📌 TOPINDIATOURS Update crypto: US Crypto ETFs Draw $670 Million in Inflows on Firs

US spot crypto exchange-traded funds (ETFs) recorded nearly $670 million in inflows on the first trading day of the year.

The surge signaled renewed investor appetite after a sluggish end to 2025.

Bitcoin ETFs Lead With $471 Million Inflow

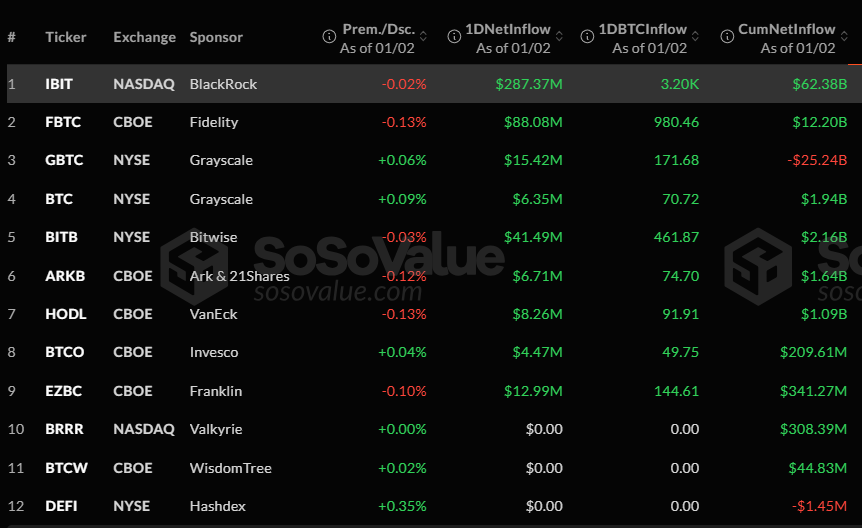

On January 2, spot Bitcoin ETFs led the digital asset class’s strong start in 2026, drawing $471 million in net inflows.

BlackRock’s iShares Bitcoin Trust (IBIT) led the sector, capturing approximately $287 million in new capital, according to data from market tracker SosoValue.

Fidelity’s Wise Origin Bitcoin Fund (FBTC) followed with $88 million, while the Bitwise Bitcoin ETF (BITB) recorded inflows of $41.5 million.

Grayscale’s converted Bitcoin Trust (GBTC) and Franklin Templeton’s EZBC also saw positive movement, registering $15 million and $13 million, respectively.

Meanwhile, this collective surge represents the second-highest daily inflow for the group since November 11 and surpasses the December 17 peak of $457 million.

The robust activity suggests that institutional investors are reallocating capital after a period of tax-loss harvesting and withdrawals in late December.

Ethereum and Other Altcoins Perform Strongly

Notably, the positive sentiment in the sector extended beyond Bitcoin to the second-largest digital asset.

Ethereum funds reported total net inflows of $174 million. In a divergence from 2025 trends, data indicates the Grayscale Ethereum Trust (ETHE) paced the cohort with $53.69 million in inflows.

The Grayscale Ethereum Mini Trust followed closely with $50 million, while BlackRock’s iShares Ethereum Trust (ETHA) secured $47 million.

Meanwhile, investment products tracking smaller market-cap assets also posted gains, reflecting broader market participation.

Funds tied to XRP recorded $13.59 million in inflows, while Solana-based ETFs added $8.53 million.

Dogecoin ETFs saw a modest inflow of $2.3 million, marking the highest single-day figure for that specific asset class since its inception.

Market analysts view the coordinated inflows across Bitcoin, Ethereum, and alternative coins as a potential indicator of a trend reversal.

The uniform positive performance across these ETFs suggests that US investors are increasing exposure to the crypto sector as the new fiscal year begins.

The post US Crypto ETFs Draw $670 Million in Inflows on First Trading Day of 2026 appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 TOPINDIATOURS Update crypto: Tom Lee Pushes for Big Share Increase as BitMine Cl

Tom Lee is urging BitMine shareholders to approve a dramatic expansion of the company’s authorized share count. This would make future dilution easier as BitMine doubles down on Ethereum as a core treasury asset.

In a New Year message, Lee asked investors to back a proposal to raise the authorized share limit from 500 million to 50 billion shares. The vote closes on January 14, ahead of BitMine’s annual meeting on January 15 in Las Vegas.

BitMine’s Share Dilution Debate Tied to Ethereum

Tom Lee said the increase does not mean BitMine will issue all those shares immediately.

Instead, he said it would give the company flexibility to support future capital needs and enable stock splits if the share price rises significantly.

BitMine pivoted last year to make ETH its primary treasury asset. Since then, the company has steadily increased its ether holdings, positioning itself less like a traditional mining firm and more like a leveraged Ethereum balance sheet.

In the past month alone, the company bought over $1 billion in Ethereum.

Lee told shareholders that BitMine’s stock has begun tracking ETH more closely than its operating metrics.

In his view, if Ethereum’s price rises enough over time, issuing new shares to buy more ETH could still benefit shareholders, even if their ownership percentage falls.

If the proposal passes before the January 15 shareholder meeting in Las Vegas, BitMine would have a much larger pool of shares to issue. That could be used for:

- Raising capital, including potentially to buy more Ethereum

- Acquisitions or strategic deals

- Stock splits to keep the share price “accessible” as Lee outlined

Lee emphasized to investors that approving a larger authorization does not automatically create dilution. Actual dilution would occur only if and when new shares are issued.

Also, he emphasized stock splits as a key reason for the proposal. If BitMine’s share price rises alongside ETH, splits could be needed to keep shares accessible to retail investors. A higher authorized share count makes those splits easier to execute.

Still, the proposal puts shareholders at a crossroads. Approving it does not dilute stakes today, but it lowers the barrier for future dilution tied directly to Ethereum exposure.

The post Tom Lee Pushes for Big Share Increase as BitMine Closely Tracks Ethereum Price appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

🤖 Catatan TOPINDIATOURS

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!