📌 TOPINDIATOURS Breaking crypto: XRP Plunges 17% in Steepest One-Day Drop Since 20

A wave of leveraged liquidations totaling $46 million dragged XRP to its steepest one-day drop in over four months. This drop contrasts Ripple’s successful bids for new regulatory approvals across Europe.

Key Takeaways:

– XRP fell more than 17% to about $1.25 on Thursday, its worst one-day performance since October 2025, as broader crypto markets plunged.

– Roughly $46 million in XRP derivatives were liquidated in 24 hours, with $43 million coming from leveraged long positions, according to CoinGlass data.

– Despite the sharp drop, XRP spot ETFs have continued attracting net inflows, pulling in roughly $24 million this week and bringing cumulative inflows past $1.2 billion since their November 2025 launch.

The XRP price dropped more than 17% over the past 24 hours to around $1.25, making it the worst-performing major token on the day. Bitcoin fell roughly 10% toward $65,000 during the same period, while Ethereum slid below $2,000 and Solana traded near $82, as the selloff widened across the entire crypto market.

The move extended XRP’s weekly losses to nearly 30% and pushed its market cap down to approximately $75 billion, a steep fall from its July 2025 peak of $210 billion. XRP is now trading 45% below its January 2026 high of $2.41. This decline has been further fueled by deteriorating broader market conditions.

Leveraged Liquidations Amplified the Selloff Across Derivatives Markets

Data from CoinGlass showed roughly $46 million in XRP derivatives liquidations over 24 hours, with bullish bets accounting for about $43 million of that figure.

Prices bled slowly through most of Thursday before a sharp drop late in the session triggered a cascade of stop-loss orders and forced closings.

The break below the $1.44 support zone flipped that area into overhead resistance, leaving $1.00 as the next widely watched psychological level.

Across the broader market, traders saw approximately $1.42 billion in total crypto liquidations on Thursday, with long positions accounting for $1.24 billion.

XRP ETF Inflows Hold Up Despite the Price Collapse

Despite the steep decline, institutional flows into XRP exchange-traded funds have remained positive.

Since launching in November 2025, XRP spot ETFs have posted inflows on all but four trading days, according to SoSoValue data. Looking at this week’s performance, inflows totaled roughly $24 million, bringing cumulative net inflows past $1.2 billion.

That resilience stands in sharp contrast to Bitcoin ETFs, which recorded approximately $545 million in outflows on Wednesday alone.

Ripple’s Regulatory Wins Failed to Cushion the Drop

The selloff came during an otherwise active stretch for Ripple. Earlier this week, Ripple announced it had received full approval of an Electronic Money Institution license from Luxembourg’s Commission de Surveillance du Secteur Financier, enabling it to scale regulated payment services across the EU.

The Luxembourg approval followed a separate EMI license from the UK’s Financial Conduct Authority in January, bringing Ripple’s global license count past 75.

None of these developments cushioned XRP against the broader risk-off move. This price development underscores that the token’s valuation remains driven primarily by positioning and momentum rather than adoption narratives.

The post XRP Plunges 17% in Steepest One-Day Drop Since 2025 as $46M in Leveraged Longs Get Wiped appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

📌 TOPINDIATOURS Breaking crypto: US Consumer Data Sparks Relief Rally in Bitcoin,

Global markets staged a broad rebound on February 6 after a sharp sell-off the previous day pushed stocks, crypto, and commodities into deeply oversold territory. Bitcoin recovered to around $70,000, while US equities, gold, and silver also advanced, driven by technical buying and easing near-term macro fears.

The recovery followed a violent deleveraging phase rather than a shift in fundamentals.

Technical Levels Sparked The Initial Bounce

The rebound began after key technical levels held across asset classes. The S&P 500 touched its 100-day moving average, a level closely watched by systematic and discretionary traders.

That triggered mechanical buying from funds rebalancing risk exposure after several sessions of heavy selling.

Bitcoin followed a similar pattern. After briefly falling to $60,000, the asset rebounded sharply as forced liquidations slowed and funding rates stabilized.

The absence of fresh liquidation pressure allowed spot buyers to step in, supporting a short-term recovery.

Positioning Reset Reduced Selling Pressure

The previous sell-off had flushed leverage across markets.

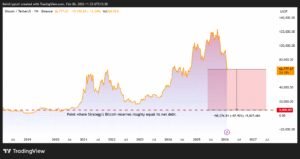

In crypto, derivatives positioning had become heavily skewed toward longs, amplifying downside once prices broke support. By February 6, much of that excess leverage had already been cleared.

As a result, marginal selling pressure eased. With fewer margin calls and reduced forced selling, prices were able to rebound even without new bullish catalysts.

The chart shows leverage building through January before being sharply flushed as price broke support in early February.

After that reset, forced selling pressure eased, allowing price to rebound despite the absence of new bullish catalysts.

Macro Signals Eased Near-Term Stress

US macro data also helped stabilize sentiment. Consumer sentiment data released on February 6 came in stronger than expected, marking a six-month high.

While not signaling strong growth, the data reduced immediate fears of a sudden economic deterioration.

Bond markets reacted by pricing a slightly higher probability of a near-term rate cut from the Federal Reserve, pushing short-term yields lower before stabilizing. That shift eased financial conditions at the margin, supporting risk assets.

Gold and silver also recovered sharply, reinforcing the view that the prior session’s decline reflected liquidity stress rather than a fundamental rejection of safe-haven assets.

A softer US dollar and bargain-hunting contributed to the move.

Relief Rally, Not A Trend Reversal

The February 6 rebound reflects a technical relief rally driven by oversold conditions, positioning resets, and short-term macro relief. It does not yet confirm a durable trend reversal.

Markets remain sensitive to liquidity conditions, interest-rate expectations, and capital flows. Volatility is likely to persist as investors reassess risk in a tighter financial environment.

The post US Consumer Data Sparks Relief Rally in Bitcoin, Gold, and Stocks appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

🤖 Catatan TOPINDIATOURS

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!