📌 TOPINDIATOURS Hot crypto: HBAR Price Is Down 40% Since Canary ETF Launch; What W

Hedera’s recent price action has struggled to inspire confidence, with HBAR failing to sustain any meaningful recovery.

While expectations were high following the launch of an HBAR exchange-traded fund, the token’s muted performance highlights a familiar crypto narrative. The episode increasingly resembles a classic “buy the rumor, sell the news” outcome.

HBAR ETF – A Disappointing Tale

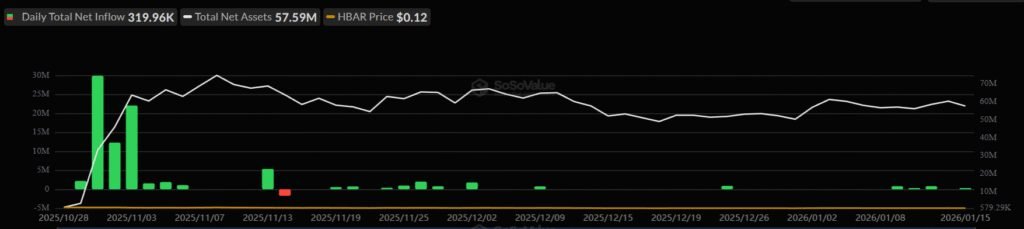

The Canary HBAR ETF has emerged as one of the weakest-performing crypto ETPs since its debut. Around its late-October launch, the product briefly attracted strong interest, peaking near $30 million in cumulative inflows. That momentum, however, faded quickly and has not returned in a sustained manner.

Recent data shows the ETF recording just $875,000 in inflows, while most trading days have seen net flows remain flat at zero. This pattern reflects speculative positioning ahead of the launch. Once the ETF went live, early participants booked profits, triggering persistent selling pressure. The approval itself failed to unlock meaningful new demand.

Furthermore, ETF impact was more symbolic than capital-driven. The Canary ETF improved visibility but did not unlock significant new demand for spot HBAR. Without strong follow-through volume, price failed to hold key technical levels, accelerating downside moves.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Technical indicators reinforce this cautious outlook. The Chaikin Money Flow, which tracks capital movement among larger holders, is slipping below the zero line. Historically, similar shifts in CMF have coincided with periods of price weakness for HBAR, as outflows begin to dominate inflows.

This behavior suggests institutional and whale interest remains fragile. When capital exits Hedera, price reactions have often been swift. If CMF continues to trend lower, it could signal another wave of distribution. That dynamic would limit upside attempts and keep recovery efforts constrained.

HBAR Price Recovery Is Difficult

Since the HBAR ETF went live, the token has declined roughly 41%, falling from $0.200 to about $0.117 at the time of writing. This drop highlights the disconnect between expectations and realized demand. HBAR has since entered consolidation phases after each sharp move, reflecting indecision.

A similar range-bound outcome now appears likely. HBAR is oscillating between $0.131 resistance and $0.113 support. If selling pressure intensifies and outflows expand, a breakdown below $0.113 could follow. That move would expose $0.104 as the next downside target, with $0.096 acting as deeper support.

A bullish alternative depends on a shift in capital flows. Should outflows stall and broader market sentiment improve, HBAR could stabilize near $0.113 and rebound. A decisive move above $0.131 would strengthen recovery prospects. Pushing toward $0.150 would invalidate the bearish thesis and signal renewed confidence.

The post HBAR Price Is Down 40% Since Canary ETF Launch; What Went Wrong? appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 TOPINDIATOURS Eksklusif crypto: Analysts Warn Bitcoin Could Drop to $86K as Bear

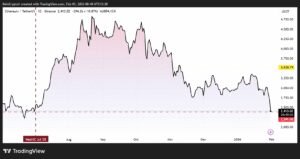

Crypto analyst Don Wedge has warned that despite recent Bitcoin gains, a bearish rising wedge pattern is forming near the $94,000 level, which, if pressured further, could trigger a decline back to the $86,000 support zone.

According to the rising wedge chart shared by Don and interpreted by the market intelligence platform Gigabrain, there’s a classic overhead battle near the white resistance line at around $98,000, which represents a clear invalidation point for bears.

Rising Wedge Shows $92K as Critical Support

The red support line near $92,000 marks the last line in the sand, and a break there would confirm the wedge and likely send Bitcoin back into the $86,000 to $91,000 green box to hunt for liquidity.

“White resistance line must be broken so it can be invalidated, two green lines will be the target if resistance is broken,” Don added, pointing to green targets at $103,000 and $112,000, which would constitute bearish invalidation if bulls successfully defend the $94,000 level.

Macro trader Crypto Batsman also shared bearish sentiment.

In a recent X post, the trader stated that, while not intending to scare retail investors, they should be aware that, on the bigger timeframe, Bitcoin’s been pumping lately, but BTC isn’t looking favorable.

“Price is currently facing the 50-week EMA, and this level acted as strong support throughout the bull run, but now that it’s been broken, it’s flipping into resistance,” he explained.

“I know it’s a lot to take in. Daily looks bullish, but zoom out and it’s a different story.”

Bitcoin Whale Accumulation at $90K-$92K Meets Sell Walls at $95K

Data from Coinglass reveals the recent Bitcoin rally saw whales accumulate between $90,000-$92,000, which pushed the price up toward $95,000, where strong sell walls emerged.

The market is now consolidating around $93,000 withouta clear reversal signal.

The Bitcoin short-term chart tracking STH profit and loss to exchanges shows that after weeks of selling mostly at a loss (purple), the last 24 hours printed the biggest profit spike in this entire range (green) as the price grinds higher.

Despite this being positive for short-term momentum, historically, these types of late profit spikes tend to appear near local trend exhaustion, not at the start of a clean leg higher.

As Bitcoin faces renewed sell-side pressure from recent buyers, Glassnode insights show attention shifts toward the Short-Term Holder cost basis, currently situated at $98,300.

This level represents the aggregate entry price of recent investors and serves as a critical gauge of market confidence.

Sustained trading above this threshold would indicate new demand is absorbing overhead supply, allowing recent buyers to remain profitable.

Historically, reclaiming and holding above the Short-Term Holder cost basis has marked transitions from corrective phases into more durable uptrends.

The ability of price to consolidate above $98,300 remains a necessary condition for restoring confidence in trend continuation and establishing foundations for a sustainable rally.

Short Gamma Zone Increases Volatility Potential

With spot trading around the $95,000-$96,000 area at the time of writing, Bitcoin’s price has moved into a short gamma zone extending roughly from $94,000 to $104,000.

Within this range, sustained price action supported by volume is more likely to trigger directional hedging flows, increasing potential for faster movement toward nearby high-interest strikes, including the $100,000 level.

Glassnode Implied Volatility Index confirms that while the risk of a $86,000 downside looms, the market is still positioning for a potential retest of the $100,000 area, while simultaneously expressing hesitation about sustained acceptance above that level over longer horizons.

Upside is being targeted tactically in the near term, but monetized at longer maturities.

The post Analysts Warn Bitcoin Could Drop to $86K as Bearish Wedge Forms appeared first on Cr…

Konten dipersingkat otomatis.

🔗 Sumber: cryptonews.com

🤖 Catatan TOPINDIATOURS

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!