📌 TOPINDIATOURS Hot crypto: Analysts Warn Bitcoin Could Drop to $86K as Bearish We

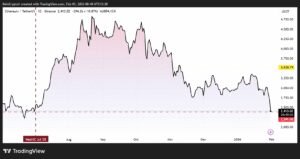

Crypto analyst Don Wedge has warned that despite recent Bitcoin gains, a bearish rising wedge pattern is forming near the $94,000 level, which, if pressured further, could trigger a decline back to the $86,000 support zone.

According to the rising wedge chart shared by Don and interpreted by the market intelligence platform Gigabrain, there’s a classic overhead battle near the white resistance line at around $98,000, which represents a clear invalidation point for bears.

Rising Wedge Shows $92K as Critical Support

The red support line near $92,000 marks the last line in the sand, and a break there would confirm the wedge and likely send Bitcoin back into the $86,000 to $91,000 green box to hunt for liquidity.

“White resistance line must be broken so it can be invalidated, two green lines will be the target if resistance is broken,” Don added, pointing to green targets at $103,000 and $112,000, which would constitute bearish invalidation if bulls successfully defend the $94,000 level.

Macro trader Crypto Batsman also shared bearish sentiment.

In a recent X post, the trader stated that, while not intending to scare retail investors, they should be aware that, on the bigger timeframe, Bitcoin’s been pumping lately, but BTC isn’t looking favorable.

“Price is currently facing the 50-week EMA, and this level acted as strong support throughout the bull run, but now that it’s been broken, it’s flipping into resistance,” he explained.

“I know it’s a lot to take in. Daily looks bullish, but zoom out and it’s a different story.”

Bitcoin Whale Accumulation at $90K-$92K Meets Sell Walls at $95K

Data from Coinglass reveals the recent Bitcoin rally saw whales accumulate between $90,000-$92,000, which pushed the price up toward $95,000, where strong sell walls emerged.

The market is now consolidating around $93,000 withouta clear reversal signal.

The Bitcoin short-term chart tracking STH profit and loss to exchanges shows that after weeks of selling mostly at a loss (purple), the last 24 hours printed the biggest profit spike in this entire range (green) as the price grinds higher.

Despite this being positive for short-term momentum, historically, these types of late profit spikes tend to appear near local trend exhaustion, not at the start of a clean leg higher.

As Bitcoin faces renewed sell-side pressure from recent buyers, Glassnode insights show attention shifts toward the Short-Term Holder cost basis, currently situated at $98,300.

This level represents the aggregate entry price of recent investors and serves as a critical gauge of market confidence.

Sustained trading above this threshold would indicate new demand is absorbing overhead supply, allowing recent buyers to remain profitable.

Historically, reclaiming and holding above the Short-Term Holder cost basis has marked transitions from corrective phases into more durable uptrends.

The ability of price to consolidate above $98,300 remains a necessary condition for restoring confidence in trend continuation and establishing foundations for a sustainable rally.

Short Gamma Zone Increases Volatility Potential

With spot trading around the $95,000-$96,000 area at the time of writing, Bitcoin’s price has moved into a short gamma zone extending roughly from $94,000 to $104,000.

Within this range, sustained price action supported by volume is more likely to trigger directional hedging flows, increasing potential for faster movement toward nearby high-interest strikes, including the $100,000 level.

Glassnode Implied Volatility Index confirms that while the risk of a $86,000 downside looms, the market is still positioning for a potential retest of the $100,000 area, while simultaneously expressing hesitation about sustained acceptance above that level over longer horizons.

Upside is being targeted tactically in the near term, but monetized at longer maturities.

The post Analysts Warn Bitcoin Could Drop to $86K as Bearish Wedge Forms appeared first on Cr…

Konten dipersingkat otomatis.

🔗 Sumber: cryptonews.com

📌 TOPINDIATOURS Update crypto: Weekly Crypto Regulation Roundup: Political Pressur

The past week in crypto regulation exposed a deeper truth about the current policy environment: digital asset oversight is no longer just a technical debate about market structure but a proxy battleground for institutional independence, surveillance power and political leverage.

From an extraordinary intervention by the Federal Reserve chair to mounting fractures in Congress over crypto legislation, the regulatory picture remains volatile—and increasingly politicized.

Powell Breaks Silence on DOJ Probe, Warns of Threat to Fed Independence

Federal Reserve Chair Jerome Powell delivered one of the most consequential public statements of his tenure on Sunday, accusing the Trump administration of weaponizing the Justice Department to pressure the central bank into cutting interest rates.

Powell confirmed that the Department of Justice served the Fed with grand jury subpoenas on Friday, tied to his June 2025 congressional testimony concerning a multi-year renovation of the Federal Reserve’s headquarters. While the investigation centers on disclosures related to the project, Powell framed the action in far broader terms.

“The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President,” he said in a rare televised address.

The implications extend beyond monetary policy. Powell warned that allowing criminal investigations to influence rate decisions risks subordinating economic judgment to political intimidation. For crypto markets—already sensitive to macro volatility—the episode underscores how regulatory stability depends not only on statutes, but on the resilience of institutional norms.

Tennessee Judge Halts State Action Against Kalshi

In a notable check on state-level enforcement, a federal judge in Tennessee temporarily blocked regulators from taking action against prediction market platform Kalshi.

U.S. District Judge Aleta Trauger granted Kalshi a preliminary injunction and temporary restraining order against the Tennessee Sports Wagering Council and the state attorney general. The order pauses enforcement of a cease-and-desist directive while the case proceeds.

Judge Trauger found that Kalshi would suffer “irreparable injury and loss” if state action continued and said the company is likely to succeed on the merits of its claims. Crucially, she added that Kalshi’s rights would likely be violated absent court intervention.

The ruling reinforces a growing judicial skepticism toward state attempts to regulate federally overseen financial products—a dynamic that could have broader implications for derivatives-linked crypto products and on-chain prediction markets.

Senate Delays Market Structure Bill as Bipartisan Fault Lines Emerge

Momentum behind comprehensive crypto legislation slowed again after Senate Agriculture Committee Chairman John Boozman postponed a planned markup of the Digital Asset Market Clarity Act to late January.

The delay follows negotiations with Democratic lead Cory Booker, as lawmakers attempt to finalize unresolved provisions covering regulatory jurisdiction, stablecoin yields, DeFi protections, and token classification. While the bill seeks to split oversight between the SEC and CFTC, political timing is becoming a growing obstacle.

With the 2026 midterm elections approaching, some analysts now warn that final passage could slip into 2027. That risk persists despite vocal support from the Trump administration and newly appointed SEC Chair Paul Atkins, who described this period as “a big week for crypto” and urged Congress to move digital asset markets out of the regulatory gray zone.

New Timeline, Old Tensions

Boozman later confirmed that legislative text would be released by the close of business on January 21, with a committee markup scheduled for January 27 at 3 p.m. The announcement followed parallel action by the Senate Banking Committee, where senators reportedly submitted 137 amendments to the CLARITY Act ahead of their own markup.

“This schedule ensures transparency and allows for thorough review,” Boozman said, thanking Booker for continued bipartisan cooperation.

Yet the volume of amendments highlights how unsettled core policy questions remain—particularly around enforcement authority, surveillance, and the treatment…

Konten dipersingkat otomatis.

🔗 Sumber: cryptonews.com

🤖 Catatan TOPINDIATOURS

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!