📌 TOPINDIATOURS Eksklusif crypto: Is XRP Heading Toward $1? Whale–Holder Fight Dec

XRP price is under fresh pressure after a sharp rejection near its recent highs. The token is down nearly 10% over the past 24 hours and remains about 13% below the $1.67 level reached on February 15. This decline is not just a routine pullback.

It reflects a deeper shift beneath the surface: XRP whales have begun selling, while long-term holders (HODLers) are attempting to absorb that supply. The outcome of this whale–HODLer fight could play a decisive role in XRP price prediction over the coming weeks.

Rising Wedge and Bearish Divergence Show Sellers Are Defending Key Levels

XRP price has been trading inside a rising wedge pattern since early February. A rising wedge is a bearish chart structure where price moves higher inside narrowing trendlines, but the advance becomes weaker over time. This pattern typically ends with a breakdown, and the current structure points to a potential 26% correction if support fails.

Momentum signals already warned that weakness was building. Between January 26 and February 15, the XRP price formed a lower high, meaning each rally peak was weaker than the previous one.

However, during the same period, the Relative Strength Index, or RSI, formed a higher high. RSI is an indicator that measures buying and selling strength. When the price weakens, but the RSI rises, it creates a hidden bearish divergence.

This signals that the upward move is losing real support, and the existing XRP price downtrend might continue.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This divergence played out on February 15, when the XRP price briefly surged to $1.67. Instead of breaking higher, above the bearish wedge, the candle formed a long upper wick. This wick shows sellers stepped in aggressively and forced the price lower.

Since that rejection, the XRP price has already dropped about 13%. The pullback has pushed the token close to the lower boundary of the rising wedge, putting the breakdown risk in focus. This technical weakness has become a central factor in XRP price prediction, as the structure now favors sellers unless buyers regain control.

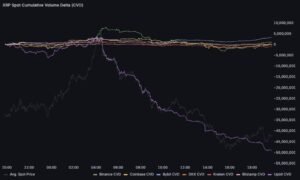

XRP Whales Sell Millions While Holders Try to Prevent a Breakdown

The rejection near $1.67 was not random. On-chain data shows XRP whales were actively selling during the rally. Wallets holding between 100 million and 1 billion XRP reduced their holdings from 8.59 billion to 8.58 billion XRP. This means roughly 10 million XRP, roughly worth about $15 million at current prices, was sold during this period.

Smaller XRP whales holding between 10 million and 100 million XRP also sold heavily. Their holdings dropped from 10.91 billion (as of early February 12) to 10.87 billion XRP at press time. This represents another 40 million XRP, worth roughly $60 million, entering the market. Combined, XRP whales sold nearly 50 million XRP, worth about $75 million, during the recent rally attempt.

At the same time, long-term holders have started buying. The Hodler Net Position Change metric shows holders increased their positions from around 127 million XRP on February 13 to about 150 million XRP now, a 17% rise. This indicates some investors are attempting to absorb the whale supply and stabilize the market.

However, the scale of buying remains limited. On February 1, the same group accumulated over 337 million XRP in a single surge. Compared to that, current buying is far weaker, still down over 55%. This imbalance explains why the XRP price failed to hold its breakout and why the XRP price prediction remains uncertain.

The market is now locked in a battle between XRP whales distributing supply and holders trying to prevent a deeper correction. And the long-term holders still do not have enough strength.

XRP Price Prediction Depends on Whether $1.26 Support Holds

The most important level for XRP price now sits near $1.26. Cost basis data shows that more than 442 million XRP was accumulated between $1.27 and $1.28. Cost basis represents the price at which investors bought their coins. When the price returns to this level, holders often defend it to avoid losses.

This makes the $1.26 zone a key chart level, the final major support before a larger breakdown. If XRP price holds above this level, stabilization could follow, and XRP price prediction could shift toward recovery. However, if XRP price breaks below $1.26, the outlook changes quickly. Yet the wedge breakdown could start the moment the 12-hour XRP price candle closes below the lower trendline of the wedge, and then $1.35.

Below this level, the next support sits near $1.16, followed by $1.06. These levels align with the full breakdown projection of the rising wedge. This means XRP price could fall toward the $1 zone if selling pressure continues. Such a move would confirm that XRP whales have gained control of the trend.

On the upside, XRP price must reclaim $1.48 to weaken the immediate bearish pressure. A stronger recovery above $1.67 would invalidate the wedge pattern and signal that buyers have regained control.

For now, XRP price prediction remains tied to this whale–holder fight. If long-term holders fail to absorb the ongoing whale selling, the rising wedge breakdown could push XRP closer to $1. The coming sessions will determine which side wins.

The post <a href="https://beincrypto.com/xrp-price-drop-1-dolla…

Konten dipersingkat otomatis.

🔗 Sumber: www.beincrypto.com

📌 TOPINDIATOURS Breaking crypto: Several Crypto Media Remove Scam Study, Sources A

Crypto news stories are vanishing without a trace. Articles questioning the influence of paid press releases have quietly disappeared from major crypto websites, leaving little evidence they were ever published.

At the same time, thousands of promotional announcements continue to flood the industry, shaping narratives, moving markets, and blurring the line between journalism and advertising.

The Shadow Pipeline That Fuels FOMO

Chainstory analyzed 2,893 press releases distributed between June 16 and November 1, 2025. Using AI-driven sentiment tagging and risk classification, cross-referenced with blacklists like CryptoLegal.uk, Trustpilot, and scam alert feeds, the report found that:

- 62% originated from high-risk (35.6%) or confirmed scam projects (26.9%).

- Low-risk issuers accounted for only 27% of releases.

- In certain niches, such as cloud mining, scam, or high-risk content, dominated ~90% of releases.

The tone of the content was heavily promotional:

- Neutral: 10%

- Overstated: 54%

- Overtly promotional: 19%

Content type breakdown further highlighted the triviality of much coverage:

- Product tweaks or minor feature updates: 49%

- Exchange listing announcements (spam): 24%

- Substantive corporate events (funding, M&A): 2% (58 releases)

Based on this, the researchers concluded that these dynamics create a “manufactured legitimacy loop.” Dubious projects buy guaranteed placements across dozens of outlets, including mainstream financial portals, sidebars, and niche crypto aggregators.

Placement allows these projects to populate “As Seen On” sections, leveraging recognition to drive retail FOMO.

Headlines are deliberately loaded with marketing buzzwords like “AI-Powered Revolution,” “RWA Game-Changer,” terms editorial desks would likely reject if scrutinized.

PR Dollars Speak Louder Than Facts

The ecosystem echoes TradFi abuses. SEC data shows press releases fueled 73% of OTC penny-stock pump-and-dump schemes from 2002–2015.

In crypto, the effect is amplified, with algorithmic trading bots that scrape keywords such as “partnership” or “listing,” automatically triggering buy orders.

The result is a short-term price pump, often followed by unexpected declines once the underlying project fails to meet expectations.

Complicating matters, FTC rules for native advertising require clear disclosure. In practice, many crypto “Press Release” sections appear neutral, erasing the sponsored stigma and conferring the illusion of independent validation.

Retail investors often interpret the placement of content on recognized domains as evidence of legitimacy.

Who Pulls the Strings Behind Crypto Coverage?

Chainstory’s findings initially gained traction across crypto media, with coverage appearing on TradingView, KuCoin, MEXC, and other outlets. Yet, key articles disappeared without explanation on several outlets.

- Investing.com – formerly titled “Crypto press releases dominated by high-risk projects, Chainstory study finds.”

- CryptoPotato, which had described wire services turning placement into a “paid commodity.”

There were no 404 errors or notices. Posts were simply erased from search and archive.

As seen by BeInCrypto via email, sources indicate that an executive from a company implicated in the pay-to-play ecosystem contacted these outlets, citing alleged data faults or bias.

Some editorial teams complied, suggesting a broader vulnerability: advertiser leverage over editorial independence.

It is imperative to note that most crypto outlets rely heavily on PR distribution revenue, particularly during bear markets or when ad budgets are tight.

Therefore, it may be safe to assume that critical reports threatening that revenue stream can prompt quiet removals or editorial self-censorship.

“I’m not involved in the day-to-day of the site/ editorial. I need to ask about this,” CryptoPotato’s Yuval Gov responded to BeInCrypto’s request for comments.

The Man at the Center: Nadav Dakner and Chainwire

At the core of the paid-PR ecosystem is Nadav Dakner, co-founder and CEO of Chainwire (MediaFuse Ltd.), which markets “guaranteed coverage” across crypto and TradFi sites.

“Broadcast your crypto & blockchain news with guaranteed coverage, in industry-leading publications,” read an excerpt on the Chainwire website.

A source close to the matter told BeInCrypto that Nadav is the force behind the article takedowns.

Chainwire mirrors the practices highlighted by Chainstory: syndication to dozens of outlets in exchange for visibility, often leveraged to influence retail behavior.

<figure class="wp-block-image size-full…

Konten dipersingkat otomatis.

🔗 Sumber: www.beincrypto.com

🤖 Catatan TOPINDIATOURS

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!