📌 TOPINDIATOURS Hot crypto: Why Bitcoin Has Become an Element of Resistance in Ira

According to Chainalysis, Bitcoin (BTC) has emerged as an “element of resistance” in Iran amid deepening unrest, with the overall crypto ecosystem surging to over $7.78 billion in 2025.

With the national currency under pressure and protests continuing across the country, cryptocurrencies have become a vital alternative for many Iranians, as evidenced by rising usage.

Iranians Increase Bitcoin Transfers as Economic Crisis Deepens

BeInCrypto reported that since late December 2025, mass protests began sweeping Iran. The demonstrations erupted due to rising inflation and the sharp devaluation of the local currency against the dollar.

The US-based Human Rights Activists News Agency (HRANA) estimates that more than 2,500 people have been killed. The authorities have also shut down internet access.

Amid this unrest, Chainalysis observed a surge in crypto activity, with a higher average daily dollar amount transacted and more transfers to personal wallets.

Large withdrawals under $10,000 recorded the strongest growth, with the average dollar value withdrawn rising 236% and the number of transfers increasing 262%. Medium withdrawals under $1,000 climbed 228% in value and 123% in transfers.

Very large withdrawals under $100,000 also rose, with dollar amounts up 32% and transfers up 55%. Even small withdrawals under $100 increased, with average value up 111% and transfers up 78%. Furthermore, withdrawals from Iranian exchanges to unattributed personal Bitcoin wallets rose markedly.

“This behavior represents a rational response to the collapse of the Iranian rial, which has lost nearly all of its value, rendering it effectively worthless against major currencies like the euro,” the report read.

Chainalysis stressed that Bitcoin is serving a broader function during the crisis in Iran than just protecting value. The firm observed that for many Iranians, cryptocurrency has become an “element of resistance.”

Unlike conventional assets, which can be illiquid and vulnerable to state oversight, Bitcoin’s self-custody and resistance to censorship give individuals greater financial mobility.

This flexibility is especially critical in situations where people may need to leave the country or rely on financial systems beyond government control.

“This pattern of increased BTC withdrawals during times of heightened instability reflects a global trend we’ve observed in other regions experiencing war, economic turmoil, or government crackdowns,” Chainalysis wrote.

Iran’s Crypto Ecosystem Reaches $7.78 Billion in 2025

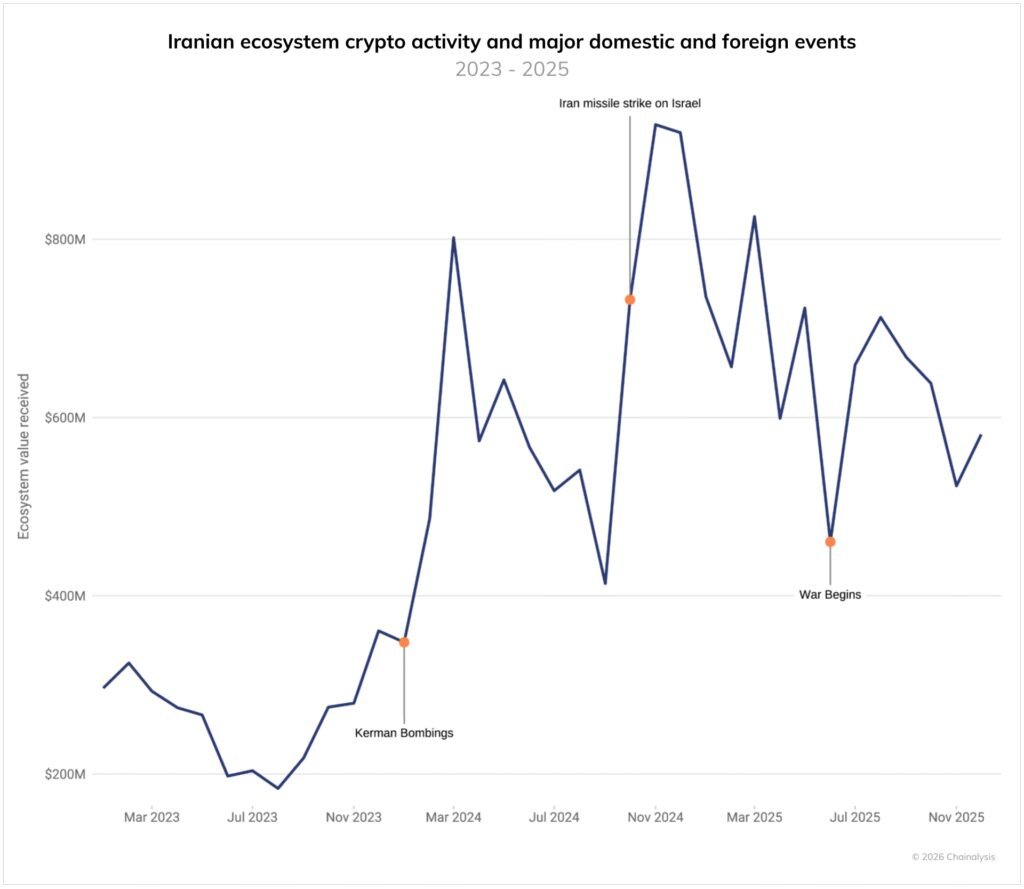

The firm added that Iran’s crypto market grew sharply in 2025 compared with the year before, with the ecosystem exceeding $7.78 billion. Drawing on past patterns, Chainalysis said that crypto activity in the country surges during periods marked by major internal or geopolitical developments.

Notable jumps occurred during the Kerman bombings in January 2024, missile strikes against Israel in October 2024, and the 12-day war in June 2025, which included attacks on the nation’s largest crypto exchange and leading bank.

The Islamic Revolutionary Guard Corps (IRGC) has become a dominant force in Iran’s cryptocurrency sector. IRGC-linked on-chain activity represented roughly half of the total crypto value received in Iran during Q4 2025.

The Chainalysis report estimates IRGC-linked wallets received more than $3 billion in 2025, up from over $2 billion the prior year. The group has increasingly relied on digital assets to bypass sanctions and support its regional financial networks. The team added that,

“We expect this figure will increase as more IRGC-affiliated wallets are publicly disclosed, and larger parts of their laundering network is exposed.”

Thus, it’s clear that cryptocurrency adoption in Iran has a dual nature. State-linked actors have leveraged digital assets to circumvent international sanctions.

At the same time, for ordinary citizens, it has become a way to protect savings from hyperinflation and the risk of asset seizure. Chainalysis suggested that cryptocurrencies are likely to remain a key tool for Iranians seeking greater financial autonomy.

The post Why Bitcoin Has Become an Element of Resistance in Iran’s Economic Crisis appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 TOPINDIATOURS Eksklusif crypto: RLUSD Hits Record High Amid Ripple’s Institution

Ripple’s US dollar-backed stablecoin, RLUSD, has surged to a new all-time high, fueled by a series of high-profile partnerships and regulatory milestones that are accelerating its adoption among institutional investors.

Yet, RLUSD appears to be the only token benefiting from Ripple’s advancements and expansion, as XRP bears the weight of market forces.

RLUSD Market Cap Surges Past $1.38 Billion as Ripple Expands Institutional Adoption

DefiLlama data shows that the RLUSD stablecoin’s market capitalization now exceeds $1.38 billion. This makes it one of the fastest-growing digital assets, with $125 million added since late November 2025.

The latest driver of RLUSD growth comes from Ripple’s newly announced partnership with LMAX Group. LMAX Group is a leading global cross-asset marketplace for foreign exchange and digital assets.

As part of a multi-year collaboration, RLUSD will be integrated as a core collateral asset across LMAX’s institutional trading infrastructure.

This integration enables banks, brokers, and buy-side institutions to leverage RLUSD for cross-collateralization and margin efficiency in spot crypto, perpetual futures, and CFD trading.

“Partnering with a leader like Ripple is a milestone for LMAX,” said David Mercer, CEO of LMAX Group. “With greater US and global regulatory clarity, fiat-backed stablecoins will be a key catalyst in driving the convergence of TradFi and digital assets, and RLUSD is positioned at the forefront.”

The LMAX partnership is complemented by a $150 million financing commitment from Ripple. This will support the exchange’s long-term cross-asset growth strategy.

Institutional clients will benefit from enhanced liquidity, secure custody via segregated wallets, and 24/7 access to a cross-asset marketplace. Notably, this feature is not typically available with traditional fiat currencies.

“LMAX has long been a leader in providing the transparent, regulated infrastructure that institutional players require. This partnership will accelerate the utilization of RLUSD—already a top-five USD-backed stablecoin—within one of the largest and most sophisticated trading environments,” added Jack McDonald, SVP of Stablecoins at Ripple.

RLUSD’s growth trajectory is further bolstered by Interactive Brokers’ announcement that eligible clients will soon be able to fund accounts using the stablecoin. With this, it expands its footprint into mainstream brokerage services.

Other notable institutional adopters include DBS, Franklin Templeton, and SBI Holdings. This demonstrates growing confidence in RLUSD as a trusted settlement and collateral asset.

Ethereum Dominates RLUSD Supply, Limiting XRP Utility

Despite these successes, the majority of RLUSD’s supply (nearly 76%) resides on Ethereum rather than Ripple’s native XRP Ledger (XRPL).

Therefore, while Ethereum integration unlocks significant DeFi liquidity, it limits XRP’s direct utility. This is because RLUSD transactions on Ethereum do not contribute to XRP burns or holder revenue.

This state of affairs has sparked de…

Konten dipersingkat otomatis.

🔗 Sumber: www.beincrypto.com

🤖 Catatan TOPINDIATOURS

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!