📌 TOPINDIATOURS Breaking crypto: Truebit (TRU) Slips 99.95% as Cyvers Flags $26M E

Cyvers Alerts flagged a suspected Truebit incident on January 8, after its monitoring detected a suspicious transaction with an estimated loss of $26 million. TRU’s on-chain pricing printed a -99.95% one-day move on at least one token tracker, a level that typically indicates DEX liquidity collapse or a broken price feed rather than orderly selling pressure.

Onchain Details

The label “Truebit Protocol: Purchase” maps to 0x764C64b2A09b09Acb100B80d8c505Aa6a0302EF2 on Ethereum, which Etherscan tags as a Truebit contract address. Cyvers’ estimate centers on 8,535 ETH (about $26M at ~$3.1k/ETH), and the open question for desks is whether that ETH represents treasury funds, a mispriced “purchase” path, or a compromised hot wallet connected to Truebit’s TRU sales flow referenced in project docs (“All sales transact in ETH”).

CoinGecko data showed TRU trading at $0.1611 (+4.1% in 24h) before crashing to $0.00007923.

Truebit lists the TRU token contract at 0xf65B5C5104c4faFD4b709d9D60a185eAE063276c, which matters because confusion between “Truebit (TRU)” and “TrueFi (TRU)” has repeatedly polluted execution and risk systems on desks that rely on symbol-only mappings.

Trading Desk Read

For a desk, the tradable signal is not “TRU down 99.95%”. The signal is that a labeled purchase contract (a flow that can touch treasury ETH, fee rails, or sale mechanics) sits at the center of a suspected 8,535 ETH loss, which increases counterparty risk for any venue still quoting TRU and raises operational risk for any strategy that keys off ticker symbols alone (TRU has a long history of symbol collision with TrueFi).

Expect market makers to widen or pull quotes until the actual drain path (treasury vs. user flow vs. labeling error) gets pinned to a specific transaction trail and a Truebit-controlled signer set.

The post Truebit (TRU) Slips 99.95% as Cyvers Flags $26M ETH Drain appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

📌 TOPINDIATOURS Breaking crypto: Crypto Price Prediction Today 8 January – XRP, Bi

“We are so back” phase lasted for around six days before the price of Bitcoin started diving again. Crypto price predictions are once again pointing toward lower targets for BTC and XRP, while some traders are rotating into new launches like Maxi Doge.

Fundamentally, all three remain as strong as ever, which is why many investors are seeing these dips as opportunities rather than panicking.

Crypto Price Prediction: Bitcoin ($BTC) Liquidating Longs Before New All-Time High?

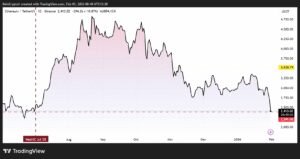

Bitcoin started the year with a massive rally from the bottom and nearly touched $95,000 before getting rejected and slipping back below $90,000.

A multitude of reasons caused this dump. Trump, being the president he is, resurfaced threats of imposing tariffs on countries that trade oil with Russia.

This unclear foreign policy, combined with the upcoming Friday jobs report, has caused uncertainty and led to nearly $500M in BTC ETFs outflows.

This is not the first time Bitcoin has been rejected from this exact price point. In early December, as shown on the chart, it was rejected and later slid to $84,000.

Bitcoin could follow the same path again if uncertainty continues. However, BTC is already below $90,000, and the RSI is around 35, signaling oversold conditions. Holding the $84,000 level would be key for bulls to stay optimistic and aim for a decent first quarter of 2026.

Crypto Price Prediction: Ripple ($XRP) – ETF Green Streak Ends

XRP’s record ETF green streak ends and records. Spot XRP ETFs saw their first net outflow in almost 2 months. $40.8M outflow has been recorded, trimming cumulative inflows to $1.2B.

This outflow and market-wide uncertainty have led to stronger effects on alts. XRP is down 12% over the last couple of days and 6% in the last 24 hours.

From this point, with the RSI around 40 and still leaving room for further downside, XRP could revisit the $2.00 zone. A sustained break below this level could lead to a deeper pullback toward the previous support at $1.80.

If the $2.00 zone holds, a bounce toward $2.20 could happen at any time. A break above that level would likely open the door for a retest of the recent highs around $2.40 before the end of January.

Crypto Price Prediction: MaxiDoge ($MAXI) Remains The Smartest Crowd Play

Smart traders want to maximize their exposure to potential gains. So they choose to diversify into newer coins and presale tokens.

When majors like Bitcoin and XRP are chopping and liquidating both sides, traders usually start looking for asymmetric plays. That is where Maxi Doge comes in.

Maxi Doge is built for high-volatility phases like this, where uncertainty is high, and conviction is low. Instead of betting on slow ETF flows or macro headlines, it leans fully into momentum, community, and meme-driven rotations.

The hype is already showing in the numbers. The $MAXI presale has raised almost $4.4 million, while early backers are earning up to 70% APY through staking rewards.

While BTC is flushing longs and XRP is reacting to ETF outflows, capital tends to rotate into fresh narratives. That is why many see Maxi Doge as the smarter crowd trade during market resets. Not after the move is already done.

If the market stabilizes and risk appetite returns, Maxi Doge is positioned to benefit first from that shift rather than last.

Visit the Official Maxi Doge Website Here

The post Crypto Price Prediction Today 8 January – XRP, Bitcoin, Maxi Doge appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

🤖 Catatan TOPINDIATOURS

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!