📌 TOPINDIATOURS Breaking crypto: BTC Traders Eye $50K as Possible Bottom: Key Metr

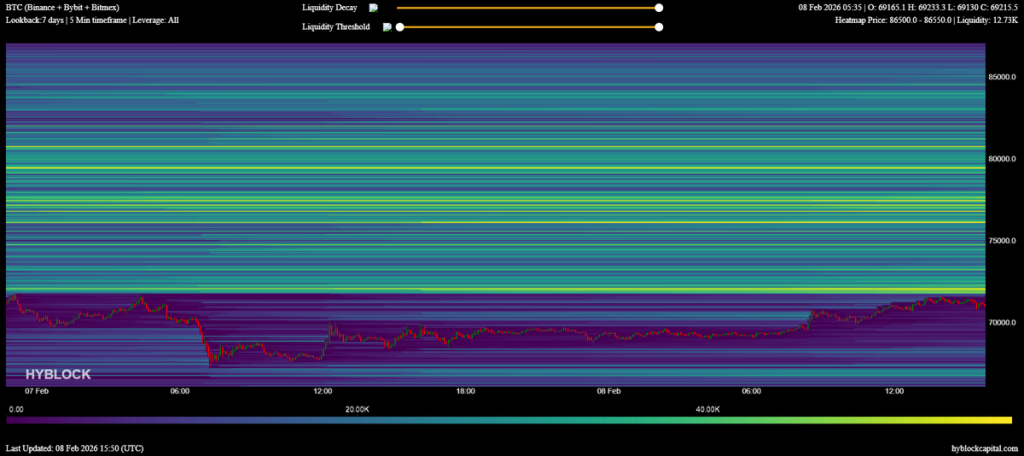

Bitcoin traders are glued to one price right now: $50,000.

After a brutal dip that saw prices flash below $60,000 for a hot minute, everyone’s wondering if we’ve finally hit rock bottom.

Yes, Bitcoin price bounced back above $70,000 temporarily, but here’s the thing, nobody’s really convinced this is “the bottom” just yet.

Key Takeaways

- Analysts warn the recent bounce to $71,000 may be a “bull trap” designed to liquidate shorts before a retest of $50,000 support.

- JPMorgan data indicates Bitcoin has traded below the estimated miner production cost of $87,000, a historical signal for capitulation.

- Technical patterns highlight critical support at $67,350, with a breakdown potentially opening the door to the $43,000 region.

Weekly Close Shows Fragility Despite $70K Rebound

Bitcoin found its way back to $71,000 as the week kicked off. However, most find this rally looking sketchy.

Sure, we saw a 7% bounce from last week’s $60,000 bloodbath, but there’s basically no volatility around the weekly close. And when things look too calm after a crash, traders get suspicious.

Trader CrypNuevo said on X: this whole move up looks like a calculated play to hunt down short positions stacked between $72,000 and $77,000.

If this “recovery” turns out to be fake, bears have one target in their crosshairs: $50,000.

Miner Costs and Stablecoin Flows Signal Caution

Here’s a number that should make you nervous: $67,000. That’s what it costs miners to produce one Bitcoin.

BTC might be trading below that soon. Historically, the miner production cost acts like a safety net, prices usually don’t stay below it for long.

if this continues, miners start going broke. And when miners capitulate? They dump their Bitcoin to stay alive, which creates even more sell pressure. It’s a vicious cycle.

While the fundamentals look grim, there’s a massive pile of cash sitting on the sidelines. Stablecoin inflows just doubled to $98 billion.

They’re ready to buy… they’re just waiting for the right moment.

Next Steps: Bitcoin Price Technical Levels to Watch

Traders are staring down at an interesting moment as inflation data drops this week. Right now, all eyes are on $67,350, that’s the support level holding this whole thing together.

If Bitcoin breaks below that? We’re looking at bearish flag patterns that could drag prices down to $50,000. Yeah, a potential 30%+ dive.

There’s a bullish scenario too. The magic number is $74,434. If BTC can reclaim and hold above that level, it kills the bearish setup and potentially opens the door back to $80,000.

The post BTC Traders Eye $50K as Possible Bottom: Key Metrics to Watch This Week appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

📌 TOPINDIATOURS Update crypto: HBAR Shorts Face $5 Million Risk if Price Breaks Ke

Hedera has remained under pressure after a sustained decline kept HBAR trapped within a month-long downtrend. Price has struggled to attract meaningful demand, leaving recovery attempts muted.

A breakout from this structure requires stronger investor support, which remains limited for now. This lack of conviction is giving derivatives traders time to position cautiously.

HBAR Traders Are Under Threat

Futures positioning shows a clear bearish skew. The liquidation map indicates that short contracts carry greater exposure than longs across key price levels. This imbalance reflects traders’ expectations that HBAR may continue to face downside pressure before any durable recovery takes shape.

However, this setup creates a potential squeeze scenario. If HBAR escapes its downtrend and rallies toward the $0.1035 resistance, nearly $5 million in short positions could face liquidation. Such an event would force bearish traders to cover, potentially injecting sudden buying pressure and shifting short-term sentiment.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

On-chain momentum signals offer a mixed picture. The Chaikin Money Flow formed a bullish divergence against the price’s lower lows earlier this week. While price continued falling, CMF trended higher, suggesting selling pressure was easing rather than intensifying.

Despite this divergence, confirmation remains absent. CMF has yet to cross above the zero line, which would signal inflows dominating outflows. Capital continues leaving HBAR, albeit at a slower pace. Until this shift completes, the bullish signal remains tentative rather than decisive.

HBAR Price May Not See a Bounce Back Just Yet

HBAR is trading near $0.0903 at the time of writing. Price action at this level has not inspired confidence among investors. Weak participation continues to limit capital inflows, reinforcing bearish conviction among futures traders who see little reason to unwind positions prematurely.

The near-term outlook hinges on whether HBAR can break its downtrend. Continued consolidation above the $0.0901 support would reduce immediate downside risk. If inflows begin improving alongside price stability, HBAR could advance toward the $0.1030 resistance. Reaching this level would place short positions under pressure and potentially trigger liquidations.

Downside risk remains prominent if conditions deteriorate. A breakdown below the $0.0901 support would expose HBAR to further losses. Under that scenario, price could slide toward $0.0830. Continued weakness could extend declines to $0.0751, fully invalidating the bullish thesis and confirming continuation of the broader downtrend.

The post HBAR Shorts Face $5 Million Risk if Price Breaks Key Level appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

🤖 Catatan TOPINDIATOURS

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!