wallets were compromised by a sophisticated actor” and confirming the attack leveraged “a well known attack vector.“

The platform immediately activated emergency protocols and reached out to cybersecurity firms for assistance.

Solana media firm Solana Floor reported that on-chain data showed the stolen 261,854 SOL was “unstaked and moved during the incident,” suggesting the attacker had obtained authorization to control staking operations.

The team emphasized it had “notified the relevant authorities” and implemented immediate remediation steps while working with top security professionals around the clock.

Ripple Effects Across Linked Protocols

The breach extended beyond Step Finance’s own operations, impacting connected platforms including Remora Markets.

The protocol disclosed that as “majority LP, Step Finance experienced a hack of treasury wallets earlier today” with some affected assets including Remora rStocks.

Remora assured users that despite the incident, “Remora assets remain held 1:1 in our brokerage account” while constructing a process for handling redemptions.

The market’s swift verdict on Step Finance came through brutal price action, with the STEP token losing most of its value as traders fled amid uncertainty about the platform’s future viability and the legitimacy of the breach.

January’s Relentless Wave of DeFi Exploits

The Step Finance hack marks the latest in what security firms describe as a devastating month for cryptocurrency security.

According to CertiK’s comprehensive January 2026 security report, “combining all the incidents in January, we’ve confirmed ~$370.3M lost to exploits” across multiple attack vectors.

Major January incidents included Truebit’s $26.6 million smart contract exploit, SwapNet’s $13.3 million breach affecting Matcha Meta users, Saga’s $6.2 million exploit that forced the Layer-1 protocol to pause its SagaEVM chain, and Makina Finance’s $4.2 million loss through flash loan manipulation.

CertiK’s analysis revealed that phishing incidents accounted for $311.3 million of January’s losses, while code vulnerability attacks totaled $51.5 million.

Notably, the Step Finance breach continues a troubling pattern affecting Solana-based protocols.

Swiss crypto platform SwissBorg lost $41.5 million worth of SOL tokens in September 2025 after hackers compromised partner API provider Kiln, while South Korea’s Upbit exchange suffered a $36 million Solana exploit in November 2025, exactly six years after its 2019 hack attributed to North Korean actors.

Beyond individual protocol failures, January als…

Konten dipersingkat otomatis.

🔗 Sumber: cryptonews.com

🤖 Catatan TOPINDIATOURS

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!