📌 TOPINDIATOURS Breaking crypto: Cathie Wood Reverses Course, Buys $6.9M in Coinba

Cathie Wood is back shopping. ARK Invest just picked up 41,453 shares of Coinbase stock, worth about $6.9 million.

What makes it interesting is the timing. Just weeks ago, ARK was trimming exposure. Now they are stepping back in as COIN tries to stabilize.

Key Takeaways

- The Buy: ARK purchased 41,453 shares worth $6.9 million across three ETFs on Feb. 18.

- The Split: The majority went to the flagship Innovation ETF (ARKK), which took 29,689 shares ($4.9 million).

- The Pivot: This reverses a selling streak from early February where ARK offloaded $17.4 million in COIN.

Is This a Tactical Pivot?

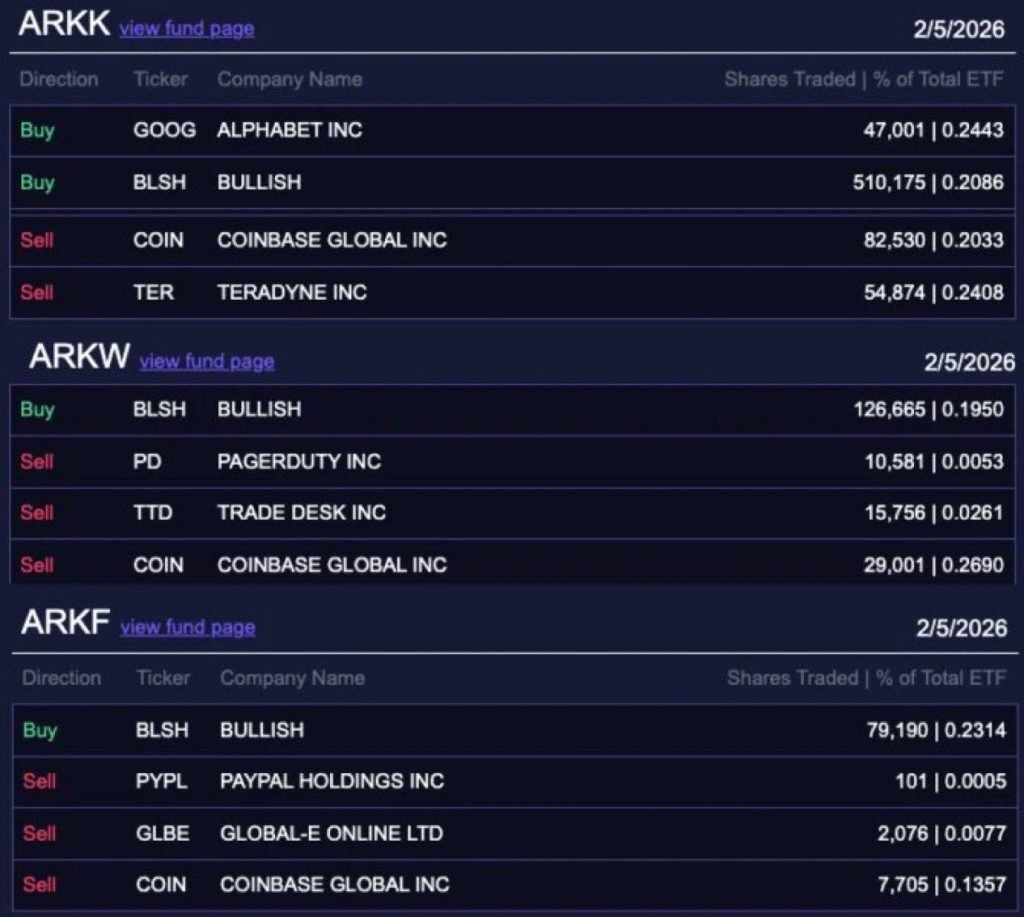

Just a few weeks ago, ARK was heading the other way. The firm dumped about $17.4 million worth of COIN on Feb. 5 and Feb. 6 while the broader market was sliding. At the same time, it rotated capital into the crypto exchange Bullish.

Now the script has flipped. That fresh $6.9 million buy suggests ARK sees value at these levels. It looks like the classic buy the dip play they are known for.

For traders watching ETF flows, this matters. ARK usually caps positions around 10% of a fund. The earlier selling and latest add likely reflect portfolio balancing, not panic. It feels more like weight management than a change in long term conviction.

Why ARK Just Bought $6.9M in Coinbase Stock

The accumulation was spread across three key funds. The flagship ARK Innovation ETF (ARKK) led the charge with a $4.9 million allocation. The Next Generation Internet ETF (ARKW) added $1.2 million, while the Fintech Innovation ETF (ARKF) picked up $704,000.

This buying activity occurred as COIN rebounded. Shares closed up 1% Tuesday at $166.02 and have gained 8.4% over the last five trading days. Technically, the stock is trying to find support after falling 28% year-to-date.

Market observers note that such purchasing often precedes potential rallies. Similar technical signals are flashing elsewhere in the market, with some analysts warning of extreme funding rates that could trigger squeeze scenarios.

According to the firm’s disclosures, COIN remains a heavyweight in the portfolio. It is the seventh-largest holding in ARKK (4% weighting) and the third-largest in ARKF (5.6% weighting).

What Does This Signal for COIN Stock?

ARK’s return to the buy side suggests confidence despite Coinbase’s mixed earnings. The company recently reported a $667 million net loss for Q4, driven largely by unrealized crypto losses.

However, analysts remain bullish. Bernstein maintained an outperform rating with a $440 price target—implying over 200% upside. This optimism is partly fueled by expectations that historical capital inflows could boost retail trading volume in the coming months.

Regulatory clarity also looms large. With discussions heating up in Washington, specifically regarding upcoming market structure bills, the fundamental case for Coinbase could shift rapidly. For now, Cathie Wood is betting that the current price is a discount, not a distress signal.

Discover: Here are the crypto likely to explode!

The post Cathie Wood Reverses Course, Buys $6.9M in Coinbase Stock – Is ARK Betting on a Rebound? appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

📌 TOPINDIATOURS Eksklusif crypto: Senator Bernie Moreno Sets 90-Day Clock on Crypt

US lawmakers may face a narrowing window to pass long-awaited crypto legislation. Speaking at the World Liberty Forum, Senator Bernie Moreno said a comprehensive market structure bill could pass “hopefully by the end of April.”

The Ohio Senator stressed that Congress must act within the next 90 days to maintain momentum.

A Compressed Timeline for Crypto Rules

The remarks, delivered at an event hosted by World Liberty Financial at Mar-a-Lago on February 18, highlighted both urgency and persistent friction between the banking sector and the digital asset industry.

According to live reporting, Bernie Moreno acknowledged the difficulty of negotiations, saying the process had “taken years off my life,” while reiterating that lawmakers “have to get it done in the next 90 days.”

Moreno has been one of the most vocal advocates for federal crypto legislation, particularly measures tied to frameworks such as the Digital Asset Market Clarity Act, which aims to define whether digital tokens fall under securities or commodities law and to establish clearer oversight of trading platforms and stablecoins.

Although elements of crypto legislation have already passed the House, Senate progress has slowed in recent months amid lobbying, technical disagreements, and partisan divisions.

Moreno’s timeline suggests lawmakers are attempting to push negotiations toward a decisive phase before the legislative calendar tightens further.

Stablecoin Yield Debate Remains a Sticking Point

One of the most contentious issues remains whether stablecoin issuers should be allowed to offer yield or rewards to users.

Banks have argued that yield-bearing stablecoins could draw deposits away from the TradFi system. Meanwhile, crypto firms maintain that such features are essential to innovation and competition.

At the forum, Moreno drew applause after vowing not to allow banks to reopen provisions already settled in the GENIUS Act.

“We’re not going to go back and revisit legislation that’s already passed,” Moreno said, adding that he would not permit changes in the digital asset space that could undermine prior agreements.

Sources familiar with negotiations indicated that talks between banks and crypto stakeholders have made little progress in recent weeks. This strengthens concerns that the legislative timetable could slip further.

Political Signals and Industry Pressure

Standing alongside Moreno, Ashley Moody injected a note of humor into the discussion, drawing laughter from the audience.

She also highlighted the intense scrutiny facing lawmakers as they attempt to finalize the bill.

“He’s in Banking. If they don’t get it done, we can blame Bernie,” she quipped.

Meanwhile, a potential White House meeting to advance negotiations may be postponed. One invitee reportedly described the planned gathering as likely to be “just for show,” suggesting that insufficient progress has been made to justify another high-level session.

The World Liberty Forum itself drew roughly 300 to 400 leaders from finance, technology, policy, and media.

This suggests growing institutional interest in how stablecoins, DeFi, and blockchain infrastructure could shape the future of the US dollar and global markets.

Moreno’s 90-day deadline serves less as a guarantee than a signal. After years of debate, the window for decisive US crypto regulation may finally be narrowing.

The post Senator Bernie Moreno Sets 90-Day Clock on Crypto Bill at World Liberty Forum appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

🤖 Catatan TOPINDIATOURS

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!