📌 TOPINDIATOURS Breaking crypto: X Bans InfoFi Projects, KAITO Plummets 20% — Is T

X’s decision to clamp down on so-called InfoFi applications has sent fresh shockwaves through the crypto market, dragging several tokens sharply lower and forcing a rethink across a niche that had grown tightly intertwined with the social media platform.

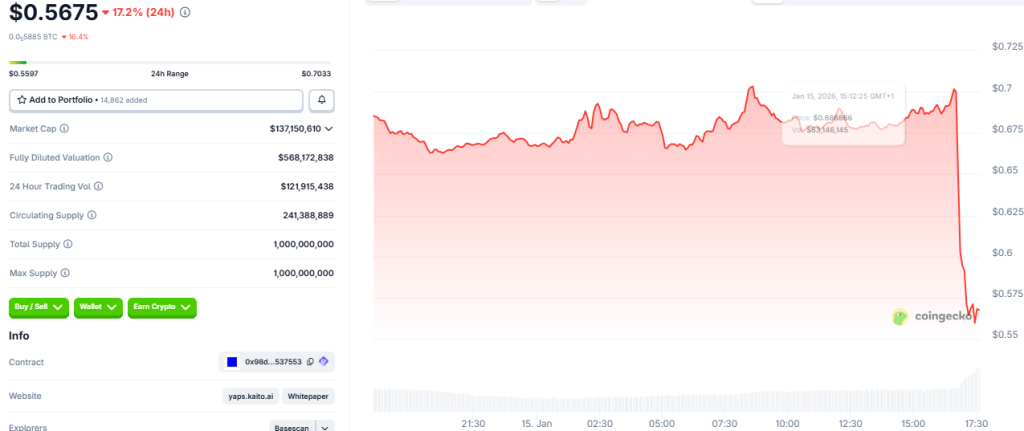

The immediate market reaction was led by KAITO, the token linked to the Kaito platform, which slid roughly 20% in a single day as investors digested what many saw as a structural threat rather than a short-term policy tweak.

X Cracks Down on Rewarded Posting, Shaking InfoFi Projects

The shift began with a public statement from Nikita Bier, X’s head of product, who said the company was revising its developer API rules to block applications that reward users for posting on the platform.

Bier said that these incentives had fueled a surge in low-quality replies, automated posts, and what he described as “AI slop,” degrading the overall user experience.

X confirmed that API access had already been revoked for affected apps, with Bier adding that developers whose accounts were terminated could seek help transitioning their businesses to other platforms such as Threads or Bluesky.

The announcement landed hard in crypto circles because many InfoFi projects are built around harvesting, analyzing, and monetizing X data.

Platforms like Kaito aggregate posts from large crypto accounts to identify trending narratives and then reward users, often in tokens, for producing content or engagement. That model left them exposed to any restriction on API access or posting incentives.

While X has not declared an outright ban on InfoFi as a category, the practical effect of cutting off rewarded posting has been to disrupt the core mechanics of several projects overnight.

Market data reflected that shock as KAITO token fell from around $0.70 to about $0.57 within hours, down roughly 17% to 20% on the day, while trading volume jumped nearly 87% to more than $121 million, suggesting forced repositioning rather than thin liquidity.

The token now trades more than 80% below its all-time high of $2.88.

Cookie DAO’s COOKIE token followed a similar path, dropping more than 20% in 24 hours to roughly $0.038, with volume also rising, a sign that holders were reassessing exposure as uncertainty spread.

Behind the price action lies a deeper debate about whether InfoFi’s incentive structures were sustainable.

Critics had long argued that paying users to post encouraged attention farming and automated content, an accusation that gained credibility as timelines filled with repetitive, AI-generated replies.

Following the announcement, Kaito founder Yu Hu said the company would sunset its “Yaps” and open incentive leaderboards, replacing them with Kaito Studio, a more selective, tier-based marketing platform designed to work across X, YouTube, TikTok, and other channels.

Hu framed the shift as an alignment with both X’s policies and brands’ growing preference for targeted campaigns over mass distribution.

Other platforms echoed that reassessment, with Cookie announcing it was shutting down its Snaps creator campaigns after discussions with X, citing the need to protect the integrity of its data products and remain compliant with platform rules.

Xeet, another project caught in the change, said all campaigns had been paused while it evaluated next steps and worked through outstanding payouts.

In each case, teams stressed that their broader analytics or data businesses would continue, but the rewarded-posting layer was no longer viable in its previous form.

The episode has shown how dependent large parts of crypto’s social layer remain on a single Web2 platform.

X’s use of automated moderation tools and AI-driven detection has turned it into a powerful gatekeeper, capable of reshaping entire business models with policy updates.

It has also intensified discussion about alternatives, including decentralized social networks and multi-platform strategies, as builders seek to reduce single-point risk.

The post X Bans InfoFi Projects, KAITO Plummets 20% — Is This the End? appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

📌 TOPINDIATOURS Breaking crypto: Senator Warns: Crypto Threatens Banking Collapse

As the Senate Banking Committee prepares to mark up new crypto market structure legislation this week, a warning from a senior Democratic senator has reignited debate over crypto’s role in the U.S. financial system and its connection to the banking failures of 2023.

The senator argues that the collapse of Silicon Valley Bank was not an isolated accident but an early signal of what happens when crypto-linked activity collides with an already fragile banking system.

The warning draws heavily on findings from a 292-page investigation released last September by the Senate’s Permanent Subcommittee on Investigations.

How Crypto-Era Bank Runs Slipped Past Regulators Until It Was Too Late, Senator Warns

In the opinion piece on Fox News, Senator Richard Blumenthal examined the failures of Silicon Valley Bank, Signature Bank, and First Republic Bank, all of which had received clean audits shortly before collapsing.

The senator noted that those audits masked growing risks tied to fast-moving deposits, opaque exposures, and a business model increasingly influenced by crypto and venture capital flows that arrive quickly and leave even faster.

In the senator’s telling, Silicon Valley Bank’s downfall followed a familiar pattern.

During the boom years of cheap money, the bank attracted massive deposits from tech startups and venture-backed firms, including companies linked to the crypto sector.

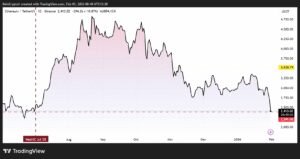

When conditions reversed after interest rates rose and major crypto firms like FTX collapsed, confidence evaporated. Panic spread rapidly through digital channels, and withdrawals accelerated at historic speed.

Regulators ultimately stepped in to prevent wider contagion, committing up to $340 billion in emergency support. Even so, more than $54 billion in equity and bond value was wiped out.

The senator has pointed to Signature Bank as a clearer example of crypto-linked risk. Signature had actively courted digital asset firms and built a large base of crypto-related deposits.

After the FTX collapse in late 2022, those deposits flowed out en masse.

Auditors repeatedly reassured the public that risks were under control, only for the bank to be shut down months later.

For the senator, this failure illustrates how crypto’s complexity and lack of transparency can overwhelm traditional oversight before regulators can react.

Notably, concern also extends to stablecoins, which the senator describes as “digital dollars” being marketed as alternatives to bank deposits.

With the stablecoin market valued around $300 billion and projections suggesting it could quadruple by 2030, he warns that losses could be far larger if safeguards are not imposed.

Since the GENIUS Act passed last summer, several major stablecoins have temporarily lost their pegs, erasing hundreds of millions of dollars in value.

How Crypto-Era Bank Runs Slipped Past Regulators Until It Was Too Late

Crypto industry figures strongly dispute that framing, as market commentators and executives argue that blaming crypto for Silicon Valley Bank’s collapse rewrites well-documented facts.

They point to SVB’s core failure as a textbook case of interest rate mismanagement.

The bank invested heavily in long-term U.S. Treasuries when rates were low and failed to hedge that exposure.

When rates rose sharply, losses were locked in with more than 90% of deposits being uninsured and concentrated among a tightly connected tech community, making a run almost inevitable once confidence cracked.

Silvergate Bank, critics note, presents a different case, as its collapse was directly tied to crypto market volatility and the loss of trust after FTX failed.

Deposits fell by 68% in a single quarter, forcing the bank to sell assets at a $718 million loss and ultimately liquidate.

Even there, defenders of crypto argue that concentration risk and poor balance sheet resilience were decisive, with crypto acting as a catalyst rather than the underlying cause.

They also reject the idea that “digital-speed” runs are unique to crypto.

Bank runs have occurred for centuries without smartphones or blockchai…

Konten dipersingkat otomatis.

🔗 Sumber: cryptonews.com

🤖 Catatan TOPINDIATOURS

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!