📌 TOPINDIATOURS Eksklusif crypto: Gate Strengthens Position in Crypto ETF Market W

Over the past two years, the landscape for crypto derivatives has shifted dramatically. A significant contraction in the supply of ETF leveraged tokens has occurred across top-tier exchanges. Platforms that previously championed these products have initiated phased suspensions, halted subscriptions, or delisted leveraged pairs entirely throughout 2024 and 2025. However, the demand for leverage among traders has not vanished. It has simply been displaced.

In this environment of market retrenchment, Gate has taken a contrarian approach. Rather than withdrawing, Gate has doubled down, treating ETF leveraged tokens not as a niche add-on, but as a core product line. By prioritizing transparent mechanisms and a unified low-fee framework, Gate has transformed what was once a complex instrument into a scalable, user-friendly tactical tool.

Why Exchanges Are Leaving

In the context of crypto, ETFs generally refer to ETF Leveraged Tokens. These are tokenized instruments traded on the spot market that track perpetual futures positions, allowing users to gain leveraged exposure (e.g., 3x Long BTC) without managing margin or liquidation prices.

Despite their utility, these products are highly structured. Without robust risk controls and clear user education, they are susceptible to volatility decay in ranging markets. Consequently, major platforms have exited the space to minimize compliance risks and user disputes. For example, exchange no. 1. phased out leveraged token services in early 2024, eventually discontinuing support, and exchange no. 2. followed suit in late 2025, issuing batch delisting announcements for BTC and other major assets.

This industry wide reduction has created a vacuum. As comparable platforms shrink, product availability itself has become a scarce competitive advantage. Gate has stepped in to absorb this liquidity, offering a stable home for short-term leveraged trading demand.

Simplifying Leverage With Unified Fees

Gate’s ETF architecture is designed to map professional derivatives positions into a simple tokenized format. For the user, the experience mirrors spot trading, there is no need to monitor margin maintenance or fear sudden liquidation events.

A key differentiator is Gate’s approach to cost transparency. In derivatives trading, costs are often fragmented across funding rates, trading fees, and slippage. Gate consolidates these fragmented costs into a single, understandable metric known as the unified management fee. This flat 0.1% daily fee is entirely all-inclusive, covering everything from hedging costs and funding rates to potential trading friction.

By packaging costs at the product level, Gate shifts the complexity from the user to the platform. The user gets a predictable cost structure, while the platform leverages professional expertise to manage execution and hedging.

Transparency in Mechanics

The sustainability of leveraged tokens relies on explainability. Two critical variables define these products: the Net Asset Value (NAV) and Rebalancing Rules.

The sustainability of leveraged tokens relies on explainability. Unlike competitors that often operated these mechanisms as “black boxes,” Gate provides explicit parameter disclosures. This includes specific leverage fluctuation ranges where rebalancing is not triggered, which significantly reduces frictional costs in choppy markets.

For instance, Gate ensures position stability by avoiding rebalancing for 3x Long tokens as long as leverage stays between 2.25x and 4.125x, while the 3x Short variant maintains a range of 1.5x to 5.25x. Similarly, for 5x tokens, no adjustments are triggered unless the leverage moves outside the 3.5x to 7x boundary. These technical parameters are vital for professional traders as they minimize the “decay” often associated with these products during range-bound price action.

Scale by the Numbers

Gate’s ecosystem is expanding. According to Gate’s 2025 annual report, the “Scale Effect” of their ETF product line is evident in the platform’s ability to support 244 different ETF leveraged tokens throughout the year. This robust supply served a cumulative user base of over 200,000 traders, driving average daily trading volumes into the hundreds of millions of dollars. This growth is supported by continuous technical iterations, including the launch of multidimensional data dashboards, rebalancing history displays, and specialized educational modules designed to reduce the learning curve for new participants.

The platform’s success is not merely a result of being one of the last providers standing, but rather a reflection of its commitment to product depth. Gate continues to broaden its asset coverage, ensuring that users can access leveraged exposure across a diverse range of emerging and established tokens. Looking ahead, Gate plans to build on this momentum by introducing sophisticated new formats, such as portfolio ETFs and low-leverage inverse ETFs. By retaining technical complexity at the platform level while delivering operational certainty to the user, Gate is positioning itself to capture an even larger share of the short-term leveraged trading market.

Conclusion

The industry wide contraction of leveraged tokens was not a failure of the concept, but a failure of execution regarding transparency and education. Gate has succeeded where others retreated by systematizing the product.

By offering clear disclosures, a unified 0.1% daily fee, and a spot-like user experience, Gate has built a sustainable ecosystem that preserves the utility of leverage while mitigating its complexity. As the market matures, Gate’s ETF offering stands as a testament to the value of explainable, transparent financial engineering.

Disclaimer: Investing in the cryptocurrency market involves high risk. Users are advised to conduct independent research and fully understand the nature of the assets and products before making any investment decisions. Gate is not liable for any losses or damages resulting from such investment activities.

The post Gate Strengthens Position in Crypto ETF Market With Transparency and Low Fees appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 TOPINDIATOURS Hot crypto: Two High Schoolers Charged in Arizona Home Invasion Ta

Two teenagers from California are facing serious felony charges after authorities say they traveled hundreds of miles to carry out a violent home invasion in Scottsdale, Arizona, in a bid to obtain cryptocurrency believed to be worth $66 million.

Key Takeaways:

- Two California teens allegedly traveled over 600 miles to carry out a violent home invasion targeting $66 million in cryptocurrency.

- Police arrested the suspects shortly after they fled the scene and recovered restraints and a 3D-printed firearm.

- Investigators say unknown contacts on an encrypted messaging app directed the plot and funded supplies.

According to court records cited by local media, the 16- and 17-year-old suspects drove more than 600 miles from San Luis Obispo County and arrived at a residence in the Sweetwater Ranch neighborhood on the morning of Jan. 31 wearing delivery-style uniforms resembling those used by shipping carriers.

Investigators say they forced entry into the home, restrained two adults with duct tape and demanded access to digital assets.

One victim denied holding cryptocurrency, after which the confrontation escalated into physical assault.

Police Stop Suspects After Violent Home Invasion Attempt

Police were alerted when an adult son elsewhere in the house called emergency services. Officers arriving at the property found a struggle underway and one victim screaming.

The suspects fled in a blue Subaru but were stopped at a dead end shortly afterward.

Authorities recovered zip ties, duct tape, stolen license plates and a 3D-printed firearm without ammunition. It remains unclear whether the weapon was functional.

Both teens were initially placed in juvenile detention but prosecutors intend to try them as adults. Each faces eight counts including kidnapping, aggravated assault and burglary, while the older suspect also faces an unlawful flight charge.

They were later released on $50,000 bail and fitted with electronic monitoring devices.

Investigators say the younger suspect told police the pair had recently met and were directed by unknown individuals communicating through the encrypted messaging platform Signal.

The contacts, identified only as “Red” and “8,” allegedly supplied the address and sent $1,000 for disguises and equipment purchased at retail stores.

The suspect also claimed he had been pressured into participating after being invited on a trip to “tie people up” for access to cryptocurrency.

Wrench Attacks on Crypto Holders Rise Sharply in 2025

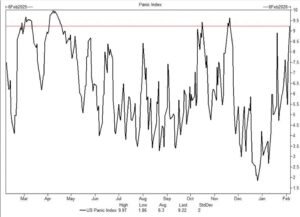

The case reflects a broader rise in so-called wrench attacks, physical assaults aimed at forcing crypto holders to hand over private keys.

Security researcher Jameson Lopp’s public database lists roughly 70 such incidents in 2025, a sharp increase from the previous year.

The Scottsdale attack is the first recorded US case of 2026, though many incidents are believed to go unreported.

Security analysts say criminals are increasingly using leaked personal data to identify targets and recruiting young perpetrators online to reduce traceability.

A recent industry breach involving customer identity information has been cited by investigators as a factor increasing exposure risks.

Authorities have not linked the incident to separate cryptocurrency ransom demands reported the same day in Tucson, about two hours away.

The post Two High Schoolers Charged in Arizona Home Invasion Targeting $66M in Crypto appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

🤖 Catatan TOPINDIATOURS

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!