📌 TOPINDIATOURS Breaking crypto: South Korea to Lift Corporate Crypto Ban, Sets 5%

South Korea is reportedly ending its 9-year ban on corporate crypto investment. The nation is coming up with new guidelines that permit listed companies and professional investors to trade crypto.

Per a local media report, the ‘Virtual Currency Trading Guidelines for Listed Corporations’ allows companies to trade crypto. If implemented, corporate participants can invest up to 5% of their equity capital in top 20 cryptos by market cap on South Korea’s five major exchanges.

The move marks the third and final phase of the Financial Services Commission (FSC) plan in granting corporations access to crypto trading. The regulator rolled out the three-phase approach in February 2025.

The final phase is expected to see approximately 3,500 entities gaining market access, once the rule takes effort.

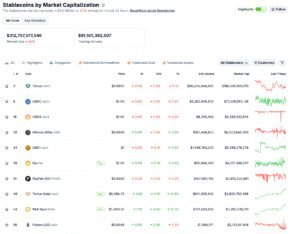

Additionally, discussions are still underway on whether to include dollar-pegged stablecoins, such as Tether’s USDT, in the permitted investment.

Nine-Year Ban Ends – Corporate Crypto Investment Legalized

South Korea’s financial watchdog, FSC, restricted corporations and banks from trading crypto due to government regulations that were put in force in 2017. At the time, the ban was put in place to alleviate “overheated speculation” and address money laundering concerns.

However, in response to the upsurge in global participation in the market, the FSC has lifted the ban. Considering risks associated with large-scale crypto investments, authorities have set the annual deposit limit at 5%of equity capital.

Further, the government has decided to establish standards for orders exceeding a particular price range on crypto exchanges. These standards aim to mitigate market risks stemming from increased liquidity.

5% Investment Cap is “Excessive”: Market Participants Argue

Financial industry insiders have expressed concerns that the 5% investment cap for corporate crypto investors seems excessively conservative. They noted that the US, Japan, and the EU impose no limits on corporate crypto holdings.

“Investment limits, which do not exist overseas, could weaken the inflow of funds and prevent the emergence of specialized virtual currency investment companies,” one market watcher noted.

Besides, with a foundation for long-term investment in place, the launch of won-denominated stablecoins and Bitcoin spot exchange-traded funds (ETFs) is expected to accelerate, industry insiders expressed.

Seoul has taken steps to become a world crypto hub and has spent much of 2025 embracing cryptocurrencies at an unparalleled pace. For instance, in September, the nation’s ruling party, Democratic Party (DP), launched a new crypto policy-making task force in a move to “foster growth” in crypto innovation.

The post South Korea to Lift Corporate Crypto Ban, Sets 5% Investment Cap for Listed Firms appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

📌 TOPINDIATOURS Breaking crypto: Top UK Labour lawmakers push to ban political d

The chairs of seven UK government committees have asked for a ban on crypto donations to be added to an elections bill set to be introduced soon.

🔗 Sumber: www.cointelegraph.com

🤖 Catatan TOPINDIATOURS

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!