📌 TOPINDIATOURS Hot crypto: CoinGecko CEO Addresses $500M Acquisition Reports Waji

CoinGecko’s CEO, Bobby Ong, acknowledged on Thursday that the company is exploring “strategic opportunities” following media reports suggesting the firm is pursuing acquisition offers valued at approximately $500 million.

“After close to 12 years of developing CoinGecko as a self-funded enterprise, a common question I encounter concerns our future direction.

What I can reveal today is that CoinGecko is expanding and maintaining profitability, while witnessing heightened institutional interest as traditional finance sectors increasingly adopt cryptocurrency,” Ong stated on LinkedIn.

Media reports, attributed to sources with knowledge of the situation, revealed that CoinGecko is exploring a possible sale with an estimated valuation of $500 million.

Moelis Tapped as CoinGecko Courts Wall Street Acquisition

Insiders indicated the company has enlisted Moelis to provide advisory services for this process, although one source emphasized it’s premature to determine a precise valuation since negotiations commenced only in late 2024.

Moelis is an established Wall Street investment banking firm specializing in strategic financial guidance across mergers and acquisitions, restructuring, and capital markets for corporations, having facilitated over $5 trillion in transactions spanning various sectors.

In a post on X, Ong acknowledged receiving numerous inquiries following recent press coverage and expressed appreciation for the interest.

He indicated that after leading CoinGecko alongside Co-founder and President TM Lee for more than ten years, “like any growing and profitable company, we regularly evaluate strategic opportunities to strengthen our business and accelerate our mission.”

This statement suggests CoinGecko is actively pursuing acquisition opportunities and positioning the deal toward traditional Wall Street institutional buyers rather than venture capital firms.

While Ong declined to address specific negotiations, he expressed enthusiasm about “possibilities that enable us to better serve users and facilitate institutional crypto adoption.“

It’s worth noting that CoinMarketCap, another crypto market data platform, was purchased by crypto exchange Binance in 2020 for an estimated $400 million.

When announcing that acquisition, Binance clarified that while both the exchange and its BNB token were featured on the platform, “CoinMarketCap and Binance remain separate entities adhering to a strict independence policy.“

More than five years later, crypto industry observers believe a $500 million valuation for CoinGecko is reasonable, given that crypto data has become increasingly valuable and Wall Street data intelligence companies command substantially higher valuations.

For instance, Bloomberg L.P., though privately held, is estimated to be worth tens of billions, recent calculations suggest over $120 billion based on a 2008 stake transaction, with current annual revenues surpassing $13 billion as of early 2025.

$8.6B in Crypto Deals: Polygon, Fireblocks Lead 2026’s M&A Explosion

The quantity and value of mergers, acquisitions, and initial public offerings within the cryptocurrency space surged throughout 2025, with dealmaking hitting a record $8.6 billion as a more accommodating regulatory stance in the United States encouraged investors and financial institutions to re-enter the sector.

According to a report by the Financial Times, 267 crypto-related deals were completed in 2025, marking an 18% increase from 2024.

Total deal value surged nearly 300% compared with last year’s $2.17 billion.

Market participants expect momentum to carry into 2026 as regulatory clarity improves across major jurisdictions.

Already in 2026, Polygon Labs’ recently revealed plans to acquire cryptocurrency exchange Coinme and crypto wallet infrastructure provider Sequence for over $250 million.

Additionally, blockchain infrastructure firm Fireblocks announced Wednesday it acquired TRES Finance, a crypto accounting and financial reporting platform, for over $130 million to meet growing demand for “audit-ready, tax-compliant” financial documentation for blockchain-based businesses.

On January 12, Bakkt Holdings, Inc. revealed its agreement to acquire Distributed Technologies Research Ltd. (DTR), advancing its strategy to develop stablecoin settlement and programmable payment capabilities through an all-equity transaction involving shares representing 31.5% of a defined “Bakkt Share Number.”

The post CoinGecko CEO Addresses $500M Acquisition Reports appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

📌 TOPINDIATOURS Breaking crypto: Ethereum Staking Activity Sets Multiple Records —

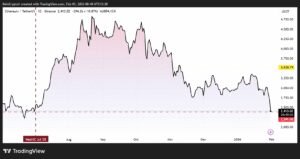

In January 2026, the Ethereum ecosystem recorded a surge in staking activity, with multiple metrics reaching all-time highs. These records may reduce liquid supply and help drive a potential price breakout.

Although the ETH price has remained below the $3,500 level for the past two months, analysts believe a breakout could be approaching due to these positive on-chain signals.

Nearly 36 Million ETH Staked, Representing Almost 30% of Supply

ValidatorQueue data shows that staked ETH has reached 35.9 million, accounting for 29.6% of the total circulating supply. At current prices, this equals more than $119 billion.

The chart highlights a notable spike since early January. Staked ETH increased from 35.5 million to 35.9 million, marking the end of a prolonged sideways phase that had lasted since August of last year.

This growth occurred despite the ETH price falling more than 30% since August. The data reflects strong long-term conviction among investors. It also reinforces the security and stability of the Ethereum network.

Additionally, as of January 15, the ETH staking queue surpassed 2.5 million ETH, marking its highest level since August 2023. Meanwhile, the unstaking queue dropped to zero.

These milestones are largely driven by staking activity from major institutions and publicly listed Digital Asset Treasuries (DATs).

Arkham reported that Tom Lee’s Bitmine staked an additional 186,500 ETH, worth more than $600 million. This move increased its total staked ETH to 1.53 million, valued at over $5 billion. In total, Tom Lee now stakes more than 1% of Ethereum’s total supply.

“Tom Lee is staking billions worth of $ETH. He 100% knows more than we do.” — CryptoGoos commented.

Meanwhile, SharpLink (SBET), the first publicly listed company to utilize Ethereum as its primary treasury asset, reported that staking activities have generated over $32 million since June. Total accumulated rewards now stand at 11,157 ETH.

Ethereum recorded another major milestone in January as user activity hit an all-time high. This trend reflects strong participation in stablecoin transactions and DeFi protocols across the Ethereum network.

With these bullish signals in place, analysts forecast that Ethereum could break above the current $3,450 resistance and rally toward $4,000. This outlook also gains support from a cup-and-handle pattern forming in the short term.

The post Ethereum Staking Activity Sets Multiple Records — Is ETH Price Ready for a Breakout? appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

🤖 Catatan TOPINDIATOURS

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!