📌 TOPINDIATOURS Hot crypto: Stablecoins, sanctions and surveillance: Why 2025 resh

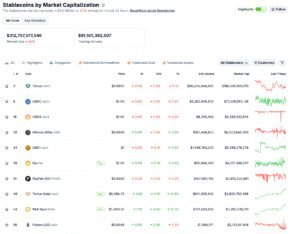

From record onchain volumes to geopolitics-driven crypto crime, 2025 structurally shifted how regulators and institutions engaged with digital assets, with stablecoins at the center.

🔗 Sumber: www.cointelegraph.com

📌 TOPINDIATOURS Breaking crypto: Why Is Crypto Up Today? – January 12, 2026 Hari I

The crypto market is up today, though barely, with the cryptocurrency market capitalisation rising by 0.6%, and currently standing at $3.2 trillion. At the time of writing, 63 of the top 100 coins have gone down over the past 24 hours. Also, the total crypto trading volume stands at $87.2 billion, quite lower than what we’ve been seeing over the past few weeks.

Crypto Winners & Losers

With the beginning of the new week, at the time of writing on Monday morning, 4 of the top 10 coins per market capitalisation have seen their prices fall over the past 24 hours, while 4 have posted gains in the same timeframe (not taking the stablecoins into account).

Bitcoin (BTC) has appreciated by 0.7% since this time yesterday, currently trading at $91,271.

Ethereum (ETH) increased by 1.2%, now trading at $3,128.

The category’s biggest gainer is Solana (SOL), which posted a 3.6% increase to $141.

It’s followed by Lido Staked Ether (STETH), having gone up 1.3% to the price of $3,124.

On the red side, the highest drop is XRP (XRP)’s 2.1%, now trading at $2.05.

Dogecoin (DOGE)’s 2% fall to $0.1368 is next, followed by Binance Coin (BNB)’s 1.2% and Tron (TRX)’s 0.2%, trading at $902 and $0.2977, respectively.

When it comes to the top 100 coins per market cap, one posted a double-digit drop. Pol (POL) is down 11.3% to $0.1584.

It’s followed by Provenance Blockchain (HASH), which declined by 9.5% to the price of $0.02155.

The rest of the red coins are down below 5% each.

At the same time, three coins in this category recorded double-digit increases. Monero (XMR) appreciated 18.1% to $569.

Canton (CC) appreciated 10.9%, currently changing hands at $0.1459. It’s followed by MYX Finance (MYX)’s 10.2% to the price of $5.51.

Meanwhile, Coinbase said it would withdraw support for major crypto legislation if the US Senate negotiators add restrictions on stablecoin rewards beyond disclosure requirements. This has increased tensions ahead of the markup scheduled for 15 January.

On the other side of the world, South Korea may be ending its nine-year ban on corporate crypto investment. It’s forming with new guidelines that will permit listed companies and professional investors to trade crypto.

‘BTC is Highly Sensitive to Institutional Risk’

Petr Kozyakov, Co-Founder and CEO at Mercuryo, commented that BTC “has surrendered early gains after breaching the $92,000 mark in Asia trading as the biggest cryptocurrency mirrors leading US tech stocks in a risk-off mode retreat.”

Markets appear to be weighing growing tensions between US Federal Reserve Chairman Jerome Powell and President Donald Trump. Against this backdrop, and amid escalating geopolitical risks, traders are retreating to safe-haven assets such as gold and silver, the CEO writes.

“Meanwhile, in the digital token space, the narrative of increasing inflows into privacy coins, which so defined the final months of 2025, is continuing to play out with Monero and Zcash recording gains of 16 per cent and 4 per cent, respectively,” Kozyakov concludes.

Bitunix analysts noted that the U.S. federal prosecutors have launched a criminal investigation into Federal Reserve Chair Jerome Powell.

From a macro perspective, they write, this is not merely an isolated legal risk. This is “a direct challenge to one of the core assumptions underpinning market pricing: the political neutrality and policy independence of the central bank.”

“The key issue is not whether the prosecution ultimately succeeds, but whether markets…

Konten dipersingkat otomatis.

🔗 Sumber: cryptonews.com

🤖 Catatan TOPINDIATOURS

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!