📌 TOPINDIATOURS Update crypto: MSTR Leverages STRC to Amplify Bitcoin Exposure as

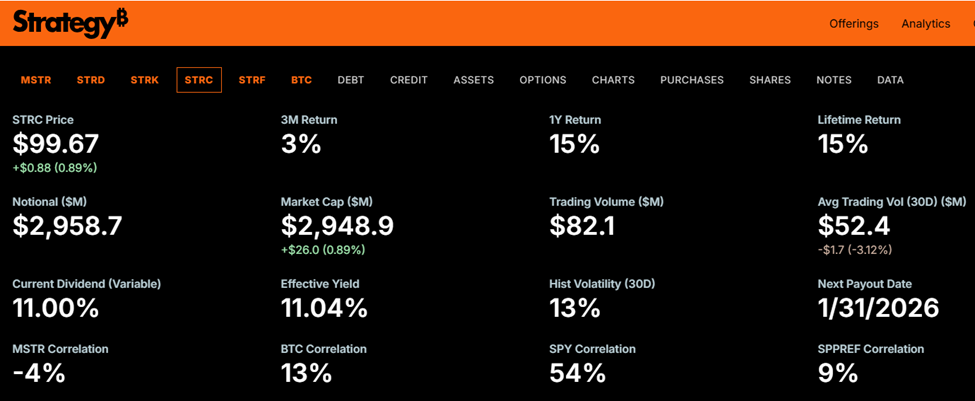

MicroStrategy’s preferred share strategy is drawing fresh attention this week as STRC once again approaches the $100 mark.

The move revives memories of early November when the stock held par for four trading days and generated roughly $100 million in ATM sales.

How STRC Preferreds Let MicroStrategy Grow Bitcoin Holdings with Minimal Dilution

Investors and analysts are closely watching as the Strategy leverages its STRC preferreds to accumulate Bitcoin. This strategy could generate substantial gains for shareholders while maintaining minimal common share dilution.

“If this BTC price action holds, $STRC will likely be bumping up against $100 for the next nine trading days. Last time $STRC hit par was early November for about four trading days. Resulted in ~ $100M in ATM sales. Amplified Bitcoin is ready to roar,” wrote crypto strategist Jeff Walton, highlighting the significance of the current price action.

His comments reflect the potential for repeated ATM capital raises at favorable premiums, providing MicroStrategy with additional firepower to grow its Bitcoin holdings.

The STRC mechanism is effectively a leveraged Bitcoin play. Shareholders benefit from BTC appreciation while exposure is managed through structured preferred issuance.

With STRC at $100, MicroStrategy appears positioned to repeat the success of early November’s ATM. This could strengthen its Bitcoin balance sheet and maintain investor interest, indicating a firm bullish stance.

“Strategy sells $100K of STRC, yielding 11% and buys 1 BTC at $100K. It now has an annual dividend obligation of $11,000. Five years pass; Bitcoin rises to $ 1 million. MSTR now holds $1 million of BTC, but has paid $ 55,000 to service the STRC dividend. That’s an $845K gain to MSTR shareholders ($900K capital gain – $55K of dividends = $845K),” explained Mark Harvey, a crypto finance analyst.

Harvey emphasizes that this strategy allows MicroStrategy to grow its Bitcoin holdings with minimal common-share dilution. At the same time, it rewards shareholders if BTC outperforms the 11% dividend rate.

Upside Risk, Not Downside: Why Bitcoin’s Rally Drives MSTR Strategy

Meanwhile, Jeff Dorman, CEO of Arca, cautioned that investors may be focusing on the wrong risks, remarks that come amidst MSCI exclusion fears.

“People are worried about the wrong MSTR risk—getting delisted by MSCI—not a big deal (marginally bad for stock, irrelevant for $BTC). BTC crashing—irrelevant for MSTR (they will never be a forced seller. 2+ years of cash & no covenants forcing sales). The biggest risk is actually BTC screaming higher, and MSTR not budging,” wrote Dorman.

According to Dorman, if Strategy’s MSTR stock stops tracking BTC and trades way below mNAV, then the story is over.

“Can’t raise via ATM if mNAV way below $0, and would have to consider selling BTC to buyback stock,” Dorman added.

This insight flips the typical risk narrative, suggesting that it is not Bitcoin’s decline but an inability to match Bitcoin’s upside that could limit MSTR’s strategy. Therefore, the upside may be tangible for bullish investors as Strategy stock rises 5%.

“Strategy up 5% overnight. What’s funny is that Saylor can literally take this level of premium handed to him, from one trading session, and raise close to enough cash to pay the dividends for an entire year,” stated Adam Livingston.

Against this backdrop, Livingston says it may be the prime time to accumulate MSTR, with his remarks highlighting how volatility and preferred share premiums can be harnessed to generate cash for dividends and reinvestment without forcing sales of Bitcoin.

The post MSTR Leverages STRC to Amplify Bitcoin Exposure as Preferred Stock Hits $100 appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 TOPINDIATOURS Eksklusif crypto: Ethereum Sees Record $8T Stablecoin Transfer Vol

Stablecoin transfer volume on Ethereum climbed to a new all-time high in the fourth quarter of 2025, topping $8 trillion, according to data released by Token Terminal.

Key Takeaways:

- Ethereum stablecoin transfers hit a record $8T in Q4 2025, nearly doubling from Q2 levels.

- Rising volumes and address activity suggest real payment use rather than speculative trading.

- Ethereum remains the leading platform for stablecoins and RWA tokenization by market share.

The figure nearly doubled from just over $4 trillion recorded in the second quarter, highlighting Ethereum’s growing role as a settlement layer for digital dollars.

The surge in activity coincided with a steady expansion in stablecoin supply on the network. Data from Blockworks shows stablecoin issuance on Ethereum rose about 43% over the course of 2025, increasing from $127 billion to roughly $181 billion by year’s end.

Ethereum Stablecoin Growth Signals Real Payments, Not Speculation

Market participants say the numbers point to practical usage rather than speculative flows.

One analyst posting on X described the growth as “global payments happening on-chain,” adding that broader institutional integrations have yet to fully come online.

Network activity also hit new highs during the same period. Daily transactions on Ethereum reached a record 2.23 million in late December, according to Etherscan, marking a 48% increase compared with a year earlier.

Token Terminal data shows monthly active addresses peaked at 10.4 million in December, while daily unique sending and receiving addresses surpassed one million toward the end of the month.

Ethereum’s dominance extends beyond transfers. The network remains the leading platform for real-world asset tokenization, accounting for roughly 65% of total on-chain RWA value, estimated at around $19 billion, according to RWA.xyz.

When layer-2 networks and other EVM-compatible chains are included, that share rises above 70%.

In the stablecoin market, Ethereum continues to hold the largest share of issuance at about 57%, ahead of Tron’s 27%.

Tether remains the dominant issuer overall, with roughly $187 billion in circulation, more than half of which resides on Ethereum.

Vitalik Declares Ethereum’s Trilemma ‘Solved’

Meanwhile, Ethereum co-founder Vitalik Buterin says the network has solved the blockchain trilemma, crossing a milestone many in crypto long viewed as unattainable.

In a post on X on Saturday, Buterin argued that recent and upcoming upgrades have finally aligned decentralization, security, and scalability through code already running in production.

At the center of the claim are two technical advances, including peer data availability sampling (PeerDAS) and zero-knowledge Ethereum virtual machines (zkEVMs).

Together, Buterin said, they are turning Ethereum into “a fundamentally new and more powerful kind of decentralized network.”

“Now, Ethereum with PeerDAS (2025) and ZK-EVMs (expect small portions of the network using it in 2026), we get: decentralized, consensus and high bandwidth,” Buterin wrote.

“The trilemma has been solved — not on paper, but with live running code.”

PeerDAS, introduced with the Fusaka upgrade in December, is designed to dramatically increase how much data Ethereum can process.

It allows nodes to verify data availability without downloading entire datasets, lowering hardware requirements while enabling higher throughput. One half of the trilemma solution, Buterin noted, is already live on mainnet.

The other half rests with zkEVMs, which allow Ethereum blocks to be validated using zero-knowledge proofs while remaining compatible with the existing Ethereum virtual machine.

While zkEVMs have been in development for years, Buterin described them as “alpha-stage” in terms of security, even if their performance is already production-ready.

The post Ethereum Sees Record $8T Stablecoin Transfer Volume in Q4 2025 appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

🤖 Catatan TOPINDIATOURS

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!