📌 TOPINDIATOURS Eksklusif crypto: BitMine Chair’s ‘Feature, Not a Bug’ Theory Fail

BMNR stock price remains under pressure in early February as selling continues across crypto-linked equities. The stock is down nearly 25% over five days and more than 33% over one month, trading around $22.35.

While management defended recent crypto-led paper losses as part of a long-term strategy, market data suggests technical weakness is still driving investor behavior. And increasingly driving them away, despite a novel defense from BitMine Chairman, Tom Lee.

Ethereum Treasury Losses Spark ‘Feature, Not A Bug’ Defense

Concerns around BitMine’s balance sheet intensified after data showed heavy unrealized losses on its Ethereum treasury.

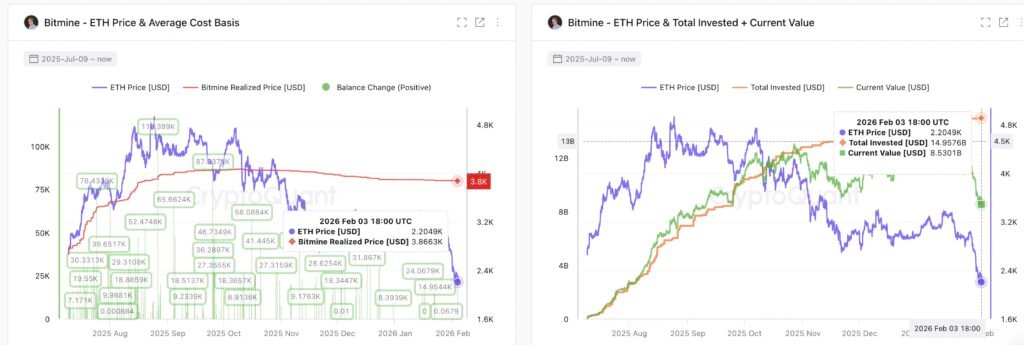

As of February 3, BitMine had invested roughly $14.95 billion into ETH holdings. However, the current market value had fallen to around $8.53 billion, implying paper losses of more than $6.4 billion.

At the same time, Ethereum was trading near $2,200, well below BitMine’s average acquisition cost of roughly $3,800. This gap highlighted how deeply underwater the company’s treasury had become.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

These figures triggered criticism from market observers, who argued that such large unrealized losses could limit future upside and pressure shareholder returns. Some warned that accumulated ETH could eventually act as a selling supply.

In response, Chairman Tom Lee defended the strategy, stating that drawdowns are “a feature, not a bug.” He argued that crypto cycles naturally involve temporary losses and that BitMine is designed to accumulate through downturns to outperform over time.

However, despite this explanation, BMNR stock failed to attract sustained buying interest after the comments.

OBV and CMF Show Buyers Stayed Away After the Breakdown

Market participation data suggests that investors began exiting even before the public debate intensified.

On-Balance Volume (OBV) tracks cumulative buying and selling pressure by adding volume on up days and subtracting it on down days. It reflects whether traders are accumulating or distributing.

From early December through late-January, OBV was forming higher lows, signaling steady accumulation. But between January 28 and 29, OBV broke below its rising trend line. This showed that possibly retail and short-term traders had started distributing shares.

After OBV weakened, institutional-style capital followed.

Chaikin Money Flow (CMF) measures whether money is flowing into or out of an asset using price and volume. Readings above zero suggest accumulation, while negative values signal capital outflows.

From January 30 onward, CMF fell sharply and remained below zero. This confirmed that large buyers were reducing exposure as the BMNR price approached key support. Both indicators aligned with the chart structure.

BMNR had been forming a head-and-shoulders pattern through December and January. When price failed near the neckline and then broke down on February 2 (gap-down formation), OBV and CMF confirmed the move.

In sequence, retail volume weakened first, large capital exited next, and prices collapsed afterward. The “feature, not a bug” ETH treasury narrative did not reverse this flow-driven sell-off.

Key BMNR Stock Price Levels Define the Next Move

After breaking the head-and-shoulders neckline and the rising trend line, the BMNR stock price resumed its broader downtrend, a projected dip of over 30%.

Several levels now define the outlook. On the downside, initial support sits near $19.26 if the BMNR stock price doesn’t reclaim $22.52 on the daily timeframe. Below $19.26, the next major level stands near $16.71, which aligns with the full technical projection of the bearish pattern.

If selling pressure accelerates, extended downside could reach toward $9.87, pushing the stock into single-digit territory. On the upside, recovery remains difficult.

The first resistance lies near $22.52. The BMNR stock price must reclaim this level to slow the decline. Above that, resistance appears near $25.07 and $28.66. These zones would need to be cleared to signal early stabilization.

<figure …

Konten dipersingkat otomatis.

🔗 Sumber: www.beincrypto.com

📌 TOPINDIATOURS Eksklusif crypto: Base Restores Network Stability After Transactio

Base, the Ethereum Layer-2 network backed by Coinbase, has restored overall network stability following intermittent transaction inclusion delays and elevated transaction drops that affected users at the end of January.

The incident began on January 31, when Base experienced periods of increased congestion that resulted in submitted transactions being delayed or in some cases dropped.

Base developers said blocks continued to be produced throughout the disruption but users saw higher-than-usual latency for transaction confirmation.

In an update posted by the Base team the network confirms that the issue stemmed from an infrastructure configuration change related to transaction propagation.

Propagation Change Triggered Execution Failures

According to Base, a configuration adjustment caused the block builder to repeatedly fetch transactions that could not be executed due to rapidly rising base fees.

As a result transactions were reprocessed inefficiently, leading to elevated drops and delays in transaction inclusion during peak congestion.

“On Jan 31, Base experienced elevated transaction drops and inclusion delays,” the team said, adding that the propagation change created a feedback loop in the transaction pipeline under volatile fee conditions.

Base later confirms that the issue was mitigated by rolling back the configuration change, restoring normal transaction processing.

Fix Validated, Postmortem Planned

Base said it has validated that the rollback successfully restored overall network stability. The team also announced plans to conduct a full root cause analysis (RCA) and publish a public postmortem in the coming days.

“We have validated the fix restored overall network stability,” Base wrote, noting that intermittent congestion may still occasionally result in delays, but longer-term improvements are underway.

The incident highlights the operational challenges Layer-2 networks face as activity scales rapidly, particularly during periods of heightened demand and fee volatility.

Pipeline Optimization and Monitoring Improvements

To prevent similar disruptions from recurring, Base said it is taking several steps to strengthen its transaction handling infrastructure.

Planned upgrades include optimizing the transaction pipeline by removing unnecessary peer-to-peer overhead, as well as tuning mempool queue behavior to improve transaction inclusion under stress.

Base expects this work to take approximately one month. The team said it is improving alerting systems and change monitoring processes during future infrastructure rollouts, aiming to detect transaction propagation issues earlier and respond more quickly.

Status Page Updates for Users

Base encouraged users and developers to follow updates through its official status page to stay informed of future incidents or network performance issues.

As Layer-2 adoption continues the network’s ability to maintain reliability during congestion events will remain a key focus for both users and institutional builders deploying applications on Base.

The post Base Restores Network Stability After Transaction Delays Triggered by Configuration Change appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

🤖 Catatan TOPINDIATOURS

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!