📌 TOPINDIATOURS Hot ai: New simulations reveal how tiny carbon pores can boost nex

Sodium may be the underdog of battery chemistry, but new research shows it could soon punch far above its weight.

As global demand for energy storage from EVs to resilient power grids explodes, scientists are pushing hard to develop alternatives to lithium-ion.

Sodium-ion batteries have emerged as one of the most promising candidates as it is cheaper, more abundant, and far less environmentally taxing. But a key technical hurdle has slowed their progress.

Researchers across the globe are scrambling to figure out what kind of anode material can store sodium efficiently.

A new study from Brown University engineers takes a major step toward solving that puzzle.

The work uncovers how sodium behaves inside porous carbon structures and lays out concrete design specifications for future sodium-ion anodes.

“This work helps us understand the mechanism of sodium storage in carbon materials for sodium-ion batteries,” said Lincoln Mtemeri, a presidential postdoctoral fellow in engineering at Brown who led the study.

The research offers rare clarity in a field where even the basic structure of “hard carbon”, which is today’s leading anode candidate, has been widely debated.

Inside carbon’s maze

Lithium-ion batteries dominate today’s electronics and EVs, but scaling them for grid resilience and mass electrification poses economic and environmental challenges. Sodium-ion systems promise relief because sodium is plentiful and inexpensive, potentially reducing both cost and mining impacts.

But commercializing the technology has been slow. Graphite, the go-to anode for lithium-ion cells, performs poorly with sodium.

Hard carbon has taken its place, yet the material’s microscopic structure is still so murky that “If you ask 10 different people what the structure of hard carbon is, you’ll get 10 different answers,” said Yue Qi, a professor in Brown’s School of Engineering and study co-author.

Researchers have long suspected that tiny pores within hard carbon are responsible for storing sodium. However, how sodium actually settles inside those pores — or what pore size works best — remained unknown.

Atoms in formation

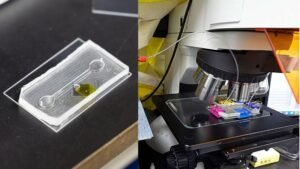

To investigate this, Mtemeri used zeolite-templated carbon (ZTC), a material with a precisely controlled nanopore network ideal for modeling pore behavior.

With a custom algorithm and density functional theory simulations, he tracked how sodium atoms arrange themselves as they enter these nano-sized chambers.

The results reveal a two-step storage phenomenon. Sodium atoms first line the pore walls through ionic bonds. Once the walls are fully coated, additional atoms gather in the middle of the pore as metallic clusters.

This dual behavior of being ionic at the edges, metallic at the center, turns out to be crucial.

The mix helps maintain a low anode voltage, boosting the battery’s overall voltage, while the ionic sodium prevents dangerous metal plating that can cause short circuits.

“This helps us determine the optimal size for the pores,” Mtemeri said. “We show that a pore size of around one nanometer maintains the good balance of ionicity and metallicity that we want.”

These findings offer some of the first firm design rules for hard-carbon anodes, providing researchers with a blueprint for future synthesis.

“Sodium is 1,000 times more abundant than lithium, which makes it a more sustainable option,” Qi said. “Now we understand exactly which pore features are important and that enables us to design anode materials accordingly.”

The study appears in the journal EES Batteries.

🔗 Sumber: interestingengineering.com

📌 TOPINDIATOURS Hot ai: Oops! Nvidia’s Stock Is Falling Again After Its “Blowout”

On Wednesday night, Nvidia released its highly anticipated-slashed-dreaded quarterly earnings report — and Wall Street let out a sigh of relief, at least initially.

The multitrillion dollar chipmaker at the center of the AI boom reported a ludicrous $57 billion in quarterly revenue, netting it nearly $32 billion in profit. Compared to the same quarter from the year before, it amounted to a 62 percent surge in sales, and a further 65 percent increase in profit.

Nvidia’s stock spiked by over four percent when trading resumed on Thursday morning. Other tech stocks received a boost, too, as did the S&P 500 overall. The chipmaker’s “blowout” quarter calmed fears of an AI bubble bursting on the horizon. If the nearly $5 trillion behemoth responsible for providing the hardware used by AI makers was still seeing its profits balloon, then perhaps the economy collapsing wasn’t in the cards just yet, and everyone could feel secure about pouring more money into AI.

But the fuzzy feelings didn’t last.

While headlines were still trickling out today about the stock market’s rally in the wake of Nvidia’s awesome third quarter, Nvidia’s stock did a swift 180, plunged again, and is now down by over 4 percent over the course of the day.

And once again, other tech stocks followed. Microsoft shares are now down by 1.6 percent, and Google’s by around 1 percent, even though it just released its hot new Gemini 3 AI model.

Perhaps cooler heads finally prevailed. In reality, the fact that the company which is selling all the shovels for an AI gold rush is doing well doesn’t really reflect on the prospects of the companies who are actually mining for all that elusive gold.

“The people who are selling the semiconductors to help power AI doesn’t alleviate the concerns that some of these hyperscalers are spending way too much money on building the AI infrastructure,” Robert Pavlik, senior portfolio manager at Dakota Wealth, told Reuters. “You have the company that’s benefiting it, but the others are still spending too much money.”

The fizzling stocks also come as the Wall Street analysts lowered their expectations of the Federal Reserve cutting interest rates in December, NBC News noted, due to a better than expected September jobs report.

The vicissitudes of the stock market can be cruel. It didn’t care, for instance, that Nvidia CEO Jensen Huang had just gloated about Nvidia’s earnings.

“There’s been a lot of talk about an AI bubble,” Huang told investors during the earnings call, before stocks started shriveling again. “From our vantage point, we see something very different. As a reminder, Nvidia is unlike any other accelerator. We excel at every phase of AI from pre-training to post-training to inference.”

More on AI: OpenAI Is Suddenly in Trouble

The post Oops! Nvidia’s Stock Is Falling Again After Its “Blowout” Earnings Report appeared first on Futurism.

🔗 Sumber: futurism.com

🤖 Catatan TOPINDIATOURS

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!