📌 TOPINDIATOURS Breaking crypto: MicroStrategy Clarifies True Breaking Point: What

MicroStrategy (Strategy) released its Q4 2025 earnings report and, along with it, disclosed an extreme downside scenario that would begin to strain its Bitcoin treasury model.

The CEO’s remarks provided rare insight into how far the market could fall before the company’s capital structure comes under serious pressure.

MicroStrategy Finally Reveals What Would Be Its Breaking Point as Bitcoin Price Drops

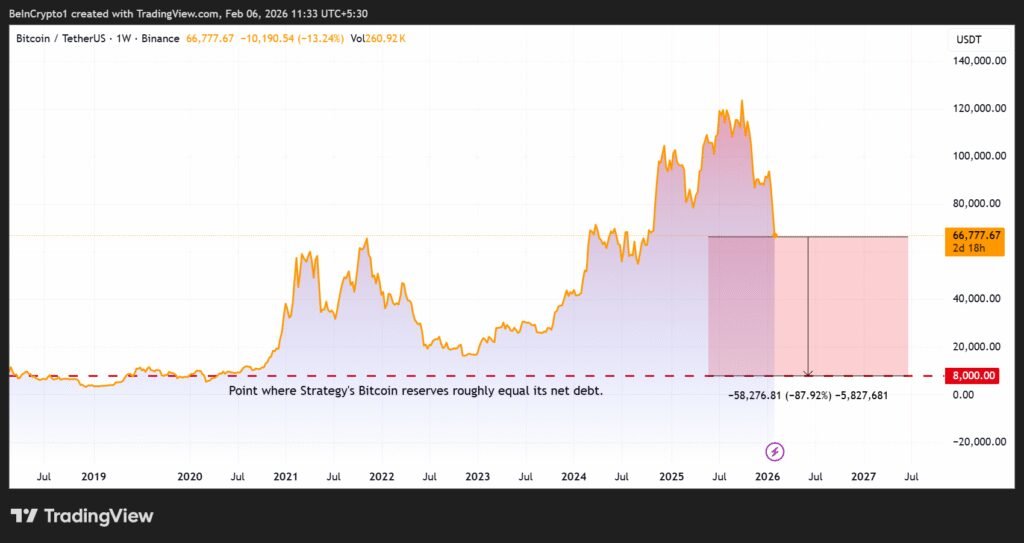

During its latest earnings discussion, MicroStrategy CEO Phong Le said that a 90% decline in Bitcoin’s price to roughly $8,000 would mark the point where the firm’s Bitcoin reserves roughly equal its net debt.

At that level, the company would likely be unable to repay convertible debt using its BTC holdings alone. As a result, it may need to consider restructuring, issuing new equity, or raising additional debt over time.

Leadership emphasized that such a scenario is viewed as highly improbable and would unfold over several years, giving the firm time to respond if markets deteriorated significantly.

“In the extreme downside, if we were to have a 90% decline in Bitcoin price to $8,000, which is pretty hard to imagine, that is the point at which our BTC reserve equals our net debt and we’ll not be able to then pay off of our convertibles using our Bitcoin reserve and we’d either look at restructuring, issuing additional equity, issuing an additional debt. And let me remind you: this is over the next five years. Right, So I’m not really worried at this point in time, even with Bitcoin drops,” said Le.

Meanwhile, it is worth noting that Le’s remarks come only months after the Strategy executive admitted a situation that would compell the firm would sell Bitcoin. As BeInCrypto reported, Phong Le cited a Bitcoin sale trigger tied to mNAV and liquidity stress.

Speaking on What Bitcoin Did, CEO Phong Le outlined the precise trigger that would force a Bitcoin sale:

- First, the company’s stock must trade below 1x mNAV, meaning the market capitalization falls below the value of its Bitcoin holdings.

- Second, MicroStrategy must be unable to raise new capital through equity or debt issuance. This would mean capital markets are closed or too expensive to access.

Therefore, the latest statement does not contradict Phong Le’s earlier position but adds another layer of risk.

Previously, a Bitcoin sale depended on stock trading below mNAV and capital markets’ closing. Now, he clarifies that in an extreme 90% crash, the immediate issue would be debt servicing, likely addressed first through restructuring or new financing—not necessarily selling Bitcoin.

Massive Bitcoin Exposure Comes with Large Losses

Strategy remains the world’s largest corporate holder of Bitcoin, reporting 713,502 BTC as of early February 2026. The company acquired the holdings at a total cost of about $54.26 billion, according to its fourth-quarter financial results.

However, Bitcoin’s decline during the final months of 2025 significantly impacted the balance sheet. The firm reported $17.4 billion in unrealized digital-asset losses for the quarter and a net loss of $12.4 billion. This highlights the sensitivity of its financial performance to market swings.

At the same time, Strategy continued to raise substantial capital. The company said it raised $25.3 billion in 2025, making it one of the largest equity issuers in the US.

Meanwhile, they also reportedly built a $2.25 billion USD reserve designed to cover roughly two and a half years of dividend and interest obligations.

Executives argue that these measures strengthen liquidity and provide flexibility, even during periods of market stress.

Bitcoin Volatility Brings the Risk Into Focus

The disclosure comes amid heightened volatility in crypto markets. Bitcoin traded near $70,000 in early February before extending successive legs lower to an intraday low of $60,000 on February 6. This shows how quickly price movements can reshape the outlook for highly leveraged treasury strategies.

Strategy’s capital structure relies heavily on debt, preferred equity, and convertible instruments used to accumulate Bitcoin over multiple years.

While this approach has amplified gains during bull markets, it also magnifies losses during downturns, drawing increasing scrutiny from investors and analysts.

However, the company’s leadership maintains that the long-dated nature of much of its debt provides time to manage through cycles. This, they say, reduces the risk of forced liquidations in the near term.

Saylor Doubles Down on Long-Term Thesis

Elsewhere, executive chair Michael Saylor reiterated his conviction in Bitcoin despite recent losses, describing it as the “digital transformation of capital” and urging investors to “HODL.”

Saylor and other executives argue that Bitcoin remains the hardest form of money and that the company’s long-term strategy is built around holding the asset indefinitely, rather than attempting to time market cycles.

The firm has also expanded its financial engineering efforts, including scaling its Digital Credit instruments and preferred equity offerings. According to management, these are desig…

Konten dipersingkat otomatis.

🔗 Sumber: www.beincrypto.com

📌 TOPINDIATOURS Eksklusif crypto: Why Is The Crypto Market Down Today? Hari Ini

The total crypto market cap (TOTAL) and Bitcoin (BTC) registered their largest single-day falls this year, bringing the latter to $64,500. Stable (STABLE) followed the crypto king, falling by 23% in 24 hours, pulling away from its all-time high.

In the news today:-

- MicroStrategy shares came under renewed pressure after Bitcoin fell to $60,000, pushing the company’s large BTC holdings further below its average purchase price. With Bitcoin about 21% under cost basis, MicroStrategy’s stock now trades at a discount to its Bitcoin net asset value, highlighting rising balance-sheet risk.

- Gemini will shut operations in the UK, EU, and Australia and cut 200 jobs, refocusing its business on the US market. The exchange cited AI-driven productivity gains and a strategic pivot toward prediction markets as the broader crypto market downturn intensifies pressure.

The Crypto Market Lost $266 Billion

The total crypto market cap fell $266 billion in the past 24 hours, dropping to $2.19 trillion at the time of writing. TOTAL is barely holding above the $2.12 trillion support. The decline was driven by cascading liquidations totaling nearly $2.2 billion, intensifying broad market pressure.

The $2.12 trillion level now represents the market’s final defense. A breakdown could expose TOTAL to a decline to $2.00 trillion. Continued weakness across major tokens raises concerns about recovery timing, as rebuilding confidence may require sustained inflows and reduced volatility.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

A rebound remains possible if investor sentiment stabilizes. Should deleveraging slow and demand return, TOTAL could defend $2.12 trillion. A successful bounce from this level may allow the total crypto market cap to recover part of the recent losses and ease near-term downside risk.

Bitcoin Falls To Its Lowest In 28 Months

Bitcoin’s price dropped 11.6% in the past 24 hours, trading at $64,536 at the time of writing. The move marked Bitcoin’s largest single-day decline of 2026. Despite heavy selling, BTC remains above the $62,893 support, which has so far prevented a deeper breakdown.

Selling pressure continues to rise amid investor uncertainty and heightened volatility. Market structure now points to $59,986 as the next major support below $60,000. A confirmed breakdown could accelerate losses, sending Bitcoin toward $55,883 as liquidity thins and risk aversion dominates short-term positioning.

A recovery scenario depends on renewed bullish momentum. If buyers regain control, Bitcoin could reclaim $65,360 and challenge $69,922. A move above $70,000 would signal stabilization and open the path toward $75,000, allowing BTC to recover a meaningful portion of its recent losses.

Stable Is Unstable

STABLE price fell 23.4% over the last 24 hours, trading at $0.0196 at the time of writing. The sharp decline reflects heightened selling pressure across smaller-cap tokens. Despite the drop, STABLE continues to hold above the $0.0189 support, a level that previously triggered short-term rebounds.

Rising outflows have dragged STABLE further away from its $0.0325 all-time high. Persistent distribution signals weaken investor confidence. If selling pressure continues, price action suggests a move toward the $0.0165 local support, which represents the next area of potential demand amid deteriorating market conditions.

A recovery scenario remains viable if buyers defend the $0.0189 support. A successful bounce from this level could push STABLE back toward $0.0225. Reclaiming that zone would invalidate the bearish thesis, ease downside pressure, and provide the altcoin with temporary relief from recent losses.

The post Why Is The Crypto Market Down Today? appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

🤖 Catatan TOPINDIATOURS

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!