📌 TOPINDIATOURS Eksklusif crypto: Chinese-Language Money Laundering Networks Proce

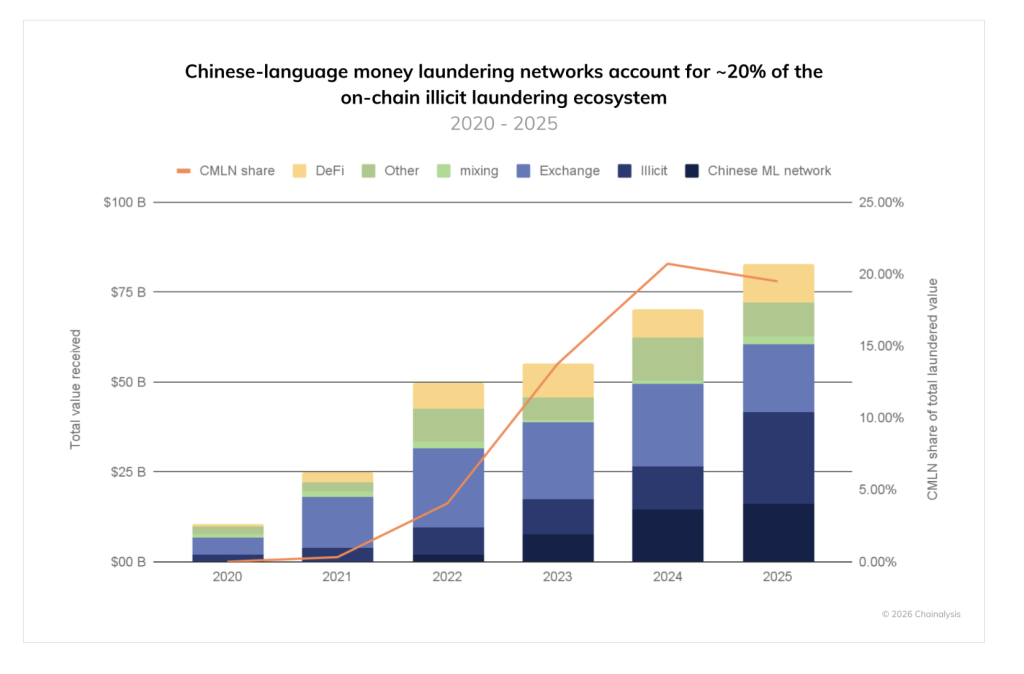

The illicit on-chain money laundering ecosystem has expanded rapidly over the past five years, growing from roughly $10 billion in 2020 to more than $82 billion in 2025, according to Chainalysis’ latest 2026 Crypto Crime Report.

Chainalysis said the sharp increase reflects the growing accessibility and liquidity of cryptocurrencies, alongside a shift in how laundering activity is conducted and who is facilitating it.

The firm noted that laundering services have become more sophisticated, industrialized and increasingly embedded in global criminal networks.

Chinese-Language Networks Now Account for 20% of Known Laundering

Chainalysis found that Chinese-language money laundering networks (CMLNs) have increased their share of attributed illicit laundering activity to around 20% in 2025.

These networks have also become a key endpoint for scam proceeds. Chainalysis noted that CMLNs now consistently launder more than 10% of funds stolen in pig butchering scams, as criminals shift away from centralized exchanges, which can freeze assets.

Since 2020, inflows to identified CMLNs have grown 7,325 times faster than those to centralized exchanges, far outpacing growth in DeFi-related laundering and intra-illicit transfers.

Chainalysis said Telegram-based services operating in Chinese-language channels now account for a disproportionate share of the global laundering landscape.

CMLN Ecosystem Processed $16.1B Through 1,799 Wallets

Chainalysis identified six major service types within the CMLN ecosystem, which together processed $16.1 billion in inflows during 2025. The number of active entities has risen sharply reaching more than 1,799 active on-chain wallets last year.

The report highlights the speed at which these operations scale. “Black U” services reached $1 billion in processing volume in just 236 days, while other typologies such as OTC desks and money mule networks scaled over longer periods.

Chainalysis estimates the ecosystem is processing nearly $44 million per day showing the industrial capacity of these networks.

Guarantee Platforms Anchor a Sophisticated Underground Market

At the center of the ecosystem are “guarantee platforms,” which function as marketing and escrow hubs connecting laundering vendors with buyers. Chainalysis said services such as Huione and Xinbi have dominated this market, even as enforcement actions disrupt individual accounts.

Vendors offer a wide range of laundering techniques, including running point brokers, money mule “motorcades,” informal OTC services, Black U discounted illicit crypto sales, gambling-linked laundering, and mixing and swapping-as-a-service.

Chainalysis noted that these networks demonstrate resilience, often migrating across platforms when challenged, while maintaining operational continuity.

Enforcement Actions Highlight Growing National Security Threat

Recent sanctions and advisories have drawn attention to the national security risks posed by laundering facilitation networks. Chainalysis pointed to actions including OFAC’s designation of the Prince Group, FinCEN’s rule targeting Huione Group, and advisories on Chinese money laundering networks.

Experts cited in the report warned that crypto has allowed rapid cross-border movement of illicit funds. Chainalysis concluded that disrupting these networks will require coordinated public-private collaboration, combining blockchain analytics, intelligence sharing, and proactive targeting of underlying operators rather than individual platforms alone.

Chainalysis emphasized that on-chain transparency offers unprecedented visibility—but only if matched with global enforcement capacity and systemic cooperation.

The post Chinese-Language Money Laundering Networks Processed $16.1B in Illicit Crypto: Chainalysis appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

📌 TOPINDIATOURS Update crypto: Tether Launches Federally Regulated USAT Stablecoin

Tether has officially launched USAT, a federally regulated, dollar-backed stablecoin built specifically for the U.S. market under the new GENIUS Act framework.

The token, issued by Anchorage Digital Bank, marks Tether’s formal entry into America’s emerging federal stablecoin regime and shows a major shift in how digital dollars may operate inside the United States’ regulated financial system.

Announced on 27 January, the launch follows earlier disclosures about the project’s design and the appointment of former White House Crypto Council Executive Director Bo Hines as CEO of Tether USAT.

USAT is now available to U.S. users seeking a stablecoin structured to comply with America’s dedicated federal oversight model.

A Stablecoin Built for America’s New Federal Framework

USAT has been developed to operate within the GENIUS Act’s new federal stablecoin framework, offering institutions a dollar-backed token issued through a nationally chartered bank.

Tether explains unlike USDT which continues to operate globally and is progressing toward GENIUS Act compliance, USAT is purpose-built for the U.S. market and its increasingly digital payment infrastructure.

Tether described the launch as a milestone not only for the company but for the trajectory of the U.S. dollar in a digital era, as countries compete to shape the future of money.

By combining the scale of USDT with federal-grade regulatory expectations, USAT aims to set a new benchmark for trust and transparency.

Anchorage Digital Bank Issues USAT at Institutional Scale

Anchorage Digital Bank, N.A., America’s first federally regulated stablecoin issuer, is the official issuer of USAT. The bank has built scalable infrastructure with on-chain transparency, deeply integrated risk management, and bank-grade compliance.

Tether stressed that USAT is designed not simply to satisfy regulatory requirements, but to function reliably within them day in and day out at institutional scale. U.S.-regulated exchanges and banking partners are being lined up to support broad access across the American financial ecosystem.

Cantor Fitzgerald will serve as the designated reserve custodian and preferred primary dealer, providing secure asset management and clear visibility into reserves from day one.

Tether’s Growing Role in the Global Dollar Economy

The launch comes as Tether continues to reinforce its role as a major macroeconomic participant. Tether Group is now the 17th-largest holder of U.S. Treasuries globally, ahead of sovereign holders including Germany, South Korea, and Australia.

USDT remains the world’s most widely adopted stablecoin, powering the digital economy at scale and supporting the international use of the U.S. dollar for payments, commerce, and reserves.

“USAT offers institutions an additional option: a dollar-backed token made in America,” said Paolo Ardoino, CEO of Tether. “USDT has proven for more than a decade that digital dollars can deliver trust, transparency, and utility at a global scale.”

Availability Across Major Crypto Platforms

During the first phase of rollout, USAT will be available on Bybit, Crypto.com, Kraken, OKX, and MoonPay, expanding access for both institutions and retail users seeking a regulated digital dollar product.

“With the launch of USAT, we see a digital dollar that is designed to meet federal regulatory expectations,” said Bo Hines. “Our focus is stability, transparency, and responsible governance, ensuring that the United States continues to lead in dollar innovation.”

The post Tether Launches Federally Regulated USAT Stablecoin for U.S. Market Under GENIUS Act Framework appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

🤖 Catatan TOPINDIATOURS

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!