📌 TOPINDIATOURS Update crypto: Trader Turns $321 into $2.18M in Just 11 Days With

A trader has turned a modest $321 investment into more than $2.18 million in just 11 days, according to on-chain data shared by blockchain analytics platform Lookonchain.

Key Takeaways:

- Early, small-scale accumulation allowed one trader to capture a 6,800x return on a Solana memecoin.

- A long period of flat trading preceded a sudden 700% price surge driven by rising volume and liquidity.

- The case highlights both the upside and the extreme risks of memecoin speculation.

The wallet, identified as 8BGiMZ, accumulated roughly 45.58 million tokens of a Solana-based meme coin known by its ticker “114514” through a series of small swaps.

Transaction records show the trader steadily bought the token over several days, with individual purchases often costing less than a few dollars’ worth of SOL.

At the time of writing, those holdings are valued at approximately $2.18 million, marking a return of around 6,800x.

From Flat Trading to 700% Surge

On-chain activity indicates the trader began accumulating the token early, well before the sharp price surge.

Screenshots from decentralized exchange trackers show a long period of flat trading, followed by a sudden vertical move as buying pressure increased.

Within hours, the token’s price exploded, pushing its fully diluted valuation close to $50 million.

Data from Dexscreener highlights the scale of the rally. Over a 24-hour period, the memecoin surged nearly 700%, with trading volume climbing above $20 million.

Liquidity also expanded rapidly, helping fuel further speculation as thousands of new wallets entered the market.

Despite the eye-catching gains, the episode underscores the extreme risk tied to memecoin trading.

While early buyers can see outsized returns, such moves often depend on timing, social momentum, and thin liquidity. Late entrants are frequently left exposed when early holders begin to exit.

So far, there is no clear indication that the trader behind 8BGiMZ has sold a significant portion of the holdings.

On-chain records show no large outbound transfers, suggesting the position remains largely intact.

Meme Coin Dominance Rebounds From Historic Lows as Risk Appetite Returns

After a year-long decline, meme coin dominance has staged a sharp reversal from historic lows, as the sector’s total market capitalization climbed back above $50 billion.

Tokens such as PEPE, BONK, and FLOKI led the rebound with strong double-digit gains, reigniting debate over whether the move reflects short-term speculation or an early signal of broader altcoin rotation.

Market data shows the shift is significant. Meme coins had fallen from around 11% of the total altcoin market in late 2024 to just over 3% by December 2025, a level previously associated with major liquidity expansions.

Recent data from Santiment and CoinGecko indicates the sector jumped more than 20% in early January, with rising volume and renewed wallet activity suggesting risk appetite is returning faster than expected.

Unlike past cycles, the current rebound also has a regulated angle. Leveraged memecoin ETFs, including Dogecoin-linked products, have attracted strong demand, extending meme exposure beyond crypto-native traders.

As the sector diversifies into themes such as PolitiFi and AI memes, its resurgence is increasingly influencing exchange listings, fund strategies, and the broader structure of the altcoin market.

The post Trader Turns $321 into $2.18M in Just 11 Days With This Solana Meme Coin appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

📌 TOPINDIATOURS Eksklusif crypto: RENDER Rally Powers the AI Boom, But a 76% Drop

RENDER price has surged nearly 85% over the past seven days, making it one of the biggest drivers of the AI sector’s recent strength. The broader AI category is up around 18% over the same period, and RENDER has played a central role in that move.

At first glance, the rally looks convincing. Price has accelerated quickly, momentum has returned, and capital flow has improved. But when the data underneath is examined closely, the picture becomes more complex.

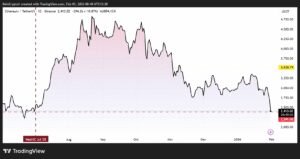

RENDER Price Is Rising, But the Bearish Structure Still Holds

Despite the sharp rebound, the RENDER price is still trading inside a descending channel that has been in place since early October. A descending channel forms when price makes lower highs over time, indicating that sellers remain in control of the broader trend.

The recent rally pushed RENDER toward the upper boundary of that channel, but the price failed to break through. More telling, this rejection occurred despite the trendline having only two clear touchpoints, making it relatively weak resistance. Yet sellers still defended it.

That rejection is visible in the candles themselves. Recent daily candles show long upper wicks, which signal selling pressure. Buyers pushed the price higher, but sellers responded quickly near the resistance, forcing the price back down. This behavior often occurs when a rally encounters structural pressure.

Capital flow confirms that this was not a weak bounce. The Chaikin Money Flow (CMF) indicator, which tracks whether money is entering or leaving an asset, trended higher while the RENDER price moved lower between October and early January. That showed accumulation during the downtrend.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

As the price broke higher, CMF also broke above its descending trendline and moved back above zero. This confirms the rally had real capital support. However, that support was insufficient to break the bearish channel.

In short, RENDER rallied with backing, but not enough force to reverse the broader downtrend.

Buying Pressure Is Fading as Momentum Warning Signs Appear

The next layer of risk appears away from the price chart but ultimately explains the long wicks: changes in exchange flow balance.

Exchange Flow Balance tracks the number of tokens moving off exchanges. High outflows usually signal buying and long-term holding. Falling outflows often point to slowing demand or rising profit-taking.

Over the past 24 hours, RENDER exchange outflows dropped from roughly 203,000 tokens to about 49,000 tokens. That is a 76% decline, showing a sharp slowdown in buying pressure just as the price hit resistance.

At the same time, momentum indicators are flashing caution.

The Relative Strength Index (RSI), which measures momentum strength, has formed a higher high, while the RENDER price is close to forming a lower high. This creates a hidden bearish divergence, a pattern that often signals momentum is weakening even as price remains elevated.

This divergence is not confirmed yet. Confirmation occurs if the next daily candle closes below $2.48, thereby locking in the lower-high structure. If that happens, it would suggest the rally is losing strength rather than building it.

Together, fading buying pressure and weakening momentum explain why the RENDER price struggled at resistance despite strong recent gains.

RENDER Price Levels Now Decide The Path

With trend resistance and momentum signals colliding, the Render price levels now matter more than indicators.

For the bullish case to regain control, RENDER needs a clean daily close above $2.56. That level would break the descending channel resistance and open the path toward $2.93. Only above that zone would the broader structure begin to turn bullish.

If the bearish signals play out, downside risk increases quickly. Initial support sits near $2.05, which would imply a pullback of roughly 14%. A deeper move could extend toward $1.80, and in a stronger correction, even $1.59.

RENDER may be powering the AI rally, but the charts show the move is being tested at a critical point. Capital flow helped start the rally. Momentum and demand now need to follow through.

Whether further upside remains depends not on how fast RENDER has moved, but on whether it can finally break free from the trend that has capped it for months.

The post RENDER Rally Powers the AI Boom, But a 76% Drop in Buying Pressure Exposes Cracks appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

🤖 Catatan TOPINDIATOURS

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!