📌 TOPINDIATOURS Eksklusif crypto: Binance and OKX To Enter TradFi With Tokenized S

Major crypto exchanges Binance and OKX are reportedly exploring the reintroduction of tokenized US stocks.

The move marks a strategic pivot to capture traditional finance (TradFi) yields amid stagnant crypto trading volumes, pushing platforms toward diversification into real-world assets (RWAs).

A Return to Tokenized Stocks?

This move revives a product Binance tested and abandoned in 2021 due to regulatory hurdles. Nevertheless, it would position the exchanges to compete in a fast-growing but still nascent tokenized equities market.

In April 2021, Binance launched stock tokens for major names like Tesla, Microsoft, and Apple, issued by German broker CM-Equity AG with Binance handling trading.

The service was discontinued in July 2021 under pressure from regulators, including Germany’s BaFin and the UK’s FCA. Regulators viewed the products as unlicensed securities offerings lacking proper prospectuses.

Binance cited a shift in commercial focus at the time. However, recent reports from The Information indicate Binance is now considering a relaunch for non-US users to sidestep SEC oversight, creating a parallel 24/7 market.

Reportedly, OKX is also weighing similar offerings as part of the exchange’s RWA expansion. No official confirmations have emerged from either exchange, and details on issuers, exact listings, or timelines remain limited.

Citing a Binance spokesperson, the report described exploring tokenized equities as a “natural next step” in bridging TradFi and crypto.

Why Crypto Exchanges Want US Equities Now

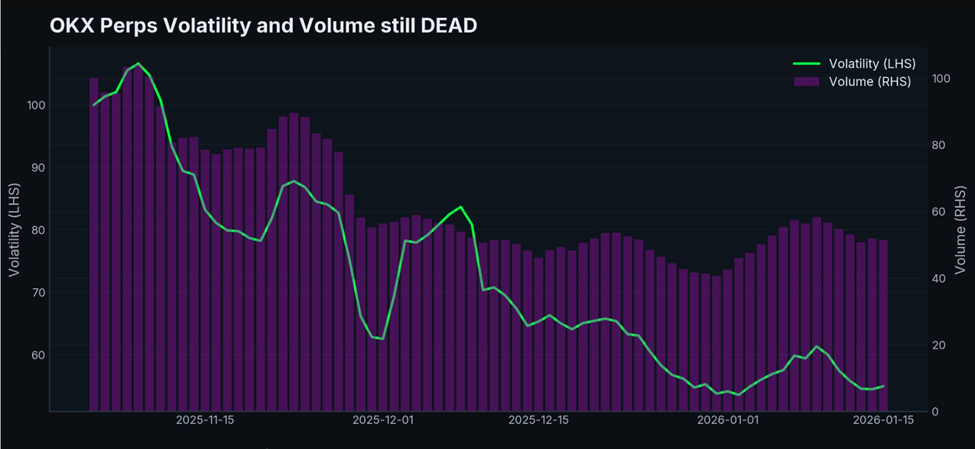

Crypto markets have experienced persistent stagnation in trading volume in 2026, prompting exchanges to seek new revenue streams.

“BTC spot trading activity remains constrained so far in 2026: Average daily spot volumes for January tracking 2% below December and 37% below November levels,” wrote researcher David Lawant in a recent post.

Analysts also note that Crypto markets remain largely dormant in January, with volatility and trading volume pinned near December’s graveyard lows.

This is not calm consolidation but a liquidity trap, where thin order books amplify risk and a single poor execution can cascade into outsized losses for overexposed traders.

Meanwhile, US tech stocks (Nvidia, Apple, Tesla) have sustained strong rallies, driving demand among crypto holders, particularly those with stablecoin balances, for equity exposure without exiting the ecosystem.

Tokenized stocks allow 24/7 trading of synthetic assets that mirror underlying share prices, often backed by offshore custodians or derivatives rather than direct ownership.

The market, while small, is accelerating. Total tokenized stock value stands at approximately $912 million, with data on RWA.xyz showing it is up 19% month-on-month. Meanwhile, monthly transfer volumes exceed $2 billion, and active addresses are surging.

“I’ve bought NVIDIA on Binance Wallet before. Actually, right now, the top priority for both companies should be how to launch a precious metals market. Especially silver—apart from gold, which is suitable for physical storage, the others don’t have much storage value. I’m in China, and even paper silver is hard to buy; I can only buy ETFs,” one user stated.

Analyst AB Kuai Dong noted that official spot markets remain limited to futures or third-party tokens like PAXG for gold.

Intensifying Competition in Tokenized Assets

This push comes amid a broader race in tokenized real-world assets. Traditional players like NYSE and Nasdaq are seeking approvals for regulated on-chain stock platforms, potentially clashing with offshore crypto-led models in the future.

Robinhood has already captured a significant share in the EU (and EEA), launching tokenized US stocks and ETFs in mid-2025. Crucial metrics from Robinhood’s offerings include:

<ul class="bic-gutenberg-list wp-l…

Konten dipersingkat otomatis.

🔗 Sumber: www.beincrypto.com

📌 TOPINDIATOURS Breaking crypto: Bitcoin Price Prediction: BTC at $88K as BIP-110

Bitcoin is trading near $88,700 as markets weigh a pullback from $97K against rising regulatory clarity in the US, internal network debates, and shifting technical momentum. Senate crypto reforms, growing BIP-110 adoption, and rumors around GameStop’s BTC transfer have added noise, but price action suggests consolidation, not collapse. The $88K zone now stands as the key pivot for Bitcoin’s next directional move.

Bitcoin Governance Debate Resurfaces as BIP-110 Node Adoption Expands

Bitcoin’s long-running governance debate has resurfaced as adoption of Bitcoin Improvement Proposal 110 (BIP-110) edges higher. Roughly 2.38% of Bitcoin nodes are now running BIP-110, a temporary soft fork designed to limit non-monetary data, or “spam,” embedded in transactions.

The proposal restores restrictions on OP_RETURN data and output sizes that were loosened in recent Bitcoin Core updates.

The issue has divided the community. Critics argue that allowing excessive arbitrary data risks turning Bitcoin into a data-storage network, raising node costs and pushing out smaller, home-run operators, which could increase centralization. Supporters counter that usage should not be artificially limited and that existing spam filters are ineffective.

While the debate may create short-term noise, it has little direct price impact. Over time, efforts like BIP-110 reinforce Bitcoin’s decentralization, strengthening its credibility as resilient, trust-minimized money.

GameStop Moves 4,700 BTC to Coinbase Prime, Raising Sale Speculation

GameStop has moved its entire Bitcoin holding, roughly 4,710 BTC worth over $420 million, to Coinbase Prime, sparking speculation that a sale may be imminent. According to CryptoQuant, the company acquired its Bitcoin at an average price near $107,900, meaning a full exit at current levels around $90,800 would imply an unrealized loss of roughly $76 million.

Large transfers to institutional trading platforms often precede selling, but the move alone does not confirm liquidation. GameStop has not issued any public statement, leaving markets to interpret the intent.

The broader impact on Bitcoin appears limited. More than 190 publicly listed companies now hold Bitcoin on their balance sheets, underscoring continued institutional participation.

Even if GameStop were to exit, it would represent an isolated corporate decision rather than a shift in overall institutional confidence. Short-term volatility is possible, but longer-term demand remains intact.

Bitcoin Price Prediction: BTC Tests $88K Support as Breakout Pressure Builds

Bitcoin price prediction remains bearish as BTC is trading near $88,600, entering a corrective phase after failing to hold the $97,300 swing high earlier this month. On the 4-hour chart, price has slipped back into a rising channel that guided the move from the $83,800 low.

The rejection at channel resistance marked a momentum shift, reinforced by long upper wicks and a bearish engulfing candle that broke short-term support.

BTC is now testing a key confluence zone between $88,000 and $87,300, which aligns with prior demand and the lower boundary of the ascending channel. Recent candles show smaller bodies with lower wicks, suggesting selling pressure is easing rather than accelerating. However, price remains below the 50-EMA and 100-EMA, while the 200-EMA near $91,200 continues to cap rebounds, keeping near-term bias cautious.

RSI has rebounded from oversold levels near 30 and is stabilizing around 40–42, signaling balance but not strength. The structure resembles a descending flag within a broader uptrend. If $87,300 holds, a reclaim of $90,000 could open $92,400–$94,500. A clean break below risks $85,600.

Bitcoin (BTC/USD) Trade Setup: Buy $87,500–$88,000, target $94,000, stop below $85,500.

Bitcoin Hyper: The Next Evolution of BTC on Solana?

Bitcoin Hyper ($HYPER) is bringing a new phase to the BTC ecosystem. While BTC remains the gold standard for security, Bitcoin Hyper adds what it always lacked: Solana-level speed. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Consult, the project emphasizes trust and scalability as adoption builds. And momentum is already strong. The presale has surpassed $30.9 million, with tokens priced at just $0.013635 before the next increase.

As Bitcoin activity climbs and demand for efficient BTC-based apps rises, Bitcoin Hyper stands out as the bridge uniting two of crypto’s biggest ecosystems. If Bitcoin built the foundation, Bitcoin Hyper could make it fast, flexible, and fun again.

Click Here to Participate in the Presale

The post <a href="https://cryp…

Konten dipersingkat otomatis.

🔗 Sumber: cryptonews.com

🤖 Catatan TOPINDIATOURS

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!