📌 TOPINDIATOURS Update crypto: 4 US Economic Events That Could Move Bitcoin This W

Bitcoin traders are heading into a macro-heavy week, with four US economic events expected to shape sentiment across crypto markets.

With Bitcoin trading in a volatile range and macro narratives dominating market psychology, traders are increasingly treating economic releases as short-term catalysts that can trigger sharp moves in both directions.

Which US Economic Signals Should Bitcoin and Crypto Investors Watch This Week?

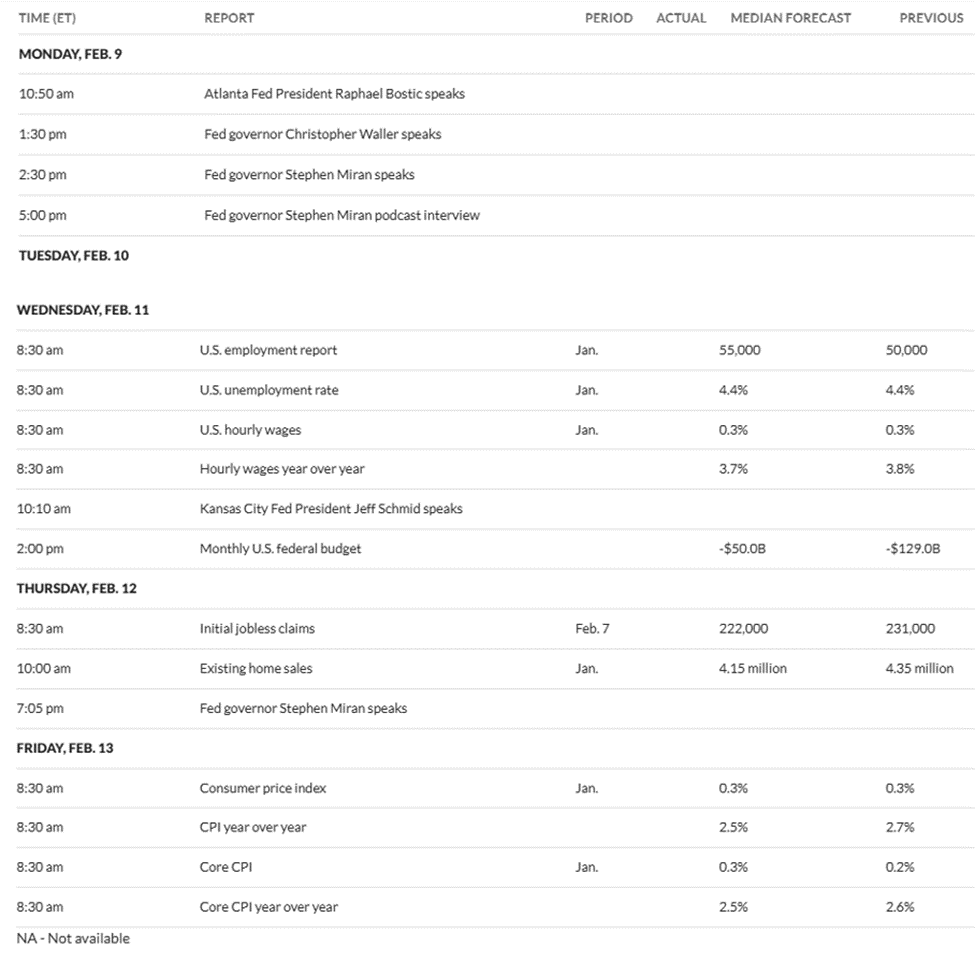

A Federal Reserve (Fed) governor’s media appearance, key labor-market data, weekly unemployment claims, and January inflation figures could all influence expectations around interest rates and liquidity—two of the strongest drivers of Bitcoin’s price cycles.

Fed Governor Stephen Miran Interview in Focus

Markets will first look to comments from Federal Reserve Governor Stephen Miran, who is scheduled to appear in a podcast interview on Monday, February 9. Ahead of the 5:00 p.m. ET. appearance, there is already mixed sentiment across the crypto community, especially amid broader market caution.

Some market participants point to Miran’s relatively constructive view on stablecoins, arguing that regulatory clarity and dollar-linked digital assets could indirectly support Bitcoin by strengthening the broader crypto ecosystem and institutional participation.

Others see risk. Speculation that Miran could play a larger role in future Fed leadership has already coincided with bouts of volatility in both precious metals and crypto. This reflects fears that tighter policy could weigh on inflation-hedge narratives.

At the same time, some macro analysts have described Miran as more dovish than many of his peers, citing past arguments in favor of substantial rate cuts to support the labor market.

Any signals in that direction could lift sentiment in risk assets, particularly Bitcoin, which remains highly sensitive to liquidity expectations.

US Employment Report Could Drive “Bad News Is Good News” Narrative

Attention will shift on Wednesday, February 11, to the US employment report, one of the most closely watched indicators of economic health and monetary-policy direction.

Forecasts suggest relatively modest job growth, potentially reaching 55,000 from the previous 50,000. Weaker-than-expected data could paradoxically support Bitcoin. Cooling labor conditions would increase pressure on the Fed to ease policy, potentially improving liquidity conditions for risk assets.

Recent labor-market indicators have already pointed to signs of slowing. Reports of rising layoffs and a slowdown in hiring have strengthened expectations that rate cuts could arrive sooner than previously anticipated.

However, the employment report also carries downside risk. A sharp deterioration in job data could spark broader growth fears, prompting investors to move toward defensive positions. Such an outcome could trigger short-term selloffs in crypto, as seen during previous macro shocks.

Jobless Claims May Reinforce or Challenge the Trend

Thursday’s initial jobless claims release will provide a more immediate snapshot of labor-market conditions. As such, it could reinforce the narrative set by the employment and unemployment reports on Wednesday.

Recent spikes in claims have coincided with risk-off reactions in crypto markets, including liquidation events and rapid price swings. Some traders interpret rising claims as a signal that economic conditions are weakening enough to force monetary easing, a longer-term positive for Bitcoin.

Others warn that in the short term, deteriorating employment data can unsettle markets, especially when liquidity is thin and <a href="https://beincrypto.com/bitcoin-long-liquidation-risk-january-2026/" targe…

Konten dipersingkat otomatis.

🔗 Sumber: www.beincrypto.com

📌 TOPINDIATOURS Update crypto: Two High Schoolers Charged in Arizona Home Invasion

Two teenagers from California are facing serious felony charges after authorities say they traveled hundreds of miles to carry out a violent home invasion in Scottsdale, Arizona, in a bid to obtain cryptocurrency believed to be worth $66 million.

Key Takeaways:

- Two California teens allegedly traveled over 600 miles to carry out a violent home invasion targeting $66 million in cryptocurrency.

- Police arrested the suspects shortly after they fled the scene and recovered restraints and a 3D-printed firearm.

- Investigators say unknown contacts on an encrypted messaging app directed the plot and funded supplies.

According to court records cited by local media, the 16- and 17-year-old suspects drove more than 600 miles from San Luis Obispo County and arrived at a residence in the Sweetwater Ranch neighborhood on the morning of Jan. 31 wearing delivery-style uniforms resembling those used by shipping carriers.

Investigators say they forced entry into the home, restrained two adults with duct tape and demanded access to digital assets.

One victim denied holding cryptocurrency, after which the confrontation escalated into physical assault.

Police Stop Suspects After Violent Home Invasion Attempt

Police were alerted when an adult son elsewhere in the house called emergency services. Officers arriving at the property found a struggle underway and one victim screaming.

The suspects fled in a blue Subaru but were stopped at a dead end shortly afterward.

Authorities recovered zip ties, duct tape, stolen license plates and a 3D-printed firearm without ammunition. It remains unclear whether the weapon was functional.

Both teens were initially placed in juvenile detention but prosecutors intend to try them as adults. Each faces eight counts including kidnapping, aggravated assault and burglary, while the older suspect also faces an unlawful flight charge.

They were later released on $50,000 bail and fitted with electronic monitoring devices.

Investigators say the younger suspect told police the pair had recently met and were directed by unknown individuals communicating through the encrypted messaging platform Signal.

The contacts, identified only as “Red” and “8,” allegedly supplied the address and sent $1,000 for disguises and equipment purchased at retail stores.

The suspect also claimed he had been pressured into participating after being invited on a trip to “tie people up” for access to cryptocurrency.

Wrench Attacks on Crypto Holders Rise Sharply in 2025

The case reflects a broader rise in so-called wrench attacks, physical assaults aimed at forcing crypto holders to hand over private keys.

Security researcher Jameson Lopp’s public database lists roughly 70 such incidents in 2025, a sharp increase from the previous year.

The Scottsdale attack is the first recorded US case of 2026, though many incidents are believed to go unreported.

Security analysts say criminals are increasingly using leaked personal data to identify targets and recruiting young perpetrators online to reduce traceability.

A recent industry breach involving customer identity information has been cited by investigators as a factor increasing exposure risks.

Authorities have not linked the incident to separate cryptocurrency ransom demands reported the same day in Tucson, about two hours away.

The post Two High Schoolers Charged in Arizona Home Invasion Targeting $66M in Crypto appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

🤖 Catatan TOPINDIATOURS

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!